The Federal Reserve’s meeting held earlier this week was largely a non-event as the US Central Bank kept rates unchanged as widely expected. However, the Fed made one major announcement: it is now reducing the pace of quantitative tightening. While the announcement did not get much media attention as markets seem to be occupied with Big Tech earnings, the move could have significant implications for the markets as we’ll discover in this article.

While the Fed uses tweaks to interest rates to achieve the desired outlook on inflation and growth, it also has other arrows in its arsenal, like quantitative tightening (or QT) and quantitative easing (QE). To understand, QT we should first get well-versed with QE, its inverse.

How Does the Fed Use QE?

Under QE, the Fed buys assets like mortgage bonds and Treasury securities from the market. QE helps increase the money supply in the market and pushes interest rates lower. It’s an unconventional monetary policy tool and is particularly important once the central bank cuts rates to zero.

There is still some sanity in the US financial system and while the Fed lowered rates to zero bound (between 0%-0.25%) overnight in March 2020 amid the COVID-19 pandemic, it did not take rates to the negative territory like its counterparts in the European Union and Japan.

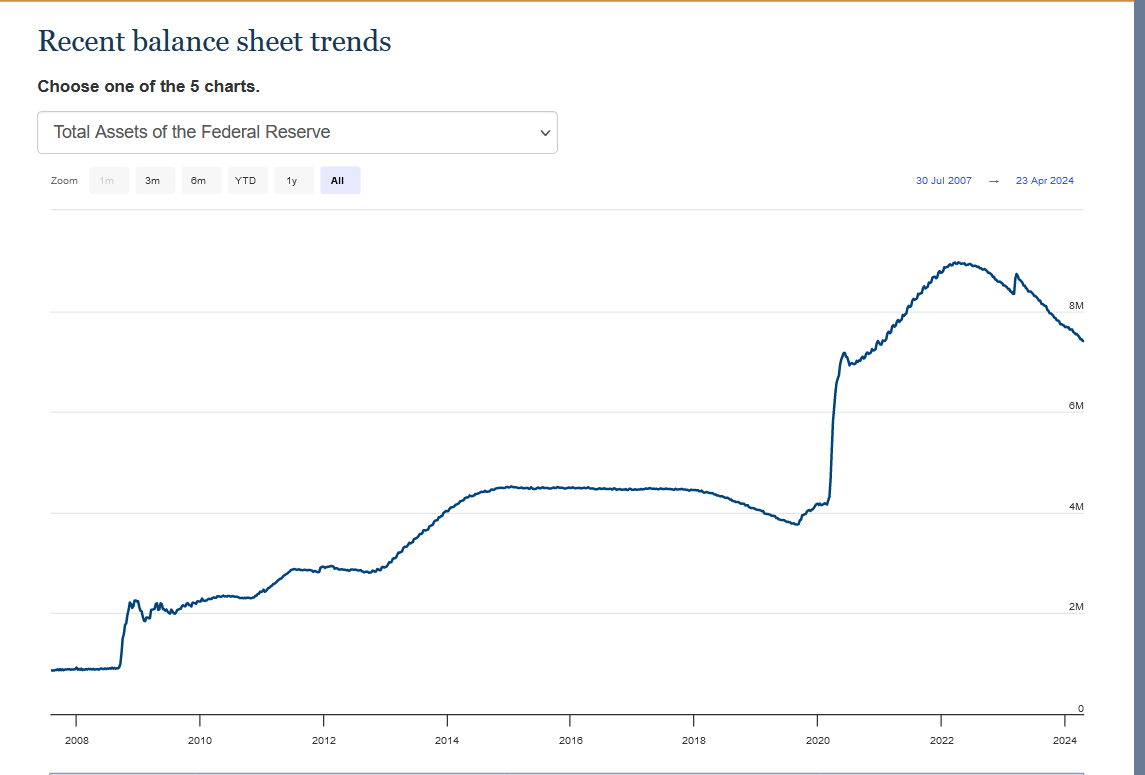

However, zero-bound interest rates tie the Fed’s hands as it cannot cut rates below zero. In such scenarios, it uses tools like QE to push interest rates even lower and nudge banks to lend more (and borrowers to borrow more). QT, on the other hand, is simply the process of rolling some of the tremendous amount of bonds and similar assets on the Fed’s balance sheet.

Source: Bankrate

Fed Began Quantitative Tightening in June 2022

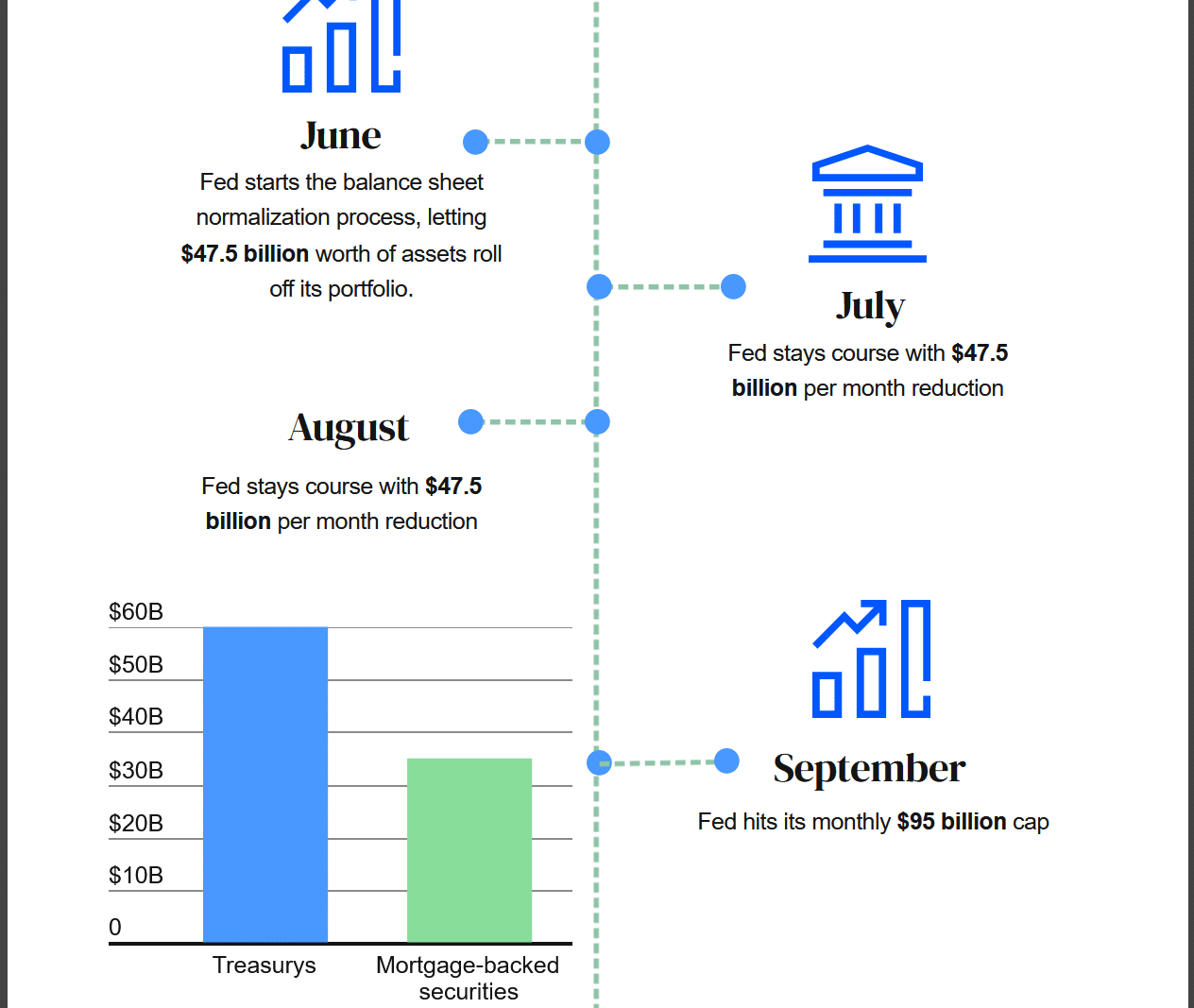

The Fed began the process of quantitative tightening in June 2022 which was a few months after it started the rate hike cycle in March. By mid-June, it was more than apparent that inflation wasn’t “transitory” as the Fed believed it to be (or that’s what it said at least). The annualized CPI peaked at 9.1% in June 2022 which was over four times the 2% that the Fed targets.

Amid sticky inflation, the Fed not only raised the policy rates to between 5.25%-5.50% – the highest since 2007 – but also began unwinding its balance sheet (another name for QT). Beginning in June 2022, it shrank its balance sheet by $47.5 billion every month and doubled the number to $95 billion in September.

During the QE program, it initiated during the COVID-19 pandemic, the Fed expanded its balance sheet by a record $4.6 trillion and despite the QT the balance sheet size is still $7.4 trillion – way above the pre-pandemic levels.

If it were to cut the size by $95 billion every month the balance sheet would have reverted to pre-pandemic level by June 2026.

Aggressive QT Was Making Some Apprehensive

While the Fed has stopped raising rates and guided for three rate cuts in 2024 (whose possibility now looks low as inflation has been stubbornly above the Fed’s 2% target), it continued with the QT program. Some had expressed concerns about the aggressive shrinking of the Fed’s balance sheet.

Jamie Dimon – chairman and CEO of JPMorgan Chase – said in his shareholder letter in April that he was “worried” about the pace of QT. He added, “we have never truly experienced the full effect of quantitative tightening on this scale.”

Fed To Go Slow on Balance Sheet Reduction

Fed has now said that it would slow the pace of shrinking its balance sheet which is akin to easing of monetary policy. Specifically, it would now lower the monthly Treasury runoff from $60 billion to $25 billion.

In his comments, Fed chair Jerome Powell said, “The decision to slow the pace of runoff does not mean that our balance sheet will ultimately shrink by less than it would otherwise, but rather allows us to approach its ultimate level more gradually.”

He added, “In particular, slowing the pace of runoff will help ensure a smooth transition, reducing the possibility that money markets experience stress, and thereby facilitating the ongoing decline in our securities holdings that are consistent with reaching the appropriate level of ample reserves.”

The Yields on Securities Fell as Fed Tones Down QT

While the Fed’s recent meeting was a bit hawkish with Powell signaling that there might not be any rate cut at its next meeting in June, the yields on both the 10-year and 2-year Treasury dropped by 0.05 percentage points on the QT decision.

The Fed’s decision to cut down on QT would mean that it would drain less liquidity from the markets. In response to a question on whether reducing QT is contrary to the current restrictive monetary policy, Powell replied in the negative.

The Fed chair said that it uses interest rates as the active policy tool and the decision to cut down on QT was long in the works. He said that the decision is “not in order to provide accommodation to the economy but to, or to be less restrictive to the economy, it really is to ensure that the process of shrinking the balance sheet down to where we want to get it is a smooth one.”

With the #Fed's announcement of reducing #QT yesterday, did they just start the beginning of the end of one of the longest drawdowns in #bondmarket history? pic.twitter.com/eghZ3EZxDY

— Lance Roberts (@LanceRoberts) May 2, 2024

Powell Does Not Want to Rattle Markets With QT

Powell added that through the move, the Fed intends to avoid a repeat of the previous QT in 2019 when the Fed’s actions led to a repo crisis and interest rates rose sharply.

All said Fed’s decision to cut down on QT has helped bring down bond yields. The move is also positive for stocks and other risk assets like cryptocurrencies which tend to do well in a lower interest rate environment.

Specifically, growth stocks that bore the brunt of higher interest rates stand to benefit as investors pivoted away from these names after interest rates rose to multi-year highs.

Now as the Fed has signaled that it has embarked on easing monetary conditions, risk assets could receive some impetus while bonds might witness a sell-off. The decision to cut back on QT also signals that the Fed might soon start cutting interest rates amid the softening of the US economy.