Reddit, the online forum and social news website that is often dubbed “the frontpage of the internet”, has publicly filed the required paperwork with regulators for an initial public offering (IPO). The move sets the stage for one of the most highly anticipated tech stock listings in the past couple of years.

According to its S-1 filing with the Securities and Exchange Commission (SEC), Reddit will be listing its shares on the New York Stock Exchange (NYSE) under the ticker symbol “RDDT”. The company did not specify how many shares it plans to offer or their expected price range.

Reddit Confidentially Filed in 2021 but Took a Step Back

Reddit initially submitted its IPO paperwork confidentially in 2021. However, the company pressed the pause button on going public amid a massive market sell-off that slammed tech valuations back then.

Fast-forward three years and Reddit is finally pulling the trigger on its public debut in 2024. The timing coincides with early signs of a recovery in the IPO market following 2023’s dismal activity.

Conditions May Be Better for Companies in 2024 to Go Public

According to data from the global accounting firm EY, a total of 1,298 companies went public last year resulting in an 8% decline compared to the number of businesses that listed their shares in 2022.

These companies raised a total of $123.2 billion, data from EY indicates, resulting in a 33% drop compared to the previous year and a 73.2% decline compared to the 2021 5-year peak of $459.9 billion when macroeconomic conditions favored the IPO market significantly.

“Despite a strong equity market rally and low volatility, public offerings have remained muted in many developed markets, with the exception of a brief September window in the US.”, EY analysts commented.

Prominent IPOs in 2023 included Instacart and ARM Holdings, which were valued at $9.9 billion and $54.5 billion respectively. Both companies took a valuation cut compared to previous rounds as market conditions were affected by the overall state of the global economy.

EY analysts believe that 2024 can be a better year for IPOs as macroeconomic conditions are improving and some prominent central banks may be preparing to reduce their benchmark interest rates.

However, they highlighted that geopolitical tensions emerging from the ongoing armed conflict between Russia and Ukraine and US-China hostile exchanges may create some turmoil in the marketplace.

Reddit Plans to Reward Loyal Users

In an unusual move, Reddit says it intends to allow some of its most active users to invest at the IPO price before its shares hit the open market. The company frames it as a reward for these users’ contributions to the platform over the years.

“We want this sense of ownership to be reflected in real ownership — for our users to be our owners”, said Reddit co-founder and CEO Steve Huffman in the S-1 filing. “Becoming a public company makes this possible.”

Reddit says that it will determine eligibility and allocation size based on users’ “karma”, a score reflecting their community activity and engagement. To participate, users must have a Reddit account created on or before January 1st of this year, they must live in the US, and be 18 years or older.

Letting everyday users in on a hot IPO is an unprecedented move for a public listing. Normally, IPO share allocations go almost entirely to large institutional investors and ultra-high net worth individuals.

User Stock Ownership Creates Volatility Risk

However, Reddit cautions that allowing users to own stock could boost volatility in its share price, especially immediately after its market debut.

Unlike institutional investors, users won’t be subject to IPO lock-up periods preventing them from dumping shares shortly after trading begins. The unpredictable behavior of Reddit’s user base could therefore cause more extreme price swings.

It is important to note that interactions within Reddit communities were partially guilty of driving the price of so-called ‘meme stocks’ to their highest levels historically including names like GameStop (GME) and AMC Entertainment (AMC) back in 2021.

‘Redditors’, as the platform’s users are often known, made coordinated efforts to buy the stock of these and other companies as they believed that they were fundamentally undervalued and that they could short-squeeze some institutional players who were betting against them.

The result was a significant spike in market volatility. Fortunes were made in the process by a handful of individuals who had the wisdom to get out before the bubble exploded but many investors lost money in the process as they stepped in without adequately understanding the risks involved in these kinds of market events.

Reddit’s Financials & Fundamentals Analyzed

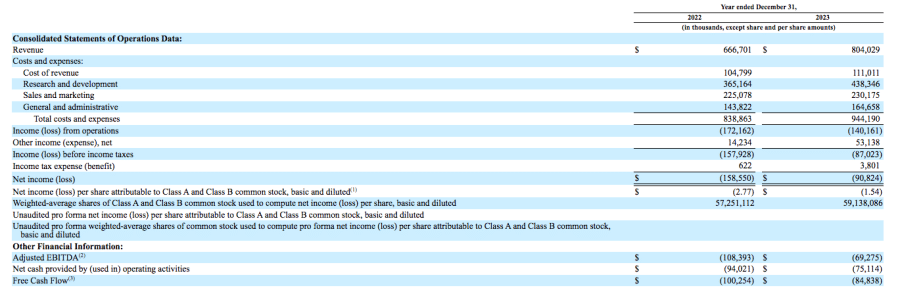

According to its IPO prospectus, Reddit generated revenue of $804 million in 2023, up 20% year-over-year. However, the company is still losing money at a point when investors are favoring businesses with robust finances amidst a challenging macro backdrop.

The company recorded a $90.8 million net loss last year. This was an improvement compared to the $158.6 million loss booked the year before. Meanwhile, in the last quarter of 2023, the firm posted a net profit of $18.5 million.

It is unclear if Reddit will manage to post positive bottom-line results in the next few quarters and most of the performance of its stock will probably be impacted by its ability to keep producing that kind of result.

Primarily an advertising-based business, Reddit cautioned that revenue could fluctuate depending on brands’ budgets and willingness to spend money on marketing. Tighter ad budgets in a slowing economy or competition from TikTok, Meta Platforms (META), and other online advertising platforms are listed as potential growth headwinds for the platform.

However, Reddit is also exploring intriguing new monetization avenues beyond ads. This includes allowing users to sell virtual goods, processing tips for content creators, and providing users with access to premium features in exchange for a subscription fee.

Data Licensing Deals Emerge as Key Revenue Driver

Notably, licensing its vast datasets and content to AI companies is emerging as a major new revenue stream.

As disclosed in its filing, Reddit has already inked data deals worth $203 million over the next two to three years. The management team expects that these agreements will contribute approximately $66.4 million of revenue in 2024 alone.

With Reddit being the home to over 100,000 active communities, its troves of data are highly valuable for training AI language models. Tech giants like Google and Microsoft (MSFT) as well as AI specialists like Anthropic are likely clamoring for access, especially as OpenAI is fighting a major copyright lawsuit from the New York Times that threatens broadly trained AIs.

The company foresees its data becoming even more important as generative AI capabilities advance. Having real-time access to evolving discussions around news events, financial markets, and popular culture will be crucial for models to stay relevant.

Final Valuation at IPO Remains Unclear

Reddit raised over $1 billion in private funding rounds, the last of which valued the company at around $10 billion in 2021. However, its final valuation upon listing will depend heavily on public market demand. Considering the fact that companies that have listed their shares lately have taken a haircut, Reddit’s valuation may be lower than that previous figure.

Notably, Reddit does not appear to be pursuing the typical Silicon Valley hyper-growth model under which profits get sacrificed completely for growth. This somewhat slower but steadier approach could make it more attractive to investors considering the current landscape.

Regardless of the final pricing, Reddit’s IPO will mark a major liquidity event for private shareholders.

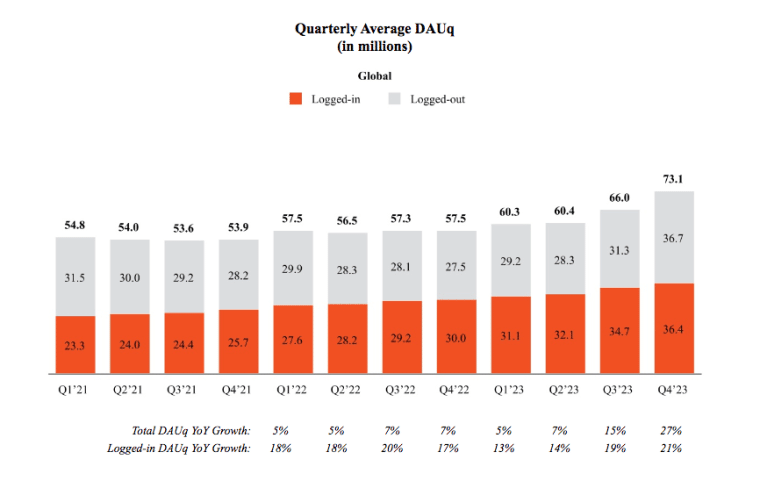

With an engaged user base of over 70 million daily active unique users globally along with expanding revenue channels, Reddit has many of the characteristics of a hot consumer internet IPO.

However, lurking risks regarding user-driven stock volatility certainly introduce a degree of unnecessary uncertainty. All eyes will probably be on Reddit’s trading debut as a gauge for IPO sentiment in 2024.