The recent clash between Iran and Israel has sent shockwaves through the global markets, raising concerns about the potential economic fallout that an all-out war between the two countries could have on the US and global economy and the financial markets.

The stakes are high, as experts warn that an escalation in the conflict could plunge the United States into a recession and cause significant volatility in the prices of just about all asset classes from oil and gold to stocks and cryptocurrencies.

Key Highlights: Iran-Israel Conflict’s Economic Impact

- Initial Conflict Overview: Iran’s missile and drone attack on Israel in April 2024 marked the first direct confrontation between the two nations, prompting concerns over potential escalation into broader regional conflict .

-

Economic Risks: A severe conflict could disrupt global oil supplies, with estimates suggesting that crude prices could exceed $150 per barrel. This would likely drive inflation higher in the US, worsening the existing economic strain (

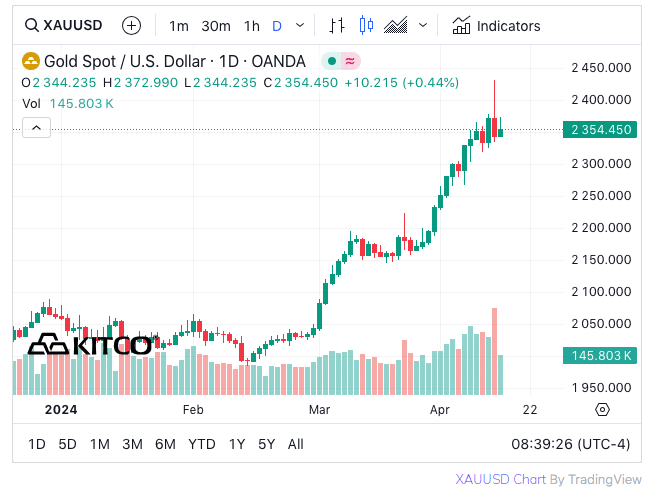

- Market Reactions: Stock markets, particularly those tied to energy and transportation, are facing significant volatility. Gold has seen a rise as investors seek safe-haven assets amid geopolitical uncertainty .

- Cryptocurrency Trends: The crypto market’s response has been mixed, with some investors seeing digital assets as hedges against traditional market risks. However, uncertainty may lead to broader sell-offs in the sector, mirroring stock market behavior .

- Policy Responses: The US has emphasized the need for de-escalation, with warnings from experts about the potential for a US recession if the conflict expands. Policy measures, including potential fiscal stimulus, are being considered to counter economic downturns .

What Happened?

Islamic Republic targeted military bases of usurping regime based on a legitimate right to defend Iran & a 1st step in a successful operation.

I warn that any new steps taken against the interests of Iranian nation will be met with a stronger response bringing the enemy’s regret.— سید ابراهیم رئیسی (@raisi_com) April 14, 2024

On April 13th, 2024, Iran launched a barrage of missiles and drones into Israel, marking the first time the Islamic Republic has directly attacked the Jewish state from its own territory.

The strike came in retaliation after Israel blew up the Iranian consulate in Syria, killing several high-up Iranian military commanders, earlier this month.

Also read: Top 10 Energy Companies in the World by Market Capitalization

Israel’s military, with the help of the US and UK, effectively shot down over 300 of the incoming projectiles with assistance from the US and other allies. Most foreign policy experts agree that the attack was merely a show of force, intended to do no real damage to avoid escalation. Nonetheless, the assault has raised fears of a potential cycle of retaliation and counter-retaliation that could rapidly spiral out of control as Israel has already promised to strike back.

“The key risks for the global economy are whether this now escalates into a broader regional conflict, and what the response is in energy markets”, warned Neil Shearing, group chief economist at Capital Economics.

The Potential Economic Fallout of an All-Out War Between Iran and Israel

A more severe conflict between Iran and Israel could have devastating consequences for the US economy, which is already fighting its way out of a cycle marked by high inflation and rising interest rates that plunged stock prices and shocked the economy.

“It would probably push the US economy into a ditch”, highlighted Stewart Glickman, an analyst at research firm CFRA. “Everywhere you look, it will be more expensive. It will feel like a really strong tax on our pocketbooks.” The problems would only get worse if the US were to join the conflict directly, though Biden has reportedly refused to join in on (or support) any Israeli offensive strikes.

The primary concern is the potential impact on global oil supplies. Iran is a major oil producer and any disruption to its production or exports could send crude prices skyrocketing. Experts estimate that, in the event of a direct confrontation between Iran and Israel, oil prices could surge above $150 per barrel.

“If the war expands to the point of direct intervention from Iran and the United States, it would bring ‘severe’ global economic consequences, spiking the price of oil to more than $150 a barrel and slowing economic activity as consumers and businesses contend with elevated prices”, journalist Max Zahn from ABC news writes upon questioning Gregory Daco, chief economist at consulting firm EY, on the matter.

Such a spike in oil prices would have far-reaching consequences. Gasoline prices in the US could easily surpass $5 per gallon and the increased cost of diesel and jet fuel would drive up the prices of a wide range of consumer goods and services.

US oil giants would surely increase their prices even more than necessary as many companies have done to price gouge Americans. Price gouging is now one of the main drivers of inflation in the US and this conflict would only give oil corporations the leeway to raise prices further.

All of this, in turn, would exacerbate the already high levels of inflation that have been plaguing the US economy, harming 100s of millions of Americans (and billions of other global citizens).

Stock Market Turmoil and Volatility in Gold and Crypto Prices

The turmoil in the oil market would also reverberate through the stock market, causing significant volatility and potential losses. Sectors heavily dependent on energy such as airlines, shipping, and manufacturing, would be hit particularly hard.

The impact on the broader stock market could be severe, with the potential for a major correction or even a full recession. Investors would likely flee to safe-haven assets like gold, which would further exacerbate the economic disruption.

Speaking of gold, experts argue that the precious metal would likely see a significant price surge if the Iran-Israel conflict escalates. As a traditional safe-haven asset, gold tends to thrive in times of geopolitical uncertainty and economic turmoil.

This morning, gold prices are jumping 0.6% in early spot trading activity at $2,358 per troy ounce. Since the year started, the price of the precious metal has increased by 14.3% on the back of significant geopolitical uncertainty, hawkish Fed policy, supply chain disruptions, and escalating tensions in the Middle East.

“In addition to monetary policy, geopolitical uncertainty is often a key driver of gold demand and in 2024 we expect this to have a pronounced impact on the market”, a World Gold Council report highlights.

Cryptocurrencies, on the other hand, could experience more mixed results.

While some investors may see digital assets as a hedge against traditional market volatility, the overall uncertainty and risk-off sentiment could also lead to a sell-off in the crypto space. Generally, if stocks are crashing, so is Bitcoin, despite its popular narrative as a safe-haven.

Is a Recession Possible or Likely in This Scenario?

The combination of skyrocketing oil prices, stock market turmoil, and broader economic disruption could ultimately push the US economy into a recession.

Daco estimates that such an outcome could reduce US inflation-adjusted GDP growth over a year-long period by 1.2%, amounting to $500 billion in lost production.

“Consumers have a lot of domestic concerns right now, but we also know how rapidly geopolitical developments can evolve”, Daco said. “any form of shock could have a larger effect on the economy and consumers.”

The US economy is already in a fragile state, grappling with high inflation, high interest rates, and concerns about a potential recession. The threat of a wider Iran-Israel conflict adds an additional layer of uncertainty and risk that could prove devastating.

“It’s critically important that the conflict not spread”, Treasury Secretary Janet Yellen warned earlier this month. Unfortunately, the situation remains highly volatile and the potential for escalation remains a significant concern.

Preparing for the Worst

Given the grave economic consequences that could stem from a wider Iran-Israel conflict, investors and policymakers must take steps to prepare and mitigate the potential fallout.

For investors, diversification is key. Spreading investments across different asset classes, including safe-haven assets like gold can help hedge their portfolios against the volatility that would likely accompany a major geopolitical crisis. Avoiding overexposure to sectors heavily dependent on energy such as airlines and shipping, may also be prudent.

Policymakers, on the other hand, must work hard to de-escalate tensions and prevent the conflict from spiraling out of control.

This may require diplomatic efforts, sanctions, and other measures to rein in the aggression from both sides. The Biden administration has already indicated that it is seeking to prevent hostilities from spreading (especially because a full war could easily lose him the 2024 election) but the path forward remains uncertain.

At the same time, policymakers must also be prepared to implement measures to support the US economy if a recession is triggered by an escalation in the conflict. This could include targeted fiscal stimulus, accommodative monetary policies, and other interventions to cushion the blow and promote economic recovery.

The stakes could not be higher. A wider Iran-Israel conflict has the potential to wreak havoc on the US economy, undoing much of the progress made in recent years and plunging the country into a period of significant turmoil. Vigilance, preparedness, and a commitment to de-escalation will be crucial in navigating the treacherous waters ahead.

That said, experts agree that the current situation should have minimal impact on the trajectory of both the US and global economy if it doesn’t escalate further.

“While we and investors must remain vigilant regarding those risks, we do not believe that the conflict in its current form is likely to have significant impacts on global economic growth”, Franklin Templeton analysts wrote in a note last week.

Meanwhile, Professor Michael Walden from North Carolina State University commented that “the impacts are going to be very dependent upon what does evolve.”

“If Israel does not respond and if Iran did this as a show of force primarily to its citizens and there’s no recurrence, I think the impact will be very, very miniscule”, Walden concludes.