The European Union announced this week an increase in the tariffs imposed on electric vehicles imported from China that will have an immediate and severe impact on the competitiveness of these cars in the region and the relationship between the economic block and the Asian country.

In a press release issued on Wednesday, the Commission shared details about its decision, noting that it comes after a formal investigation that began last October. This investigation examined how the Chinese government’s subsidies for these vehicles affected the ability of European EV manufacturers to compete with their Asian counterparts.

The US recently chose to impose tariffs on Chinese electric vehicles, but since no Chinese carmakers sell vehicles in the country, the impact on them is minimal. In contrast, the EU imports many Chinese EVs, so China’s EV companies are expected to face a considerable loss due to the new tariffs.

Individualized and Group Tariffs of Up to 38.1% Will be Applied to Chinese EVs

Under the new tariff regime, which is set to take effect starting on July 4 unless negotiations with Chinese authorities result in a different outcome, Chinese EV makers will face additional duties ranging from 17.4% to 38.1%. These new tariffs will be levied on top of the existing 10% duty imposed on all imported vehicles entering the EU.

As part of our ongoing investigation, we have provisionally concluded that the battery electric vehicles value chain in China benefits from unfair subsidisation.

This is causing a threat of economic injury to EU battery electric vehicles producers.

We have reached out to… pic.twitter.com/URNCcgDL7q

— European Commission (@EU_Commission) June 12, 2024

The highest additional tariff of 38.1% will be applied to vehicles imported from state-owned SAIC Motor, one of China’s largest automakers with joint ventures involving Volkswagen and General Motors. Meanwhile, BYD, the leading Chinese EV manufacturer, will face a 17.4% additional duty while Geely, the owner of the Swedish carmaker Volvo, will be subject to a 20% hike.

Other Chinese EV firms that cooperated with the EU’s investigation will face a 21% average customs duty while those that did not cooperate with the Commission will be slapped with the maximum 38.1% levy.

The Commission mentioned that it received an individual request from Tesla (TSLA) to analyze its case as the company produces a significant portion of its vehicles in China but does not necessarily benefit from the country’s subsidies.

EU officials will be calculating an individual duty for the company headed by Elon Musk and will publish its decision on the matter in the following 9 months.

“The EU’s green transition cannot be based on unfair imports at the expense of EU industry,” the Commission asserted, emphasizing the need to ensure a leveled playing field for European automakers.

China Threatens to Retaliate

Beijing has strongly condemned the EU’s decision, accusing the bloc of “blatant protectionism” and “creating and escalating trade tensions.” A spokesperson for the Chinese Ministry of Commerce stressed that the country will “take all necessary measures to defend the legitimate rights and interests of Chinese enterprises.”

“The EU ignored the facts and WTO [World Trade Organization] rules, ignored repeated strong objections from China, and ignored the appeals and dissuasions of many EU member states’ governments and industries,” the Chinese spokesperson added.

The EU’s move to increase tariffs on Chinese EVs comes less than a month after the United States quadrupled its duties on Chinese electric vehicles to 100%. Washington’s decision was part of a broader package of tariffs targeting Chinese goods, including semiconductors and batteries, aimed at protecting American companies from unfair competition.

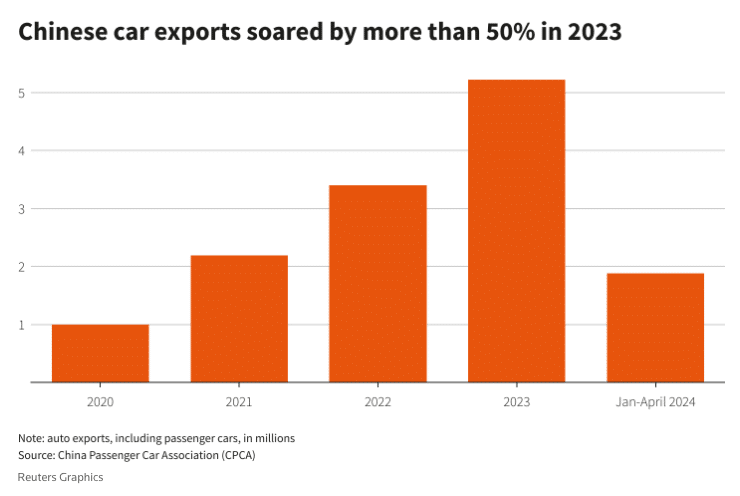

China exports millions of cars every year so new tariffs on one of its most important trade goods could cause major problems for the country’s economy.

The escalating tariff war between the West and China has raised concerns about potential retaliation from Beijing and the possibility of a full-blown trade conflict between these superpowers. Analysts warn that China could retaliate by raising tariffs on EU vehicle imports, currently set at 15%, or target other European exports such as wine and luxury goods.

Brandy companies are already on high alert as their products could be impacted by actions taken by China in response to the EU’s decision. Meanwhile, other businesses in sectors such as food production – i.e. pork exporters – could also become a target for the Chinese government if they opt to increase tariffs on certain EU-produced goods.

Cracks Within the Economy Block Could Undermine the Commission’s Decision

The decision to increase tariffs on Chinese EVs has exposed rifts within the EU, with a few member states holding conflicting views on how to approach trade relations with China.

Germany, a major producer of automobiles with a significant footprint in the Asian country, has voiced its opposition to the Commission’s decision. German Chancellor Olaf Scholz recently warned against protectionism and isolation, stating that such measures “ultimately just make everything more expensive and everyone poorer.”

“We do not close our markets to foreign companies because we do not want that for our companies either,” Scholz stressed.

Meanwhile, officials from Hungary voiced their discontent with the decision and stated that they do not agree with these “punitive tariffs” as “protectionism is not a solution”. They went on to deem the measure as a “highly discriminatory” move. Hungary will be taking over the leadership of the European Council next month.

Meanwhile, analysts from the Rhodium Group highlighted that China will do everything in its power to create divisions within the economic bloc so not all countries opt to implement the Commission’s decision.

“Beijing is likely to use both carrots and sticks to build opposition to the Commission’s case, in the hopes that a sufficiently large group of (EU) member states… emerges in order to block permanent duties,” they noted in a research paper published recently.

Analysts Have Mixed Views About the Impact of Higher Tariffs

Experts have offered mixed views on the EU’s decision and its potential consequences.

Jacob Gunter, a lead analyst at the Mercator Institute for China Studies, expressed skepticism about the possibility of a negotiated settlement, stating: “I can’t imagine that they [the EU] would be willing to allow the distortions from the subsidies to continue unabated, given the significance of the automotive sector in Europe.”

Also read: China’s Tech King Xiaomi Launches Electrifying EV in Crowded Market as Its Shares Soar

Meanwhile, Alicia Garcia-Herrero, a senior research fellow at Bruegel, shared this sentiment, suggesting that it might be “too late for negotiation” as China should have engaged in productive discussions with the EU before the tariff hikes were announced.

However, James Moran, a senior research fellow at CEPS, believes that the new tariffs might not stop the surge in Chinese EV imports as they will still be able to offer competitive prices and generate decent profits despite the higher levy. He also expects China’s retaliatory moves to be limited, citing Beijing’s need to maintain productive trade relationships with the economic bloc.

“China needs smooth commercial relations with the EU, given its continuing dependence on trade for its own economic recovery and the serious problems it has with its other main market, the U.S.,” Moran commented.

Chinese EV Stocks Surge as Market Expected a Worse Scenario

Market participants are reacting positively to the news as the stock of top Chinese EV manufacturers including Geely, Nio (NIO), and BYD are posting gains of 1.7%, 1.3%, and 5.8% respectively following the European Commission’s decision.

Analysts from Citi highlighted that the increase was “modest” compared to what the United States did last month and emphasized that they will not “derail China’s ongoing economic recovery”, which is a top priority for Beijing at the time.

Both BYD and Geely have made significant infrastructure investments in the continent and this is possibly the reason why their case was individualized and treated differently from other companies while SAIC has been taking a long time to ultimately decide where it will be basing its next manufacturing plant in Europe.

Given the importance of the European market for the sustained growth of Chinese EV makers and their global ambitions, the Commission’s decision could ultimately result in direct investments in the sector within the region in the form of manufacturing facilities.

Since vehicles manufactured within the bloc will not be impacted by these tariffs, most Chinese companies may opt to open new facilities to evade the levy and compete with domestic automakers.