Generative AI (artificial intelligence) has been making waves globally and the optimism has helped catapult Nvidia into the ranks of $2 trillion dollar companies.

Enterprise generative AI is set to be the next battlefield now as Linux Foundation, along with other tech giants like Intel, Qdrant, Red Hat, Domino Data Lab, and Cloudera have launched a new initiative to drive open-source innovation in data and AI infrastructure.

Key Highlights: Enterprise Generative AI & OPEA

- OPEA Initiative: Aims to address fragmentation in AI tools and solutions, offering standardized RAG pipelines.

- Generative AI Growth: Expected to grow from $1.74 billion in 2022 to $19.8 billion by 2030.

- Corporate Contributions: Companies like IBM and Cloudera are developing tools alongside the open-source framework.

- Balancing Collaboration & Competition: Members must manage competitive interests while building a unified platform.

- Industry Adoption: Success hinges on widespread adoption of standardized AI solutions.

Understanding Enterprise Generative AI: Threat or Innovation?

Enterprise generative AI models, like most other business-facing products, are not exactly enthralling at the surface but it seems like they will be unbelievably profitable if done right. Linux Foundation’s LF AI & Data Foundation is seeking a piece of the pie, announcing the Open Platform for Enterprise AI (OPEA) as its latest Sandbox Project.

“OPEA will unlock new possibilities in AI by creating a detailed, composable framework that stands at the forefront of technology stacks. This initiative is a testament to our mission to drive open-source innovation and collaboration within the AI and data communities under a neutral and open governance model,” said Ibrahim Haddad, Executive Director at LF AI & Data.

The OPEA is looking to empower enterprises with open, multi-provider AI systems that can drive innovation and value for generative AI. Haddad said OPEA would offer open source, standardized, and heterogenous Retrieval-Augmented Generation (RAG) pipelines that would provide “optimized” support for AI toolchains and compilers.

The release said that the rapid advancement of generative AI has led to “fragmentation” of tools and solutions. It emphasized that “OPEA intends to address this issue by collaborating with the industry to standardize components, including frameworks, architecture blueprints and reference solutions that showcase performance, interoperability, trustworthiness and enterprise-grade readiness.”

Intel welcomes the Open Platform for Enterprise AI, an initiative that unifies the developer community for the advancement of #GenAI systems.

Learn more: https://t.co/aNoqgfXvwm pic.twitter.com/ZYtYp9YThQ

— Intel News (@intelnews) April 16, 2024

In its separate announcement, Intel said that the RAG ecosystem is developing gradually through the creation of new projects.

It added, “Enterprises are challenged with a do-it-yourself approach because there are no de facto standards across components that allow enterprises to choose and deploy RAG solutions that are open and interoperable and that help them quickly get to market.”

This lack of options opens the way for SaaS and XaaS companies to take over the market with customized AI solutions for any given industry.

OPEA Members Are Building Enterprise Generative AI Tools

Meanwhile, even as multiple tech companies have come together for an open-source enterprise generative AI stack, they are also working on their own individual tools. For instance,

- Last year, Red Hat, which is owned by IBM announced Red Hat Ansible Lightspeed generative AI service that helps automation teams create and maintain Ansible content in a more efficient and organized way.

- In October, Domino Data Lab announced new capabilities for building generative AI “rapidly and safely at scale.”

- In December, Cloudera said that it is launching and expanding partnerships to create a new enterprise AI ecosystem.

It remains to be seen how these companies collaboratively work on enterprise generative AI when they are also competitors, vying for a share of customer wallets.

According to Grand View Research, the enterprise generative AI market was only $1.74 billion in 2022. It however expects the industry to grow at a CAGR of 36.4% until 2030 and reach annual revenues of $19.8 billion.

It’s not surprising that companies are working to develop good enterprise AI models and capitalize on the nascent but rapidly growing demand.

Which Companies Are Making Promising AI Tools for Enterprise

There are several companies – both in the startup and listed space – that are working on AI tools for enterprises. The following are some of the privately held companies in the space:

- SambaNova Systems promises the only enterprise-grade full-stack AI solution

- Fractal Analysis helps companies power human decisions in the enterprise by bringing analytics and AI to the decision.

- Gong.io is an Israel-based AI startup that helps power the revenue workflows for companies

- 6Sense uncovers anonymous buyers, understands their behavior, and connects companies with buyers who are most likely to buy its products and services.

Since generative AI is an emerging technology, most companies in the industry are in the startup space. There are proxy plays like Microsoft which has invested billions of dollars in ChatGPT’s parent company, OpenAI.

Large Tech Companies Are Not Pure-Play AI Plays

Alternatively, companies like Amazon are also a play on the enterprise AI market but artificial intelligence still does not account for much of Amazon’s revenues even as the e-commerce giant expects AI to add billions of dollars in revenues in coming years.

There aren’t many publicly listed companies dedicated entirely or even mostly to enterprise AI but there are a few. C3.ai is a top contender that is trying to capture the massive market of enterprise AI. C3.ai has long been predicting that the enterprise AI market would be quite large – an assertion that a section of the analyst community did not agree with.

During their fiscal Q3 2024 earnings call in February, C3.ai was quite upbeat – both about the enterprise AI opportunity as well as its ability to cater to that market.

In the quarter, it closed 62% more bookings with its partner network when compared with the previous quarter and termed the demand for enterprise AI products as “overwhelming.” However, the stock has struggled to hold on to this enthusiasm and the gains from the upbeat February earnings call have already been wiped out.

The company credits itself for establishing the enterprise AI category and said that it has been at the forefront of the industry for 15 years.

C3.AI Could Be a Major Contender in Enterprise AI

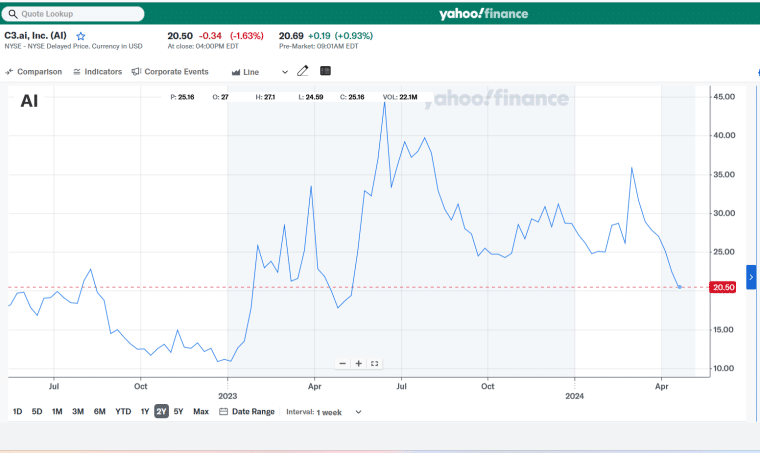

C3.ai went public in December 2020 and priced the IPO at $42. While the stock soared 140% on the listing, it crashed over the next two years amid the slump in growth stocks. However, AI stocks were the flavor of the season in 2023, thanks to the AI euphoria and C3.ai rose a massive 177%.

The stock has since crashed and trades at less than half of its 52-week highs. However, some analysts are quite bullish on this enterprise AI play with Tipranks.com setting a mean target price of $30.55, implying an upside of almost 50% over the next 12 months.

As enterprise AI also gets the same respect that generative AI plays as Nvidia has received over the last year, better days might lie ahead for C3.ai and other enterprise AI contenders as well.