Spotify’s stock increased by 5.6% yesterday after the company revealed a price increase for its premium subscription for the second time in under a year. The stock’s year-to-date gains have reached a notable 66%, even as many content creators are upset with CEO Daniel Ek, who sparked controversy by stating that the cost of producing content is now “close to zero.”

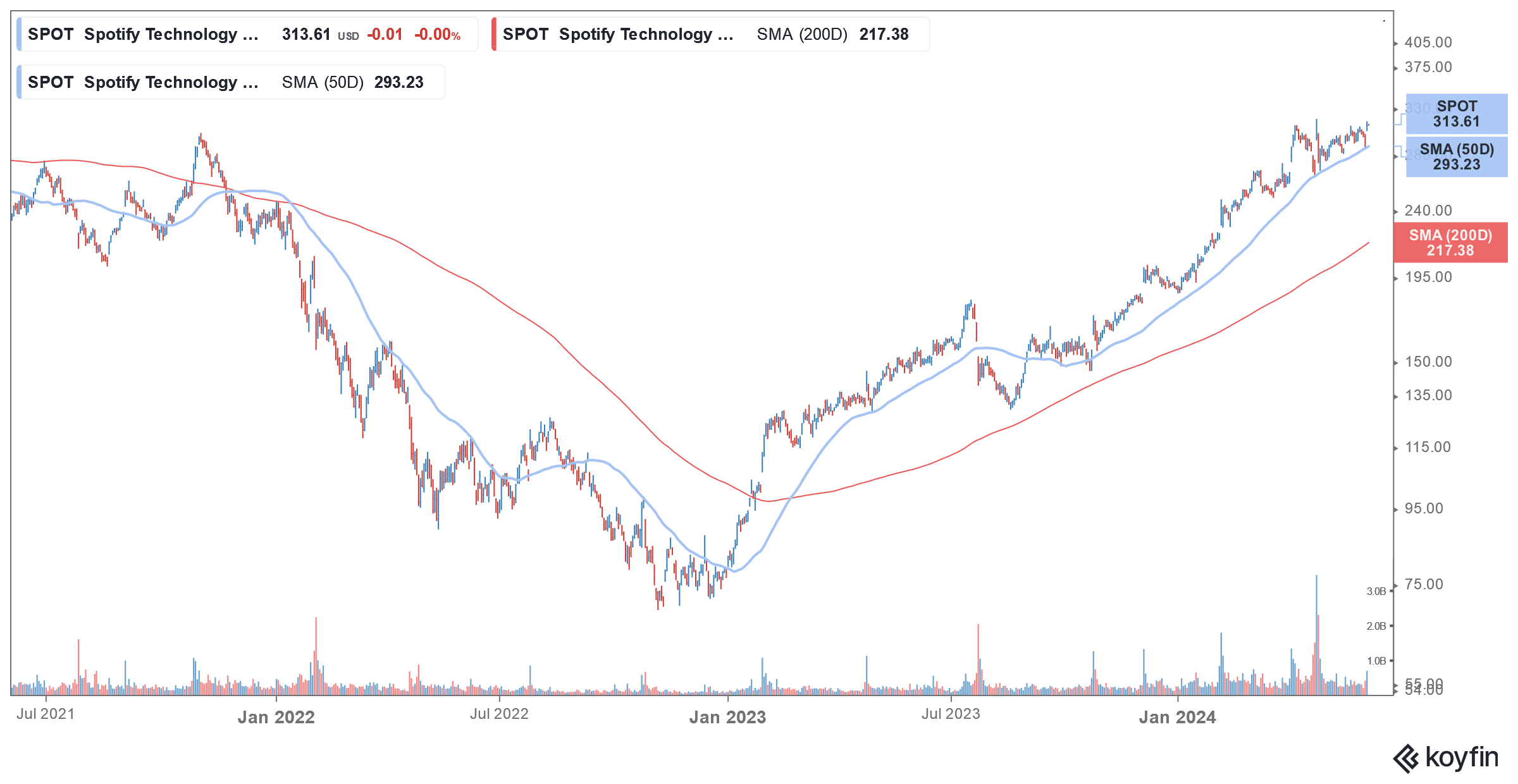

These comments coming from Ek, whose net worth exceeds $9 billion, haven’t exactly helped build good will with the creators it relies on. For now, the controversy doesn’t seem to have had a major impact on Spotify stock which is outperforming the markets by a wide margin this year even as it trades below its 2021 highs.

Daniel Ek Controversy

On May 29, Ek tweeted, “Today, with the cost of creating content being close to zero, people can share an incredible amount of content. This has sparked my curiosity about the concept of long shelf life versus short shelf life.”

Today, with the cost of creating content being close to zero, people can share an incredible amount of content. This has sparked my curiosity about the concept of long shelf life versus short shelf life. While much of what we see and hear quickly becomes obsolete, there are…

— Daniel Ek (@eldsjal) May 29, 2024

As expected, there was a furor over his comments with artists seeing them as belittling their efforts. Yesterday, Ek clarified, “My original point was not to devalue the time, effort, or resources involved in creating meaningful works, whether it’s music, literature, or other forms of creative expression.”

The Spotify co-founder added, “My focus was on exploring the staying power of the most creative, most thought-provoking ideas. That didn’t come across, and that’s on me.”

Spotify Raises Subscription Prices

Spotify has meanwhile raised prices of all its US plans barring the student plan which would continue to cost $5.99. It has raised the price of its individual plan by $1 to $11.99 which is just over a 9% hike. Similarly, it has hiked the prices on the duo plan by $2 to $16.99 and the family plan by $3 to $19.99 which implies a hike of 13.3% and 17.6% respectively.

In its blog post, Spotify told subscribers it is raising prices so that it can “continue to invest in and innovate on our product features,” and bring the “best experience” to them.

Notably, this is the second price hike for Spotify in less than a year and it last raised the prices in July 2023. Back then, it raised the prices for the individual, family, and student by $1 each while that of the duo plan by $2. Importantly, that was the first time since its 2011 US launch that the company raised prices in what’s its biggest market by a wide margin.

Spotify Has Been Pushing for Profitability

Spotify has been posting net losses frequently since inception as the focus was on growing the subscriber base and revenues.

However, over the last year, it has been also focusing on enhancing its margins. Many of the cost-cutting measures it took were announced after activist investor ValueAct disclosed a stake in the company and publicly called upon the company to cut costs.

Notably, tech companies have anyways been on a spending rationalization spree over the last year and Spotify laid off almost a sixth of its workforce in 2023.

These cost cuts (including a reduction of marketing spend) coupled with last year’s price hikes helped Spotify post a record quarterly gross profit margin of 27.6% in Q1 2024 with a record operating income of almost $183 million.

The company posted an EPS of $1.04 in Q1 which was well ahead of what analysts were expecting. Markets have also rewarded the stock as the company turned around a corner in terms of profitability and the Spotify stock has more than doubled over the last year.

Price Hikes Are a Positive for Spotify

Subscription revenues are Spotify’s bread and butter. In Q1, the company reported 239 million premium paying subscribers. While premium subscribers account for just around 39% of Spotify’s total subscribers, they contributed almost 90% to its revenues.

A price hike for the premium subscription is a positive for Spotify and also highlights its pricing power in a market where it competes with giants like Apple, Amazon, and YouTube.

Brokerages have been getting incrementally bullish on the streaming company as it aims for higher margins through a mix of price hikes and efficiencies. Last month Citi raised the stock’s target price by a whopping $55 to $310 even as it maintained its “neutral rating.”

After the recent price hike announcement, JPMorgan raised its target price by $10 to $375 while maintaining its “overweight” rating.

SPOT Stock’s Valuations

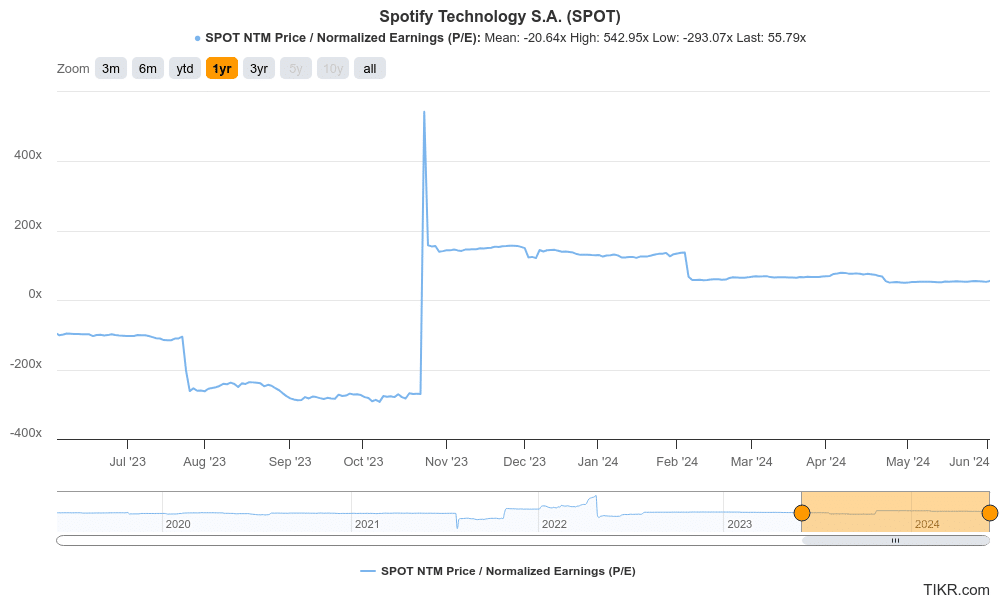

Spotify stock trades at a next 12 months (NTM) PE multiple of 55.8x. While the multiples might look elevated at first sight, they are less than half of what they were at the end of 2023. Prior to that, we did not have a PE multiple in a true sense as the company wasn’t posting profits. Naturally, 55.8 is still high, though it isn’t unusual for massive tech companies prioritizing growth over revenue.

The price hikes would help Spotify increase its profits as much of it should flow to the bottom line. The key for Spotify would be to keep adding more premium users while trying to minimize any pushback from subscribers in the form of cancelations after the recent price hikes.

The company is also working to make its offering even more attractive for listeners. In April, Spotify launched its personalized AI playlist builder which is expected to come up with better recommendations for Spotify users which could help fuel its popularity. Spotify is offering the AI recommendation functionality to premium subscribers only and if it gains popularity among listeners, more users might pivot to the premium plan.