Are you in need of a few million dollars and have information on criminal misconduct in your company? The US Department of Justice announced the launch of a new whistleblower reward program in March this year just for you, incentivizing workers to report crimes within their organization.

Deputy Attorney General Lisa O. Monaco unveiled this new initiative that marks a significant expansion in the DOJ’s efforts to tackle white-collar crime and combat financial misconduct in corporate America.

In this article, we will share some of the most interesting details about this program and how authorities have been increasingly relying on whistleblowers and handing them sizable rewards for sticking their necks out.

Program Overview and Objectives

According to Deputy AG Monaco, the new program aims to fill the gap left by programs endorsed by regulatory agencies like the US Securities and Exchanges Commission (SEC) and the Commodity Futures Trading Commission (CFTC), which are a bit limited in their scope.

The initiative will “address the full range of corporate and financial misconduct that the Department prosecutes,” Monaco stressed.

The DOJ will be particularly interested in:

- Foreign corruption cases outside the SEC’s jurisdiction, including violations of the Foreign Corrupt Practices Act (FCPA) by non-issuers and violations of the recently enacted Foreign Extortion Prevention Act (FEPA).

- Criminal abuses of the US financial system.

- Domestic corruption cases, especially those involving illegal corporate payments to government officials.

The DOJ initiated a “90-day sprint” back in mid-March to develop and implement this department-wide pilot program. The initiative is expected to formally go into effect later in 2024, following this development period.

Alongside this program, the DOJ is also testing another pilot that involves offering non-prosecution agreements to whistleblowers that can provide valuable information that helps the department’s investigations.

Eligibility and Reward Structure of the DOJ’s New Program

The DOJ has established several “basic guardrails” for the new program:

- Compensation will only be available to individuals who provide truthful information that the government was not previously aware of.

- Whistleblowers must not have been involved in the criminal activity themselves.

- Rewards will only be provided after all victims of the reported misconduct have been properly compensated.

- An informant may receive a reward only where there was no existing financial incentive to disclose, such as through a qui tam action or under another federal whistleblower program.

- Rewards will be available only where the monetary sanction imposed for the reported misconduct exceeds a specific threshold (yet to be announced).

While specific details are still being finalized, the program will offer whistleblowers a percentage of the resulting forfeitures from successful prosecutions based on their tips. This approach mirrors successful programs at other agencies, such as the SEC and CFTC, where whistleblowers can receive between 10% and 30% of the penalties and fees assessed in a case. This could be millions of dollars in some cases so this program could be the massive incentive we need to out more white collar crime and corruption.

Also read: New Boeing Whistleblower Makes Explosive Claims – Will It Survive This Time?

The DOJ’s Money Laundering and Asset Recovery Section (MLARS) will play a leading role in designing and implementing the program. This is because the statutory authority for the reward program is the same as that used for the asset forfeiture program that MLARS administers.

SEC and CFTC Are Poster-Childs of the Success of Whistleblower Reward Programs

The DOJ views this program as one critical piece of a broader strategy to promote responsible corporate citizenship.

By incentivizing individual reporting, the department hopes to create a race-to-reporting trend that will help uncover and prosecute wrongdoing more effectively.

This new program builds upon other recent DOJ efforts, such as:

- The Voluntary Self-Disclosure Program – announced in 2022 and rolled out in 2023.

- The Compensation Incentives and Clawbacks Pilot Program. This one offers companies credit for holding individual wrongdoers financially accountable.

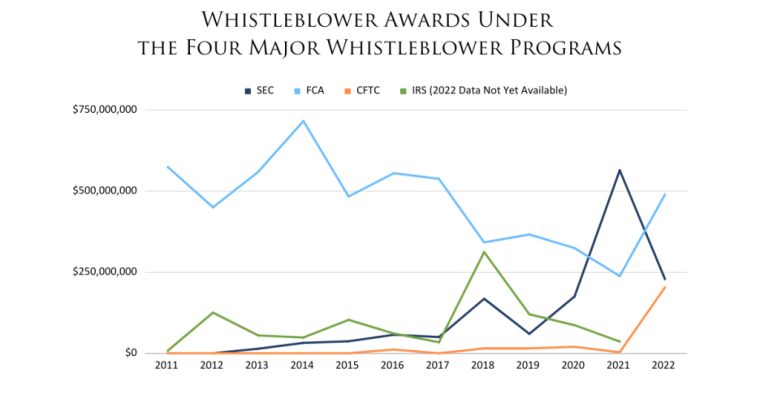

The DOJ’s initiative draws inspiration from the successful whistleblower programs at the SEC and CFTC, established by the Dodd-Frank Act in 2010. These programs have yielded positive results according to the latest data.

Also read: New DOJ Lawsuit Threatens to Dismantle Apple’s $300bn a Year Business

For example, in 2023 the SEC received a total of 18,354 whistleblowers tips that resulted in over $600 million awarded to 68 individual tale-tellers.

Meanwhile, the CFTC informed that they received a total of 1,530 tips last year as well and awarded $16 million in rewards to 7 whistleblowers for their efforts to uncover corporate misconduct.

Meanwhile, several high-profile cases demonstrate the potential impact of whistleblower programs:

- Danske Bank Case: A mid-level manager alerted authorities that the bank was being used as an intermediary to move funds from Russia to the United States (despite sanctions). The bank pleaded guilty and agreed to forfeit $2 billion for laundering over $230 billion in assets.

- Ericsson Case: The SEC awarded a whistleblower a record figure of $279 million in exchange for tips regarding a bribery case that involved the Swedish telecom company Ericsson.

- Deutsche Bank Case: The CFTC granted $200 million to a former Deutsche Bank employee for his role in uncovering a scheme associated with the manipulation of interest rates by the German bank.

While specific payout structures for the DOJ program have not been finalized, the rewards could be substantial based on the precedents set by other agencies.

Are Whistleblower Rewards Programs Effective? Legal Experts Weigh In

Legal experts and industry observers have offered mixed opinions and reactions to the DOJ’s announcement:

- Stephen Kohn, an attorney who represented Howard Wilkinson in the Danske Bank case, described the proliferation of whistleblower award laws as “the biggest untold story in whistleblowing” and a “revolution” in corporate accountability.

- Robert Anello, a New York corporate defense lawyer, acknowledged that the program would make the DOJ’s work easier and help bring cases that might not otherwise be discovered.

- Mike Piazza, a Dallas attorney who has defended companies in whistleblower cases, cautioned that whistleblowers don’t always have a complete picture of corporate activities and investigations based on their tips could cause reputational harm even if no charges are filed.

- Siri Nelson, executive director of the National Whistleblower Center, emphasized the need for a dedicated whistleblower office with sufficient staff to manage the incoming tips effectively. “A lot of times, we hear concerns about, ‘How do we deal with all the tips? How do we differentiate between what is legitimate and what is not supported or is misleading and results in the waste of the agency’s time?” Nelson stressed.

The DOJ’s new whistleblower reward program represents a significant development in the fight against corporate crime and financial misconduct. By offering substantial financial incentives to individuals who report wrongdoing, the DOJ aims to uncover and prosecute a wider range of criminal activities that may have previously gone undetected.

Also read: DOJ May Soon File Criminal Charges Against Boeing Over 737 Max Safety Problems

While the program’s goal of enhancing corporate accountability and deterring misconduct seems attainable, its structure also presents challenges that will need to be carefully addressed.

These include managing the volume of tips, investigating and identifying true leads, and protecting whistleblower identities.