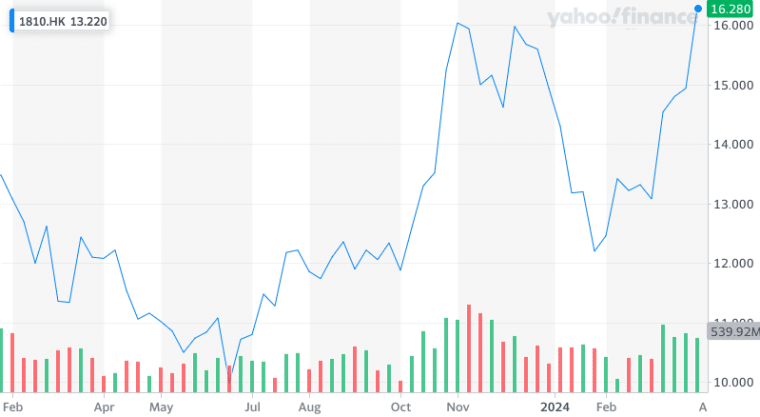

Shares of Chinese tech giant Xiaomi Corp soared by as much as 16% on early Tuesday trading activity, adding over $7 billion to the company’s market capitalization, after investors massively endorsed the launch of its newest electric vehicle.

This is the first trading day since Xiaomi unveiled its long-awaited EV. Consumers showed overwhelming interest in the affordable luxury sedan. This initial demand spike is positioning the SU7 as a formidable challenger to market leaders like Tesla (TSLA) and BYD in the world’s largest EV market.

Key Highlights: Xiaomi’s EV Launch and Stock Surge

- Xiaomi’s EV Debut: Xiaomi unveiled its first electric vehicle (EV), the SU7 sedan, triggering a massive rally in its stock price, which surged up to 16%, adding $7 billion in market capitalization.

- Strong Pre-Order Demand: Over 88,000 pre-orders were received within 24 hours, pushing waiting times to 20 weeks for new buyers.

- Competitive Pricing: The SU7’s base model is priced at around $30,000, making it more affordable than competitors like Tesla’s Model 3 in China.

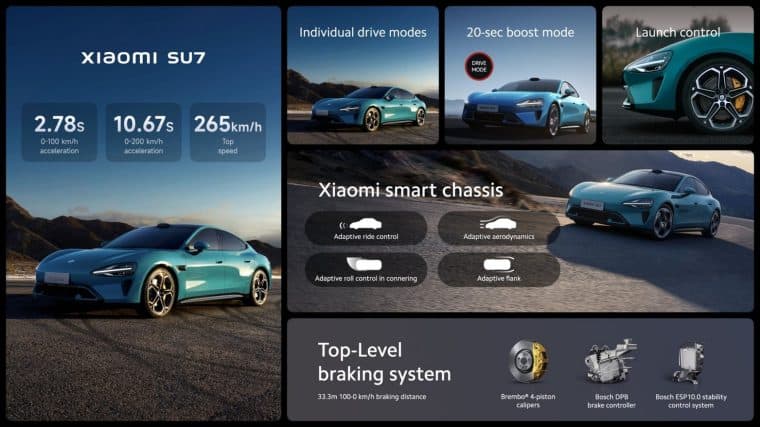

- High-Performance Specs: The sedan boasts impressive features, including a top speed of 260 km/h, a 630 km range, and a 0-100 km/h acceleration in just 2.78 seconds.

- Market Impact: The EV’s success caused a shakeup in the Chinese EV market, with competitors like Nio and Xpeng offering incentives to counter Xiaomi’s aggressive entry.

- Investor Optimism with Caution: Analysts are excited about Xiaomi’s potential in the EV space but warn of profitability challenges, with expected losses of $566 million in the first year.

Xiaomi Stock Supercharged by EV Euphoria

Xiaomi’s Hong Kong-listed shares skyrocketed to HK$17.34, their highest level since January 2022, before paring gains to close the day with a 9% uptick.

At its peak, the stock’s $55 billion market valuation briefly exceeded that of traditional American automakers like General Motors and Ford, despite just entering the vehicle manufacturing business a few months ago.

The exuberant investor reaction highlighted rising confidence in Xiaomi’s ability to replicate its runaway success in consumer electronics within the hypercompetitive Chinese EV space. Analysts widely lauded the company’s initiatives and its pricing strategy for the inaugural model, the SU7 sedan.

“Xiaomi’s goal is to make a dream car that is as good as Porsche and Tesla”, boasted billionaire co-founder and CEO Lei Jun in an event held in December. Jun categorized this EV push as the “final major entrepreneurial project” of his career.

As SU7 Orders Flood In, Waiting Times Extend

Underpinning today’s rally were the staggering pre-order numbers for Xiaomi’s SU7 electric sedan racked up just days after its splashy unveiling. The company reported that more than 88,000 refundable orders were logged in the first 24 hours after sales commenced last Thursday.

It shouldn’t be all that surprising that the Xiaomi SU7 is so popular. The car is no doubt beautiful, with its exterior resembling a Porsche Taycan and its interior reminiscent of high-end Tesla EVs.

That tsunami of initial demand prompted Xiaomi’s online stores to already reflect waiting times of at least 20 weeks for new SU7 orders. Lei Jun announced that the first deliveries of a limited 5,000-unit “Founder’s Edition” would commence on Wednesday across 28 cities in China.

Xiaomi has asked suppliers to dramatically ramp up production capacity from an initial 3,000 per month to meet consumers’ surging interest. Capacity is slated to hit 10,000 units monthly by May according to reports. The sedan is being produced at a state-owned BAIC facility with an annual ceiling of 200,000 vehicles.

SU7 Pricing Punches Above its Weight Class

Most analysts expected the car to look great as Xiaomi has long developed brilliant technology but some were worried that it wouldn’t be price competitive with other top EVs. It turns out that they were completely wrong to worry. Much of the SU7’s early popularity can be attributed to its aggressively low pricing compared to internal combustion and electric vehicle competitors in its premium market segment.

Also read: Are Tesla’s About to Get 50% Cheaper? This Revolutionary Production Method Could Save Tesla

While official sale prices have not been announced, Xiaomi stated that the SU7’s base model would retail for around $30,000 – roughly $4,000 cheaper than Tesla’s most affordable Model 3 car offered in China.

This ambitious pricing represents a sharp departure from conventional automotive industry norms, where new EV entrants typically charge a hefty premium for their luxury models. Xiaomi has clearly taken the opposite tack, leveraging its expertise in designing premium hardware coupled with its massive supply chain relationships and manufacturing scale to provide luxury styling and performance at mass-market pricing.

Premium Performance to Match Tesla

Despite the SU7’s value-oriented pricing, Xiaomi has issued eye-popping performance claims that rival or even eclipse top luxury EVs from Tesla, Mercedes, and Porsche. Company officials stated that their sedan bests the acceleration of the Porsche Taycan Turbo and Tesla Model S. SU7 buyers will be able to outrace many, if not most, supercars with its absurd 2.78 0-100 km/h acceleration.

The SU7’s projected 260 km/h top speed and nearly 630 km maximum range per charge also place it squarely among the upper echelon of today’s EV benchmarks. Its custom-designed motors are touted as having higher rotational speeds and more compact size than competitors’ offerings.

Flush with a reported $1.5 billion in EV development investments over three years, Xiaomi has clearly spared no expense in outfitting the SU7 with premium components and advanced technologies. This includes an in-house developed smart car operating system (HyperOS), biometric facial recognition, and autonomous highway driving abilities.

Xiaomi Has Its Rivals on High Alert as Competition Heats Up

In a sign of just how seriously incumbent automakers are taking Xiaomi’s EV ambitions, several moved swiftly to counter the SU7’s competitive threat within days of its launch. Electric upstarts like Nio (NIO) and Xpeng announced purchase incentives of $2,800 and $10,000 respectively on select models this week.

“Xiaomi’s strong entry may pose a threat to its more established peers”, wrote Citigroup analysts led by Jeff Chung. They predicted that other Chinese brands like BYD “may follow with pricing adjustments to keep up with the competition.”

Shares of the two EV startups sold off sharply on Tuesday, with investors likely spooked by the newest player’s rocketing first-day success. Xpeng stock plunged by as much as 10% during the Hong Kong session and ended 5.6% lower. Meanwhile, Nio stock sank by 3.2% initially and closed the session 2.8% lower after the SU7’s debut sparked fears of an intensifying price war. Traders were simply unprepared for how incredible Xiami’s EV would be in everything from looks to price and performance.

Analysts are Cautiously Bullish and Mostly Worried About Profit Margins

Most analysts struck an optimistic but measured tone about Xiaomi’s budding four-wheeled pursuits, heartened by the company’s pricing power and technological expertise. Most of them are wary about the prospect of steep losses in automotive manufacturing.

“We maintain our cautious view that ultimately everyone could be a loser within the 200,000 to 300,000 yuan ($27,649.90 to $41,474.85) segment”, predicted Citi Research analysts. They estimated a whopping $566 million net loss for Xiaomi in the SU7’s first year, equating to around $9,400 in red ink per vehicle based on projected sales of 60,000 units.

Goldman Sachs analysts projected even higher 2024 sales of 100,000 SU7 models but echoed concerns about “manufacturing capability ramp-up” and wait times that have already ballooned to 5 months for new orders.

Regardless of the bottom-line profitability picture in its maiden EV voyage, Xiaomi has signaled an intent to be an enduring industry disruptor. “By working hard over the next 15 to 20 years, we will become one of the world’s top 5 automakers, striving to lift China’s overall automobile industry”, pledged the company’s CEO.

The SU7’s blockbuster debut has a robust early statement that is being interpreted as a positive signal for that lofty ambition.

After captivating the world’s smartphone market for over a decade, Xiaomi appears poised to be ready to assault the EV world thanks to the expertise it has gained over the years in the tech industry. Today’s soaring share price suggests that investors are ready to buckle up for a thrilling ride.