Artificial intelligence (AI) has been the most prominent theme in the investing world over the past year and chip giant Nvidia has been its biggest benefactor. The company hasn’t been able to satiate the tremendous demand for its high-end AI chips despite restrictions on exports to China.

While Nvidia has had a monopoly in the market so far with over 90% market share, several other companies – big as well as startups – are trying to grab a pie of the lucrative market. Here are some of the companies that are looking to challenge Nvidia’s dominance in AI chips.

How Large Is the AI Chip Market?

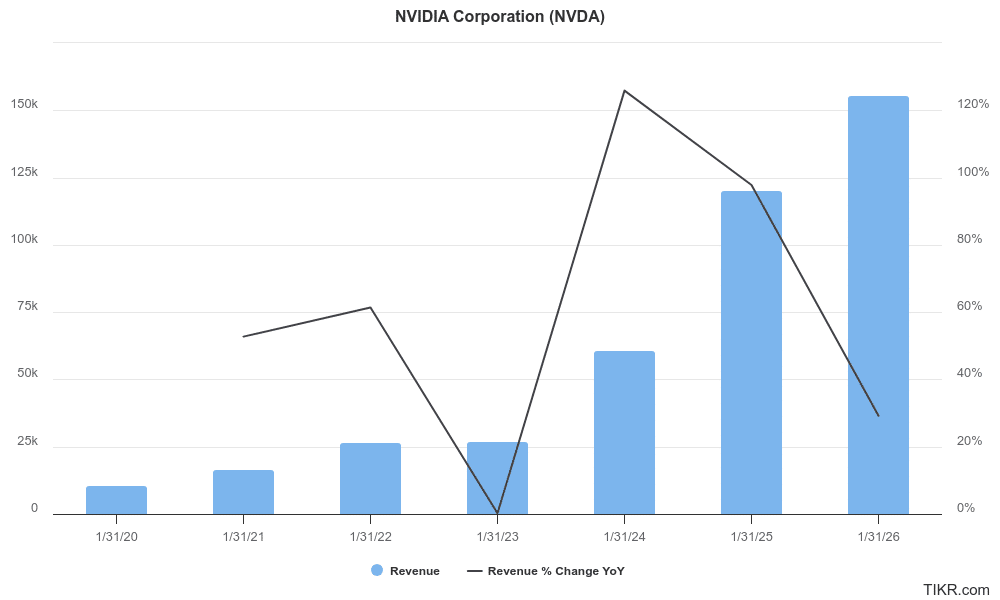

During Nvidia’s fiscal Q1 2025 earnings call, Nvidia talked about the massive opportunity for AI chips. These kinds of chips are used to train the massive large language models that power AI systems. Nvidia’s CEO, Jensen Huang, said that the demand for GPUs (graphics processing units) from data centers was “incredible” and the company is “racing every single day” to meet the soaring demand.

He added, “what people see today are the beginning of the things that we’re working in our labs and the things that we’re doing with all the startups and large companies and developers all over the world. It’s going to be quite extraordinary.”

There are varying estimates of how large the market for AI chips will eventually become. While Advanced Micro Devices (AMD) pegs the market to reach $400 billion by 2027, Intel expects it to be a trillion-dollar market by the end of this decade.

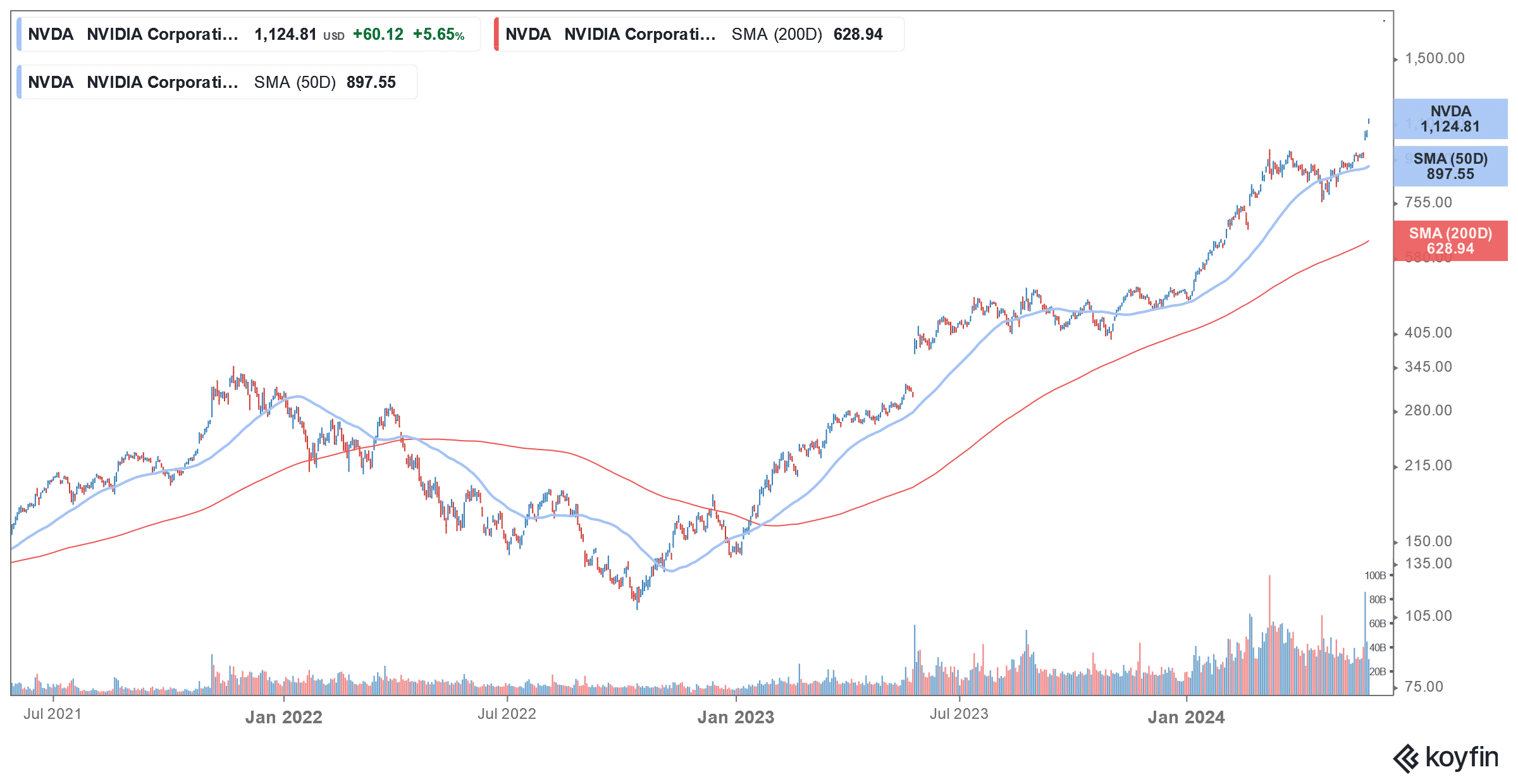

Nvidia’s Shares Have Soared Over the Last Year

No wonder, investors have scrambled to buy Nvidia shares even as a section of the market is apprehensive of its valuations. Experts have pointed out that Nvidia’s recent unbelievable growth looks frighteningly similar to Cisco’s run-up before the dot-com bubble popped, bringing the entire economy down.

Nvidia’s price action is nothing short of spectacular and the stock has been hitting new milestones. It became a $1 trillion market cap company last year only and now is inching towards becoming a $3 trillion behemoth.

The company’s success, including its soaring market cap, which is now worth more than the combined market cap of Tesla, Meta Platforms, Intel, and AMD has prompted several other companies to build AI chips.

Intel and AMD Are Looking to Challenge Nvidia

Nvidia has had a literal cakewalk as other chip companies haven’t been able to come up with competing (and compelling) AI chips for now.

However, several chipmakers are already working in that direction. For instance, Intel has unveiled its Gaudi 3 AI chip and expects to realize $500 million in revenues from its sales in 2024. AMD forecast that sales of its MI300 AI chip will be around $4 billion this year.

While these numbers pale in front of the $120 billion revenues (the bulk of which is expected from sales of AI chips) that Nvidia is expected to post in this fiscal year, it goes to show that other chipmakers are also trying to play catchup.

Hyperscalers Are Working on Their Own Chips

Google launched its AI chip, the Cloud TPU v5p, in December of last year. It says that the tensor processing unit is now equipped to train large language models (LLMs) roughly three times faster than the previous avatar Google’s TPU v4.

At the Google Cloud Next 2024 last month, Alphabet announced a custom-built Arm-based server chip and said that the new central processor unit – which would make cloud computing more affordable – would be available later in 2024. The processor, dubbed Axion, would mark Google’s entry into the extremely attractive market, joining ranks with the likes of Microsoft, Meta Platforms, and Amazon which have made custom chips for cloud-based AI.

Hyperscalers like Alphabet and Amazon have reasons to work on their own AI chips as they are currently spending billions of dollars in buying Nvidia’s chips. ChatGPT’s parent company, OpenAI, is also considering making AI chips.

"Arm will create an AI chip division and launch its own AI chips in 2025"

Interesting rumor $ARM $NVDA https://t.co/G6yD7GuOfx

— The AI Investor (@The_AI_Investor) May 13, 2024

Nvidia could also face competition from Arm which it tried to unsuccessfully acquire in the past but gave up after failing to secure regulatory clearances. Arm is reportedly looking to launch AI chips next year and could spin off the business to its parent company SoftBank once mass production begins.

Startup Companies Are Also Coming Up with AI Chips

Meanwhile, not only chipmakers and Big Tech companies but several startup companies are coming up with AI chips to take on Nvidia. For instance, a Sunnyvale, California-based startup Cerebras is working on a chip that sounds better than Nvidia’s GPUs.

To address the issue of some cores lying idle in GPUs when training LLMs, Cerebras has put 900,000 cores and lots of memory in one single, enormous chip. According to the company’s founder Andrew Feldman, it would help lower the complexity of connecting multiple chips. The company’s CS-3 chip is by far the biggest in the world.

Another startup named Groq is taking a different approach and is working on LPUs (language processing units). These also act as routers and help transfer data between interconnected LPUs. According to Groq, its LPUs can run LLMs at ten times their current speed.

Other startup companies like Israel-based Hailo, Britain-based Graphcore, and Toronto-based Taalas are also working on AI chips.

Since these are private companies, only accredited investors can invest in them. This makes it much more difficult to invest in but it’s not impossible.

Alternatively, you can consider ETFs that invest in AI companies for diversified exposure to the promising sector. WisdomTree Artificial Intelligence and Innovation ETF and Invesco AI and Next Gen Software ETF are among such ETFs.

Can Nvidia’s Dominance Really Be Challenged?

Several companies are trying to challenge Nvidia’s dominance in the AI chip market but it’s shaping up to be a Sisyphean task. An important factor here is that the top semiconductor chip manufacturing company in the world, TSMC, has its factories booked for years in advance by Nvidia, Intel, and others. Because TSMC is essentially the only company able to manufacture the advanced chips required for flagship AI hardware at large scale right now, it will be extraordinarily difficult to challenge Nvidia’s dominance for years.

Dethroning Nvidia would be an even taller ask for startup companies some of which might eventually be acquired by tech giants. Nvidia’s GPUs are an industry standard and the company has built a vast and enviable ecosystem that is not easy to breach.

That said, given the soaring demand for AI chips and the expected increase in the target market, the pool is quite large to accommodate multiple players. There is also inherent demand from end users as companies might want to derisk their business and reduce their reliance on Nvidia’s chips.

For now, though, Nvidia is having a home run with its AI chips which continues to fuel the rally in its shares that are hitting one high after the other.