In a critical moment for the US economy, even the Federal Reserve Chairman Jerome Powell is starting to panic about the country’s unsustainable economic policy. He issued a dire warning about the country’s ticking time bomb, its unthinkable $34.2 trillion national debt. He urged leaders from both parties to come together for serious discussions before the world economy implodes.

His straightforward remarks highlight an urgent need to address the country’s financial path, which is currently not sustainable. Powell’s call to action isn’t just about alarming debt numbers; it’s a crucial opportunity to improve the nation’s financial well-being and its position in the world economy.

As businesses and decision-makers reflect on Powell’s message, a key question arises: Can the US use its strong points to overcome this financial challenge, or will the massive debt be too much to handle?

This article explores Powell’s alert, its implications for the economy and businesses within it, and the hopeful signs that suggest there might be a way out, stressing the need for smart, flexible approaches in these unpredictable times.

Powell’s Dire Alert: America’s $34.2 Trillion Debt Crisis

Chairman of the Federal Reserve, Jerome Powell, recently spoke out in a candid moment that veered away from the traditionally reserved stance on fiscal policy. On CBS’s “60 Minutes”, Powell highlighted concerns about the US’s spending habits and national debt, which is almost at $34.2 trillion.

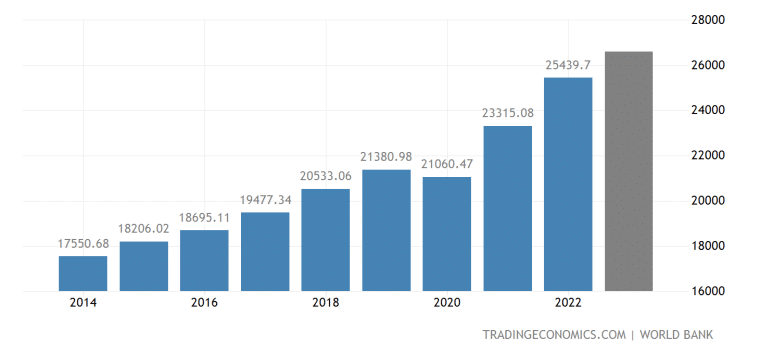

Powell highlighted that the $34.2 trillion in debt isn’t just a number—it’s a signal that the debt is growing much faster than the country’s economy. Despite managing to avoid a recession in 2023, the US is on an unsustainable fiscal path according to Powell, with government spending going up and tax receipts dwindling.

Powell’s warning is underlined by his call for an “adult conversation” among the nation’s leaders. He’s pleading for actionable, bipartisan commitment to slowing down the debt and ensuring the country’s financial health in the future.

The moment represents a rare instance from the Federal Reserve’s typically apolitical stance, emphasizing the severity of the situation. His warning is a call to elected officials to prioritize fiscal sustainability, highlighting that the consequences of this trajectory would burden future generations with financial crises.

Unpacking the Implications for the Economy and Businesses

The US is facing significant challenges due to its fiscal policy and growing national debt. This growing debt already affects many different parts of the economy, by influencing interest rates, inflation, and market confidence. If the US gets to a point where it can no longer handle this much debt, its affects will only worsen dramatically.

One immediate concern for pretty much all businesses in the nation is that interest rates might go up. The Federal Reserve, which controls these rates, decide to raise rates to try to deal with the debt. This would make it more expensive for companies to borrow money, reducing their profits and making it harder to expand or innovate.

The impact on the investment climate is equally serious. With the government needing more money to cover the debt, there’s less capital available for companies to innovate and grow. This could make the US less appealing to both domestic and international investors, slowing growth further and making the problem even worse. The uncertainty surrounding the debt and how the government will handle it can destabilize the financial markets, making it hard for businesses to plan for the future and make informed strategic decisions.

Looking ahead, the Federal Reserve and policymakers face a delicate balancing act. They might tighten up monetary policy to combat inflation spurred by the high levels of government spending. This could lead to higher borrowing costs and less liquidity for businesses.

Alternatively, it could maintain a more accommodative stance to support economic growth in the short term, but this could worsen the debt problem in the long term. But the decision isn’t even that easy.

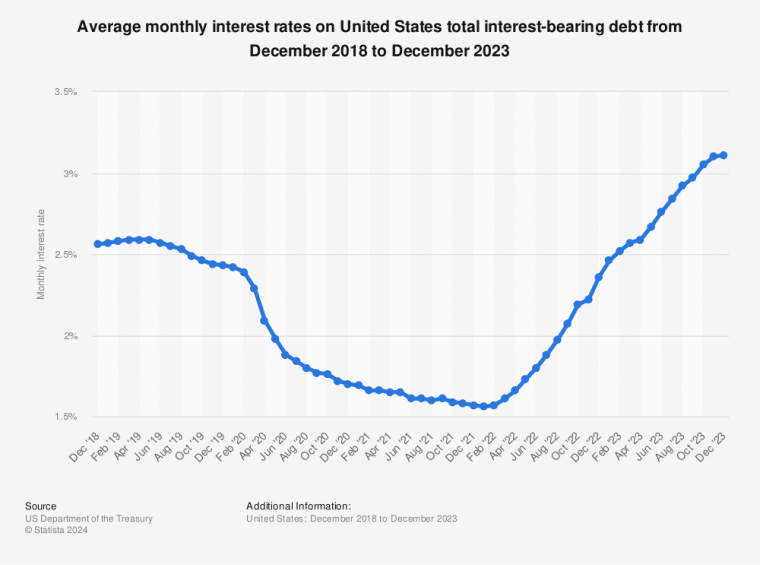

Economies on this scale are so complex that they can be extremely difficult to predict and many potential solutions affect multiple variables at once. For example, raising rates could also make the national debt worse in the short term and raise interest rates on the debt which are already starting to soar.

No matter what the Fed or Congress decides to do, businesses will need to be very adaptable and strategic as they face these uncertain times. They need to be ready for a range of economic conditions, from tightening credit markets to shifts in how much people are spending and investing. Finding the right balance between growing the economy and keeping debt under control is crucial for the overall health of the economy and the success of individual businesses.

A Glimmer of Hope?

Even with the towering national debt and many experts criticizing the government’s spending habits, there’s still some hope for the US economy.

Powell pointed out the inherent strengths of the US economy – its dynamism, innovation, flexibility, and adaptability. These qualities are essential for the country’s economic health and growth. Because of these factors, the US economy is still growing at an impressive pace. It just isn’t growing fast enough relative to its mounting debt.

Powell’s optimism is rooted in the belief that these attributes provide a unique ability for the US to address and rectify its fiscal challenges. He has seen the US economy do better than other countries in recent years, despite the debt issues. Powell’s message is hopeful: if action is taken soon, the government’s spending and earnings could get back on track.

Echoing this sentiment, Treasury Secretary Janet Yellen provided a measured perspective in September. She focused on the interest payments compared to the country’s entire economy, noting that through this lens, debt is still at a manageable level. This means that while the debt figures are daunting, the cost to manage the debt isn’t too overwhelming for the economy right now.

The Bottom Line

The US is at a pivotal point, dealing with the huge problem of rising national debt and the necessity for lasting financial strategies.

Powell’s frank warning highlights the immediate need to tackle these issues with adult, cross-party discussions and practical plans. The message to businesses is straightforward: being able to adjust and plan wisely is crucial in times of financial instability.

As the nation faces these financial difficulties, the enduring spirit of innovation and resilience that characterizes the American economy might still lead to a secure and thriving future. Now is the time for action.