Tensions in the perpetually volatile Middle East have once again reached a tipping point, that could have profound implications beyond the obvious toll of life and limb including spiking oil prices and potentially a full-blown recession.

Key Highlights: Escalating Tensions Between Iran and Israel

- Direct Military Confrontation: Iran launched a missile and drone strike on Israel, marking a significant escalation after Israel targeted top Iranian generals. Reports also suggest a possible Israeli strike on Iran’s Isfahan.

). - Oil Price Volatility: Oil prices initially surged due to concerns over potential disruptions in the Middle East, with Brent crude reaching above $90 per barrel. However, prices fell back slightly after Iranian state media downplayed the damage .

- Strait of Hormuz Concerns: A key focus is the risk of a blockade of the Strait of Hormuz, a critical passage for global oil trade, which could severely impact oil supplies and prices .

- Economic and Political Risks: Rising oil prices could exacerbate inflation, affecting global economic stability and complicating the Biden administration’s efforts to manage fuel costs ahead of the 2024 elections .

What Happened to the Oil Markets: The Israel – Iran Conflict

Over the weekend, Iran launched an audacious barrage of missiles and drones toward its arch-nemesis Israel, marking a stunning new phase of direct military confrontation between the two bitter adversaries. The world expected this strike for more than a week after Israel escalated the conflict by killing multiple top generals in an attack on an Iranian consulate in Damascus, which is considered Iranian soil under the Vienna Convention.

While Israel’s sophisticated air defenses managed to intercept the overwhelming majority of the projectiles, the attack represented a further escalation that suddenly put the oil-rich region on a knife’s edge yet again. Many pundits and analysts argued that this Iranian strike was merely a show of force to try to end the conflict and regain deterrence as it was telegraphed hours in advance.

Nevertheless, just yesterday, reports started to circulate about a direct attack from Israel to Iran that targeted the city of Isfahan – a key hub where the Islamic country has military bases and nuclear research facilities.

Although the Israeli army and leadership have not confirmed the attack, US sources and people on the ground reported at least three explosions within the city that, if confirmed, raise grave concerns regarding the stability of the region.

Escalation of some sort seems likely though not inevitable amid chilling prospects of a wider war, energy analysts and market watchers are now sounding alarms about the growing risks of an escalation in the conflict and the threat that it poses to global crude supplies.

Oil Prices Spike, Then Recede on Israel-Iran Reported Attack

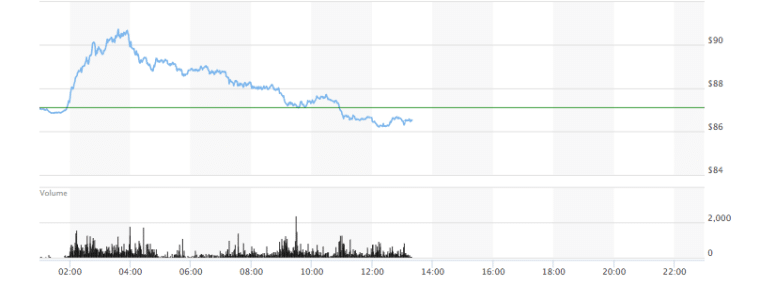

The potentially explosive situation in the Middle East was already starting to move energy markets on early Friday. Following reports of overnight explosions near the Iranian city of Isfahan from Israel’s strikes, Brent crude futures spiked by over 3% in early oil trading activity and managed to push the price to more than $90 per barrel.

However, the initial oil price surges proved relatively short-lived after Iranian state media downplayed the extent of damage from Israel’s strikes, essentially saying it was a piddly drone attack that did little to no damage. As of now, Brent prices have slid 0.6% lower to $86.60 per barrel while US crude is off 0.5% at $82.33 per barrel.

While fears of a wider conflict disrupting oil supplies were priced into the markets to some degree, the muted reaction suggests that traders may not yet be fully preparing for a worst-case scenario in the Middle East.

According to Neil Shearing, chief economist at Capital Economics, the market’s tepid response “suggests that some of that risk has already been priced in.”

Strait of Hormuz Blockade Could Strangle Global Oil Flows

The main dread looming over energy markets at the moment is the risk of an extended disruption or blockage of the crucial Strait of Hormuz, a narrow waterway off Iran’s coast through which over a quarter of the world’s maritime oil trade transits daily.

Should Iran succeed in cutting off this global chokepoint, energy analysts warn of crippling shocks to global crude supplies and crude price spikes.

“It’s the main or only route for the Middle Eastern oil exporters”, Richard Bronze, co-founder of data firm Energy Aspects said to CNN. “Any significant disruption would have a huge impact on global oil supplies and oil prices as a result.”

While Iran is a major crude producer itself, most of its exports go to China due to the longstanding sanctions imposed by the US However, if its oil flows were cut off entirely due to a blockade of the Strait, the impact would still likely be “massive” as China would scramble to compete for supplies from other sources, Bronze emphasized.

The Strait of Hormuz has long been a flashpoint in the region, with Iran periodically threatening to shut down this vital route as leverage against its foes. However, analysts still see a complete closure as relatively unlikely given the astronomical blowback that Iran’s economy would suffer by cutting itself off from crucial oil export revenues.

That said, these escalating tensions are stoking fears that other actors like the US could move to strangle Iran’s remaining exports, potentially through another wave of sanctions. This could result in further tightness on a global crude market that has already seen prices skyrocket this year amid resilient demand and tight OPEC+ supplies.

Goldman Sachs: Oil Trades With $5 to $10 Premium Due to Middle East Tensions

For consumers already grappling with elevated energy costs amid stubborn inflation across major economies, a full-blown oil shock stemming from these hostilities would threaten to exacerbate financial pressures and erode their purchasing power even further.

This could also dent global growth prospects and deepen the economic turmoil that some countries have already been suffering as a result of post-COVID disruptions and changes in monetary policies.

The triple-digit oil prices that were seen following Russia’s invasion of Ukraine could rapidly re-emerge if the Iran-Israel powder keg explodes into an outright regional war, multiple analysts warn. Goldman Sachs recently told clients that current oil prices already reflect a $5-10 per barrel risk premium tied to Middle-East-tied supply chain disruptions.

High Oil Prices Isn’t Good for Anyone… Except Oil Companies

As the US gears up for its presidential election in 2024, the specter of energy shocks stemming from the Iran crisis carries major political and economic risks for the incumbent Biden administration. The consequences of high oil prices would hurt everyday Americans where it hurts the most: the wallet.

Facing already-elevated fuel costs that have sapped consumer spending power, a fresh surge in gasoline prices could hamper the economic recovery and hand potent ammunition to Biden’s opponents.

The White House has already moved to repair frayed ties with oil producers like Saudi Arabia ahead of the election cycle in a bid to keep a lid on crude costs, but it’s to be seen whether the plan will be successful.

The spiraling Middle East crisis now threatens to nullify those efforts and force more drastic actions like a revival of Iran sanctions enforcement or even military moves to defend Gulf shipping. This wouldn’t just be bad politically, it would likely be horrible for the greater global economy that greatly depends on oil and global stability.

So far, the White House reaction to the latest Israeli strikes has been relatively muted, likely reflecting internal caution about escalating a conflict that could create severe shockwaves on global energy security and economic stability.

That said, the administration’s room for maneuverability could rapidly shrink depending on Iran’s next moves and domestic pressures over fuel prices.

“The Biden administration wants as many barrels on the market as possible in an election year to keep the global oil prices low”, a report from the Atlantic Council Experts published a few days ago reads.

Ultimately, the administration may need to walk a treacherously narrow path to defuse hostilities and prevent the situation from spiraling into a supply shock that could ultimately quash Biden’s re-election hopes. Memories of the 1970s oil shocks undoubtedly still loom and no one wants them to happen again (except for oil companies).

Inflationary Tsunami Could Push Central Banks to Revaluate Policy-Easing Decisions

Beyond the immediate pain that higher oil prices could inflict on consumers, the Iran-Israel crisis also risks kneecapping the efforts of major central banks to tame runaway inflation across their economies.

For policymakers already struggling to reign in stubborn price pressures, an oil shock would represent a fresh wound that will increase the cost of living of the citizens they serve.

Also read: 10 Best Oil Stocks to Buy in April 2024

While most forecasters expect renewed disinflation this year as rate hikes work through the economic plumbing, any breakdown into war in the Middle East will drastically affect that calculus. In fact, the mere threat of disruptions is already casting a cloud over central bank rate outlooks.

Last week, Lithuanian European Central Bank member Gediminas Simkus warned that the current geopolitical turmoil could result in the European Central Bank reconsidering its latest interest rate cut.

For consumers and businesses still reeling from the aftermath of the first rounds of inflation unleashed by pandemic-era supply shocks and the events in Ukraine, the prospect of a new conflict in the Middle East is reviving concerns and creating stress.

Economic Risks Loom if Iran Crisis Worsens

To sum up the precarious situation, the stakes could hardly be higher when it comes to the fallout if the brewing storm between Iran and Israel turns into something more cataclysmic. A full-scale regional war, especially if it involves the US runs the risk of kicking off a global energy price spiral and an inflationary tsunami that would endanger economic recoveries worldwide.

There are also other risks that analysts are currently considering stemming from tensions in the relationship between the US and Venezuela with the former country possibly reinstating its sanctions on the Maduro-ruled South American nation after the ruler failed to live up to the promises his administration made that led to a temporary lift.

At the same time, the Atlantic Council of Experts sounded a relatively optimistic tone that any supply shocks would likely be temporary so long as the crisis doesn’t transform into an existential conflict. The Council sees “the risk of long-term, elevated oil prices owing to a supply shock from the Middle East is still low.”

However, that assessment assumes a relatively contained clash in line with the recent history of Middle East flare-ups.

If the latest events lead to a broader conflict that resembles the region’s past wars, it would be open season for all potential worst-case scenarios, both for the energy market and the global economy as a whole.