The multi-billion-dollar logistics industry is under siege from a new breed of tech-savvy cargo thieves. By exploiting vulnerabilities in digital tools originally meant to streamline shipping, hackers are rerouting trucks, falsifying identities, and staging brazen heists – all while hiding miles away from the cargo they are targeting.

The disturbing trend, known as “strategic cargo theft,” has sparked alarm bells across the transportation sector. Data indicates that this type of cargo theft has surged to all-time highs and experts warn that the threat could cripple supply chains if left unchecked.

“Prevention is the key”, said Scott Cornell, a cargo theft specialist at Travelers Insurance. “Make sure you know who you’re doing business with.”

From Harrisonburg Yogurt Hijacking to Nationwide Mayhem

One of the most daring incidents pulled off by the digital cargo bandits involved a refrigerated trailer filled with $50,000 worth of Danone yogurt and plant-based milk products. The trailer, which had been loaded at a Danone plant near Harrisonburg, Virginia, never made it to its intended Florida supermarket destination.

According to the Wall Street Journal, hackers exploited an online logistics platform to impersonate a legitimate trucking company and divert the shipment to New Jersey by hiring an unsuspecting driver. They then demanded a $40,000 ransom from the freight broker handling the load.

“I thought I was going to run this place into the ground”, freight broker Rob Hoffman told the Journal about the yogurt hijacking his firm fell victim to.

Unfortunately, Hoffman’s ordeal is just one of thousands of similar events being pulled off annually by sophisticated cyber criminals.

The Many Faces of Modern Cargo Theft

While traditional methods like physical hijacking still occur, an increasing number of heists nowadays leave no trail of broken locks or assault rifles. Instead, thieves are hacking their way into digital shipping infrastructures.

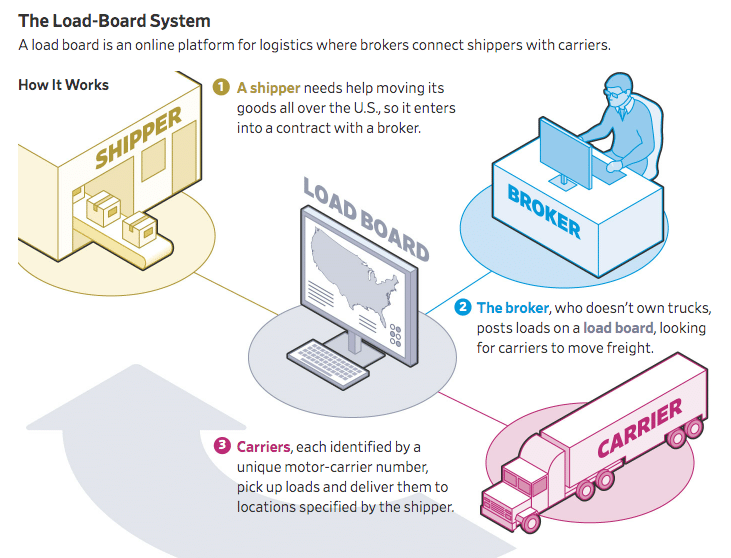

Strategic cargo theft encompasses a number of schemes used by hackers to redirect loads virtually, including the following:

- Carrier Identity Theft: Thieves steal the credentials of legitimate trucking companies and then pose as those firms to secure loads from brokers on online platforms used to arrange freight contracts. The loads are reassigned to crooked drivers who divert them to the criminals’ warehouses.

- Double Brokering: Bad actors pose as legitimate freight brokers to book loads from shippers. They then re-broker those loads to real carriers at lower rates, pocketing the difference, or they simply disappear with the goods after the driver picks them up.

- Fictitious Pickups: Thieves set up fake logistics companies, complete with spoofed websites and documentation. They use the fake identities to arrange pickups of loads, which are then stolen upon retrieval.

Regardless of the exact digital trick used, the outcome is always the same: shippers are deceived, and their cargo is redirected from its intended destination for criminals to steal. After that, the thieves either sell it on the black market or demand a ransom from the cargo owner, as seen with the yoghurt truck incident.

“It’s probably the worst that I’ve seen it in the 27 years that I’ve been doing this,” Cornell told the Journal regarding the current spike in strategic cargo thefts.

From Scattered Events to Multi-Billion Dollar Crisis

While cargo theft is nothing new, the scope and frequency of heists being pulled off by tech-savvy criminal networks is rapidly escalating into an existential crisis for the shipping sector.

The latest data quantifies the dire situation.

- Total cargo theft incidents in 2023 grew 59% compared to 2022 according to estimates from industry data firm CargoNet.

- Nearly $130 million worth of freight was reported stolen in 2023, though the unreported total is likely far higher.

- The number of monthly cargo theft reports has more than doubled since 2014 to over 220 incidents.

These are not just isolated events anymore and CargoNet has traced the surge to coordinated crime rings operating internationally

“More criminals are turning from traditional crime, [and] the reason why they’re attracted to cargo theft is it’s very, very low risk and very, very high reward,” explained Barry Conlon, CEO of supply chain security firm Overhaul, in an interview with CNBC.

While still concentrated in hotspots like California, Texas, and Florida, cargo theft is becoming more geographically dispersed as virtual methods allow criminals to strike from anywhere. Even logistics hubs in the Midwest like Louisville have seen spikes in incidents in recent months.

“When you’re basically stealing the cargo remotely, you can steal anything, anywhere, from anywhere. You don’t need to be near those traditional hot spots all the time”, Travelers Cornell said.

Combating Cargo Thieves with Enhanced Security

Faced with a surging threat, the logistics industry is scrambling to deploy new prevention and security measures. However, technological vulnerabilities and operational realities make it an uphill battle.

On the prevention front, logistics companies are investing in technologies like GPS tracking, tamper-proof smart seals, remote monitoring, and artificial intelligence to analyze shipment data for anomalies.

Some firms like Overhaul have developed Bluetooth-connected smart seals that alert a monitoring center the moment trailer doors are opened, providing real-time intervention opportunities.

However, industry realities have crippled the pace at which some of these high-tech solutions are being adopted. According to CargoNet’s VP Keith Lewis, logistics firms are reticent to implement time-consuming security steps that could delay deliveries – even if this can be immediately translated into reducing theft risk.

“The folks on the other side of the table [are] saying, ‘You don’t understand, we got to get this freight moving'”, Lewis said of his customers’ competing priorities.

Implementing identity checks is another major challenge. While companies like DAT Solutions have started investing in identity verification of carriers on their freight booking platforms, fake firms keep slipping through.

“It’s an ongoing daily siege with no finish line,” said Jeff Hopper, the VP of Roper Technologies, the company that owns DAP.

Law Enforcement Agencies Have Failed to Coordinate Efforts to Stop Strategic Cargo Theft

Compounding industry prevention efforts is the lack of a unified enforcement approach to combat these digitally-enabled cargo crimes that easily cross jurisdictional boundaries.

The FBI has acknowledged it needs to work more closely with the private sector to go after transnational double-brokering and identity theft schemes. However, cyber crimes frequently fall through the cracks between local and federal authorities.

“If I can’t come to you when a crime is happening, what am I supposed to do?” Hoffman lamented to the Journal about the lack of responsiveness from law enforcement after his company’s hijacking.

Some lawmakers are pushing for a centralized federal cargo theft task force to fill this enforcement void. Nonetheless, arranging such a coordinated public-private partnership has proven elusive so far as the threat outpaces institutional responses.

As hackers refine their digital arsenal, future stakes extend beyond financial losses for the shipping industry. Data is emerging as another tantalizing target, with cargo thieves aiming to hijack not just physical goods but also valuable shipment information itself.

The new frontier of cyber-enabled cargo crime demands a cohesive technological and enforcement response before it cripples the global flow of goods. Otherwise, this recent uptick in daring digital heists may just be the beginning.