Cathie Wood, the CEO of ARK Invest, is well known for her bold inventions in popular, innovative tech through the company’s various funds, including her flagship fund, ARK Innovation ETF (NYSE: ARKK),which counts Tesla as its biggest holding.

Wood doubled down on this tactic recently by investing in ChatGPT-maker OpenAI through her ARK Venture Fund (NASDAQ: ARKVX).

While Wood is arguably the most optimistic Tesla supporter, predicting that the stock will increase more than ten times by 2027 and hit $2,000, Elon Musk may not feel the same way about OpenAI. The billionaire has voiced his concerns about the company (mostly for minor reasons, though he has valid points) and has also launched his own AI venture called X.ai.

Coming back to Wood buying a stake in OpenAI, in a note sent to clients, ARK said, “As of April 10, 2024, the ARK Venture Fund invests in OpenAI.” It added, “OpenAI is at the forefront of a Cambrian explosion in artificial intelligence capability.”

Cathie Wood’s Ark Investment Management has announced it holds a stake in OpenAI https://t.co/9pUvtyyEjb

— Bloomberg (@business) April 11, 2024

The investment would be quite small though as ARK’s Venture Capital Fund has total holdings of just about $54 million while OpenAI’s valuation is over $80 billion.

Key Takeaways: Cathie Wood’s ARK Venture Fund

- Investment in OpenAI: Cathie Wood’s ARK Venture Fund invested in OpenAI, reflecting her continued focus on disruptive technologies.

- Tesla Optimism: Wood remains highly bullish on Tesla, predicting its stock could reach $2,000 by 2027, though this contrasts with Elon Musk’s criticisms of OpenAI.

- Underperformance of ARK ETFs: ARK Invest’s ETFs, including its flagship ARK Innovation ETF, have underperformed since 2021, trailing behind the broader market’s performance in 2024.

- Focus on AI: Despite the setbacks, Wood’s investments in AI through companies like OpenAI and Anthropic align with the growing importance of AI in the tech industry.

- Mixed Results in Holdings: While some ARK Venture Fund holdings like Coinbase and Robinhood have performed well, other key investments, including Tesla, continue to struggle.

Cathie Wood’s Venture Fund Invested in OpenAI

Cathie Wood’s bet on OpenAI shouldn’t be surprising after all given the growth-oriented fund manager’s obsession with disruptive technologies. Generative AI is currently the king of disruptive technology at the moment and is attracting billions of dollars in investment from tech giants.

You can now purchase ARKVX to get exposure to OpenAI, though it only represents about 4% of the ETF’s holdings.

If you want more direct exposure to OpenAI and its technology, Microsoft is a clear choice.

Microsoft has already invested over $13 billion into OpenAI and has committed to invest billions more over a multi-year horizon. If the quantum of funding looks fascinating, it is not even a fraction of the $7 trillion funding that Sam Altman is seeking for ChatGPT’s parent.

Nonetheless, while Wood’s bet on OpenAI is rather small, it does signal her backing for the company.

To her credit, Wood invested in companies like Tesla and Block (formerly Square) quite early and investors in her funds reaped great rewards until about early 2021.

Wood’s ETFs Have Underperformed Since 2021

Before you go and invest in ARK’s funds, make sure you know what you’re getting into.

While these ETFs are often exciting, offering exposure to next-generation tech, they simply have not performed well in years.

Growth stocks peaked in early 2021 and have since looked weak amid the Fed’s relentless rate hikes. Wood’s ETFs have also underperformed since then including in 2024 where her flagship ARK Innovation ETF is down over 7%, making it the second worst-performing diversified ETF.

In contrast, the S&P 500 rose by over 10% in the first quarter of 2024 and had its first quarter since 2019. The underperformance is not limited to ARKK and the ARK Space Exploration & Innovation ETF is also down around 4% for the year and is among the worst-performing ETFs.

After the massive underperformance between 2021 and 2022, the long-term returns of ARK funds also look quite dismal. For instance, the five-year returns of ARKK are a mere 1.97% while ARK Genomic Revolution ETF has lost 1.71% over the period.

Growth Stocks Have Been Out of Favor

ARK Next Generation Internet ETF and ARK Autonomous Tech and Robotics ETF have been a bit of a saving grace and have gained around 10% over the last five years. However, even their returns have trailed that of S&P by a wide margin.

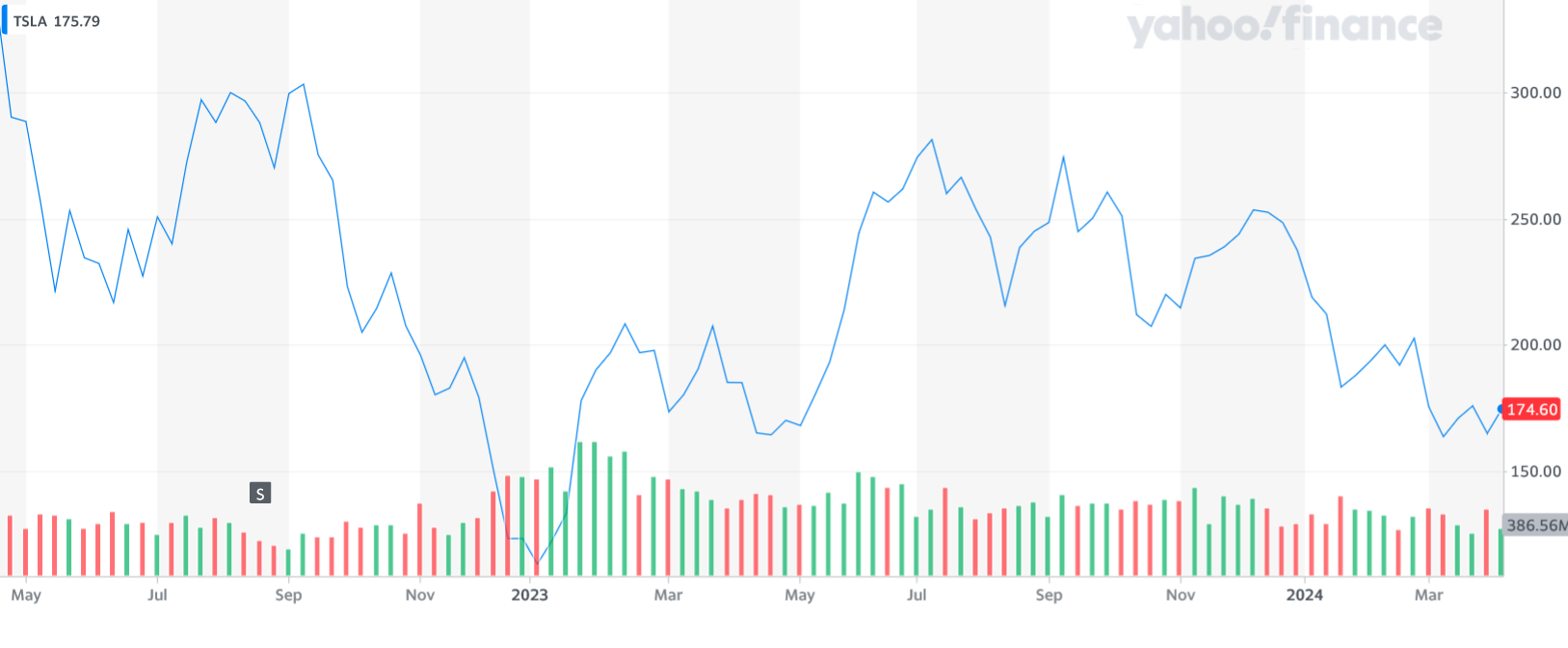

Most of Wood’s favorite names have been out of favor with markets. For instance, Tesla, the biggest holding of ARKK, and also a constituent of the Venture Fund, trades at less than half of its 2021 highs and is among the worst-performing S&P 500 stocks this year.

Other Holdings of ARK Venture Capital Fund

ARK Venture Fund has quite a broad investing mandate and says, “As an evergreen public-private crossover fund, the ARK Venture Fund can hold shares of companies throughout their private and public market lifecycles, from early stage to mega cap.”

It holds a total of 27 privately held companies.

These include:

- Epic Games

- Anthropic

- Discord

- Figure AI

- SpaceX

- Relation Therapeutics

Since these are privately held companies, we don’t have credible metrics about their valuation. That said, SpaceX’s valuation has been rising steadily and Elon Musk’s spacecraft company was valued at around $180 billion in December 2023.

Epic Games, the publisher of a myriad of extremely popular games like Fortnite, also attracted a $1.5 billion investment from Disney earlier this year. However, the deal valued Epic Games at $22.5 billion – a significant discount to the $31.5 billion that it was valued in 2022.

Meanwhile, ARK Venture Fund has also invested in several publicly traded companies, all of which happen to feature in other ARK funds.

The fund has put money into 21 publicly traded companies, including Tesla, Coinbase, Robinhood, and Palantir Technologies. Wood’s investment in Coinbase and Robinhood has done particularly well, as both stocks have soared during the cryptocurrency boom. However, Tesla has faced challenges since hitting its highest point in November 2021, dropping over 50% from that peak.

As bitcoin prices reached record highs investors in cryptocurrencies as well as ancillary players like crypto miners and exchanges also benefited.

Wood Bets on OpenAI Amid Underperformance

AI has become a buzzword among leading companies and is increasingly featuring in earnings calls. Data compiled by FactSet showed that 179 of the 500 S&P 500 companies used the term “AI” in their earnings calls between December 15 2023 and March 14, 2024.

The figure is more than three times the ten-year average and the second highest since 2014.

The highest (181) was in Q2 2023 when advanced generative AI changed the tech world forever. The AI euphoria seemed to culminate in May 2023 when Nvidia became a $1 trillion company, but the hype was far from over. Nvidia is now a $2 trillion company could very well become a $3 trillion company if this trend continues.

Through her bet on companies like OpenAI and Anthropic, Wood is also trying to participate in the AI rally.

That said, after her massive underperformance over the last few years, Wood has lost some of her fan following – at her peak many dubbed her to be a better investor than the legendary Warren Buffett.

Wood’s performance is a pale shadow of past and ARK Investment’s ETFs topped the Morningstar list of ‘wealth-destroyers” and cumulatively eroded $14.3 billion in value over the 10 years ended December 31, 2023.