Facebook’s parent company Meta Platforms made history today when it declared its first-ever quarterly cash dividend along with a huge $50 billion stock buyback in an attempt to court investors. It will pay shareholders 50 cents for every share they own 4 times per year. The announcement sparked a massive wave of hype from investors, driving the stock up more than 20% in the first few hours of trading. But dividend investors are still not sure whether Meta will be a competitive option for their portfolios. Keep reading to see how it stacks up.

The new dividend comes on the heels of Meta’s best-ever quarterly profit, buoyed by revitalized digital ad demand. All of these factors helped drive Meta’s market capitalization up roughly $230 billion to $1.23 trillion, making it the 7th most valuable company in the world.

Investors’ optimism stems from Meta’s stellar momentum after a challenging 2023. However, leadership remains fixated on long-term bets around artificial intelligence and the metaverse despite its eye-popping short-term profitability burst.

How Does Meta’s New Dividend Compare to Other Dividend Stocks?

Meta joins fellow tech juggernauts including Microsoft, Apple, and Oracle in paying a regular dividend. The move ushers Meta into a new echelon of tech maturity in a sector that is not necessarily best known for returning capital in this form.

“Introducing a dividend just gives us a more balanced capital return program and some added flexibility in how we return capital in the future”, CFO Li told analysts during the earnings call. The board must still approve the dividend every quarter based on business performance and cash flow retention needs for additional investments.

Meta’s newly declared 50-cent quarterly dividend equates to $2 per share annually. This produces a 0.5% forward yield at current valuations. That may sound enticing but 0.5% is far from the best yield, even when it comes to tech dividend stocks.

Microsoft and Apple (AAPL) pay roughly 1% and 0.7% yields, respectively. Meta seems to be leaving room for potential future dividend increases while avoiding overcommitting its cash flows from the get-go.

Even though it doesn’t have the highest dividend yield, Meta could still be a good choice for some investors. It combines exposure to the tech sector and specifically Meta’s extremely popular social media platforms while providing passive income. However, that exposure could very well turn out to be quite detrimental if the company hits another slump like it did in 2022.

Over the course of about a year, between late 2021 and late 2022, Meta’s stock fell about $300 in a 77% slow crash. If it had already instated its dividend at the time, it would have paid $2. This is why many dividend investors much prefer less volatile stocks that provide strong passive income but are less likely to collapse by nearly 80% in 1 year.

A Pivotal Year of Recovery for Meta

If you had told investors in 2022 (or much of 2023) that Meta was instituting a dividend and massive stock buyback program they would be shocked following its incredibly dismal year. But the company is actually performing better than ever, despite the billions of dollars it wasted on the metaverse.

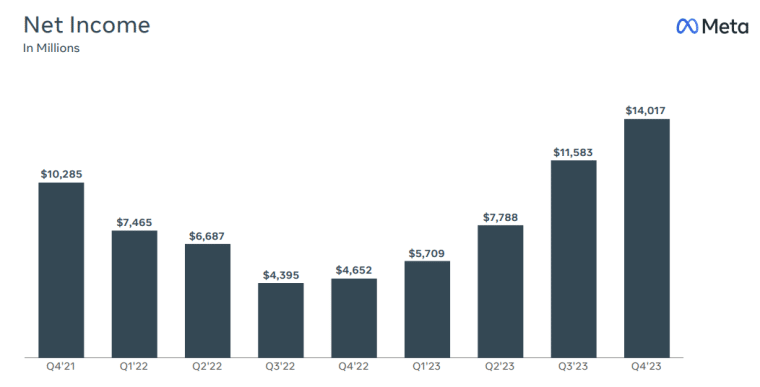

Meta Platforms (META) capped off 2023 with $14 billion in Q4 net income, a 200%+ jump from last year. Meanwhile, quarterly revenues surged by 25% to $40.1 billion, effectively exceeding analysts’ expected figure of $39.2 billion for the period. Annual sales hit $134.9 billion, up 16% year-over-year.

The company’s Chief Financial Officer, Susan Li, credited increased operating discipline and advertising gains as the two main factors fueling this jump in profitability. Meta’s average ad price rose by 2% compared to a 22% fall in Q4 2023. This illustrates how market dynamics are stabilizing and improving for Meta’s core business.

After shedding over 20,000 staffers since late 2022, Meta is running leaner and may have achieved its goal of right-sizing the company to current market conditions and AI-related productivity tailwinds. Its austerity kick rescued the firm from sluggish growth as the leadership team managed to respond to investor angst over experimental spending in initiatives associated with its ill-fated metaverse pivot.

The stock’s meteoric 194% climb in 2023 signaled investors’ restored confidence in the company’s ability to monetize some of the most relevant tech industry trends. However, a handful of clouds persist concerning increased regulation and platform safety issues. The company’s Chief Executive Officer, Mark Zuckerberg, was berated by Congress just a day before the earnings release came out over inadequate protection for children using Meta’s apps.

Nonetheless, Meta’s financial position has demonstrably strengthened. The firm’s free cash flow hit $43 billion as margins widened. These shiny metrics empowered Meta to enrich its direct returns to shareholders in the form of its first dividend ever and an increased share buyback budget.

Zuckerberg is Not Backing Down from Any of His ‘Moonshots’

With the social media cash engine firing on all cylinders, Meta aims to crank up its investment in AI infrastructure and metaverse development.

Its Reality Labs segment focusing on VR/AR technologies generated record quarterly sales of $1.1 billion during this last quarter of 2024. Meta’s latest Quest headset experienced strong holiday demand according to Meta’s top executives.

A new smart glasses version incorporating AI voice assistants has also won over consumers beyond the firm’s expectations. Zuckerberg believes that these assistants could become the “killer app” when it comes to futuristic AR/VR capabilities.

Still, Reality Labs burned cash aggressively. Its Q4 operating loss neared $5 billion as expenses keep expanding. Management highlighted that they expect significantly wider losses in 2024 for this unit.

Capex expectations also rose by $2 billion to $30-37 billion, attributed to increased AI and infrastructure investments. Zuckerberg made clear that Meta’s AI push is still in its very early innings.

The CEO plans to incorporate AI across ads, recommendation engines, digital assistants, content moderation, and more. While sales contributions will take time, enhanced ad-targeting and creative tools present an opportunity for “near-term monetization”.

On the metaverse front, Zuckerberg stressed that its ambition remains unchanged even as the vision has evolved due to advancements in the field of artificial intelligence. Even though the initial emphasis centered on virtual worlds and immersive gadgets, AI its now become the priority and potentially a previous step toward fully developing this vision.

Analysts Caution Against Profit or Dividend-Centered Optimism

Earnings week often sparks significant hype for big tech stocks. However, analysts urge caution as short-term profits are not an indication of the success of the company’s ongoing pivot toward the latest tech trends. Furthermore, the announcement of a dividend and major buyback almost certainly helped fuel today’s buying spree. Meta must still address whether its VR and AI bets can generate above-cost returns at scale. If not, competition for digital ad money could squeeze margins over time.

There are no shortcuts to building such bleeding-edge innovations either. While Meta’s finances bounced back swiftly from prior stumbles, the road ahead means stepping into even riskier territory.

Moreover, the regulatory spotlight won’t dim anytime soon. Lawmakers continue probing Meta’s impact on child safety, user privacy, and fair competition. With antitrust cases in the EU and US on the rise, the tech giant may soon find its way under the crosshairs of regulators.

Still, Wall Street responded ecstatically to Meta deploying its prodigious cash flows to reward shareholders. The company still prints billions in spare capital even as it keeps funding visionary moonshots.

Strong guidance suggests that Meta’s backbone ad business may have the capacity to withstand the latest economic turmoil and keep pace with the firm’s much-needed investments for the future. Whether its grand technology transformations will pay off remains to be seen.

For now, Meta is prudently pacing itself on nascent bets while returning profits to investors. The latest figures and shareholder initiatives reinforce Meta’s financial might and innovation track record.

Meta may face bumps pursuing another epic platform shift, but investors don’t expect that this will slow Zuckerberg’s drive to dominate the tech industry’s next era.