When you think of inflation, you usually stick to simple supply and demand. If the money supply increases, so does inflation. But that’s far from the only source of the painful trend of rising prices that we are all suffering from. New reports and investigations are starting to show that price-gouging, illegal collusion, and rent-fixing have helped to increase prices tremendously for consumers, all to enrich a handful of companies.

Two weeks ago, the Federal Bureau of Investigation (FBI) raided the corporate offices of a company called Cortland Management without previous warning. Cortland was accused by the Department of Justice (DOJ) of conspiring to artificially inflate apartment rents nationwide, affecting millions of tenants across the country.

The raid marked a significant escalation in the government’s efforts to crack down on companies whose pricing policies are designed to take advantage of temporary market distortions caused by inflation or scarcity.

Unfortunately, Cortland is not an isolated case. In fact, the number of complaints, lawsuits, and law enforcement actions in the country involving these practices is growing as businesses use the excuse of higher raw materials costs or deteriorating market conditions to squeeze consumers out of their hard-earned money.

The Cortland Rent-Fixing Case Explained

Cortland Management is a corporate landlord located in Atlanta that has a portfolio of over 85,000 units across thirteen states. They reportedly used an algorithm to fix prices and coordinate pricing decisions with other landlords in these regions to maximize revenue. This practice undermined the impact of healthy competition and ultimately hurt consumers.

A software company called RealPage helped Cortland and other landlords in orchestrating the price-fixing scheme as their systems provided recommendations for pricing by analyzing real-time data shared by various real estate companies in the area.

RealPage allegedly provided pricing recommendations that ensured that no landlord was undercutting others by offering lower prices and undervaluing the market. This practice is, however, against the law as it automatically creates a cartel and prevents competitive forces from acting in the marketplace to regulate prices based on supply and demand dynamics.

The data analyzed by RealPage included pricing, inventory, occupancy rates, and unit types that are or will be available for rent.

RealPage Fixed Rents for Over 70% of All Multi-Family Apartments in the Nation

The DOJ’s investigation against RealPage is probably larger than you’re imagining. In Tennessee alone, a total of 2021 property management companies and institutional investors are being investigated. Their network accounts for roughly 70% of all multi-family apartment buildings and a staggering total of 16 million units offered for tenancy nationwide that were actively engaged in the scheme.

The influence of RealPage in Atlanta is tremendous as it affects more than 80% of all multifamily units on the market. Rents in the city have surged by over 80% in the past 8 years or so and the actions of this software company are partially responsible for this situation.

Judge Lets Class-Action Lawsuit Against Cortland and RealPage Proceeds

The accusations against Cortland and RealPage are extremely serious. They are alleged to have engaged in price-fixing, a clear violation of antitrust laws. By sharing sensitive pricing information among competitors and providing unified pricing recommendations, its software effectively eliminates competition in the property rental market.

RealPage also takes things up a notch as they offer access to ‘pricing advisors’ who monitor the market and encourage landlords to accept their recommended tiers for their properties. They are also being accused of pressuring and even advocating for the forced departure of employees who try to block their actions and issue threats against property managers who decline to accept their recommendations.

The company denies any wrongdoing, stressing that their software is simply a tool that is used at the discretion of real estate companies to make better assessments of market conditions to adequately price the properties they own. A federal judge in the state of Tennessee has allowed a class-action lawsuit against the company to continue its course.

Also read: 10 Biggest Real Estate Companies in the US by Market Cap

The implications of this investigation are far-reaching, potentially affecting millions of renters across the United States. If the allegations are proven true, the artificially inflated rents have placed undue financial burdens on millions of tenants.

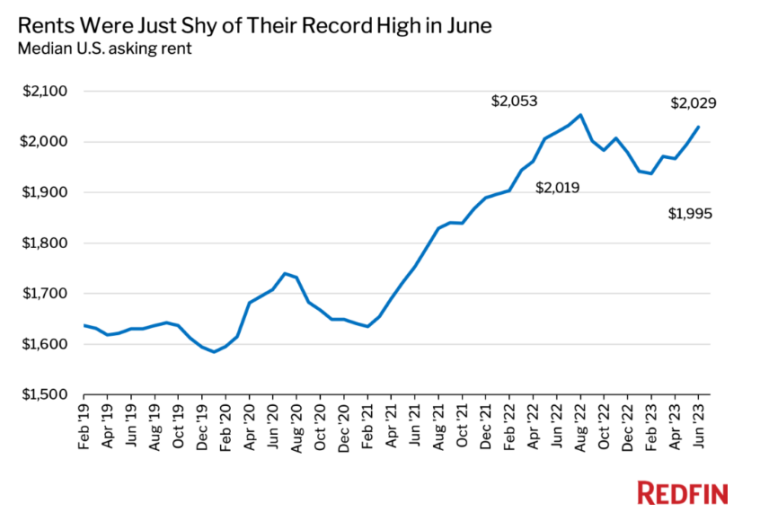

Millions of renters may soon benefit from the efforts of the DoJ and law enforcement agencies to dismantle these rent-fixing schemes. Notably, rent prices have skyrocketed in key cities in the past 12 months or so.

For example, a report from Rent indicated that, in the city of Providence, rent prices have increased more than 16% from March 2023 to March 2024. Aside from Tennessee, class-action lawsuits have been brought up against the company in Washington, Arizona, and North Carolina as well.

Inflation Incentivizes Corporations to Engage in Price-Gouging Beyond Real Estate

The RealPage scandal is shining a light on how inflation is pushing businesses to engage in practices like price-gouging to maximize their profits in a distorted economic environment. The issue extends beyond the real estate market and affects other industries like food supplies and gas stations.

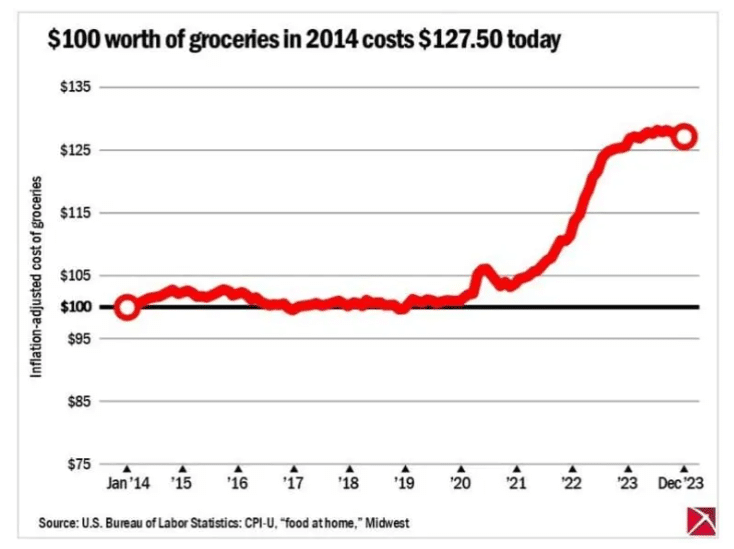

President Joe Biden acknowledged this problem, stating: “prices are still too high for housing and groceries” and went on to address key businesses “including grocery retailers, to use record profits to reduce prices.”

The president’s concern is justified, to some extent. Corporate profits reached a record high in the fourth quarter of 2023, suggesting that many companies exert significant market dominance to keep prices high.

Also read: How to Invest During Inflation – Best Investment Strategies

This trend is visible across much of the economy. At the end of 2023, Americans were paying at least 30% more for beef, pork, and poultry products compared to 2020.

Who is to blame? Monopolistic power and unlawful pricing policies. Studies show that only four companies now control the production of 80% of the country’s beef, nearly 70% of pork, and almost 60% of poultry, making it easy for them to coordinate price increases.

The problem extends well beyond groceries as well, as 75% of US industries are controlled by a smaller number of companies compared to 20 years ago.

An increasingly visible concentration trend is harming consumers as it reduces the impact of competitive forces in establishing adequate prices derived from supply and demand dynamics.

Here’s an example: PepsiCo’s chief financial officer stated that, even though inflation was dropping, its prices would not be. He went on to announce plans to keep prices at high levels in 2024. The result: some of its products are experiencing lower demand.

Government Response to Inflation-Linked Price-Gouging

In response to these issues, the Biden administration has been enforcing antitrust laws more aggressively than any administration in the last 40 years.

They’ve taken action against alleged price-fixing practices in the meat industry, sued to block the merger of Kroger and Albertsons, and are suing Amazon and Apple (AAPL) for using their market dominance to artificially jack up prices.

Meanwhile, in the legislative arena, Senator Elizabeth Warren and others recently unveiled the latest version of their Price Gouging Prevention Act. This bill would empower the Federal Trade Commission (FTC) and state attorney’s general to stop companies from charging “grossly excessive” prices. It would also require public companies to disclose more about their costs and pricing strategies.

“Giant corporations are using supply chain shocks as a cover to excessively raise prices and sometimes charging the same price but shrinking how much consumers actually get,” Warren highlighted.

However, economists are still debating the extent to which corporate greed is driving up inflation.

A study by the Federal Reserve Bank of San Francisco found that while some companies did exercise pricing power in certain sectors, aggregate markups across the economy have stayed essentially flat. This suggests that while ‘greedflation’ is a concern in some industries, it’s apparently not the main driver of the country’s inflation.

In addition, economists at the Kansas City Fed found that corporate profits contributed 41% to inflation during the first two years of the COVID recovery, but noted that this isn’t unusual as profits contributed even more (59% on average) to inflation during prior economic recoveries.

Another interesting phenomenon that both regulators and lawmakers are trying to tackle is ‘shrinkflation’ – a practice that involves reducing the size of a product’s package while keeping the price either similar or equal to what it was previously.

This practice affects consumers as it increases their purchase frequency or demands changes in their habits to reduce spending.

Maintaining Fairness While Fostering Competition Should be the Goal

The FBI’s raid on Cortland Management and the accusations against RealPage of rigging the property rental market are signaling the rise of a broader trend in the United States that involves taking advantage of market conditions to raise prices via unlawful practices like price-gouging and cartel formation.

The impact on consumers and their financial wellbeing is likely dramatic and government agencies and lawmakers are noticing it and acting against it – although some may argue that they are not addressing the issue from the right angle.

From a capitalist standpoint, the goal will always be to generate more profits. Meanwhile, the government’s goal is to ensure fair conditions in the marketplace and full compliance with the law.

This is a complicated balance that demands the involvement of law enforcement agencies and drafting adequate laws that tackle the issues at hand at a time when inflation has emerged once again to disrupt even the most developed economies.