The ongoing legal battles between the United States Securities and Exchange Commission (SEC) and prominent crypto entities like Coinbase and Binance have brought a critical question to the forefront of crypto regulation: Is a crypto token itself a security?

The SEC’s fluctuating stance on this matter has sparked confusion and debate, suggesting an underlying uncertainty within the regulator itself about the legal status of cryptocurrencies.

A Tale of Two Arguments: The SEC’s Contradictory Stances

In recent federal court hearings against Coinbase and Binance, the SEC’s lawyers presented what seemed likely completely contradictory arguments.

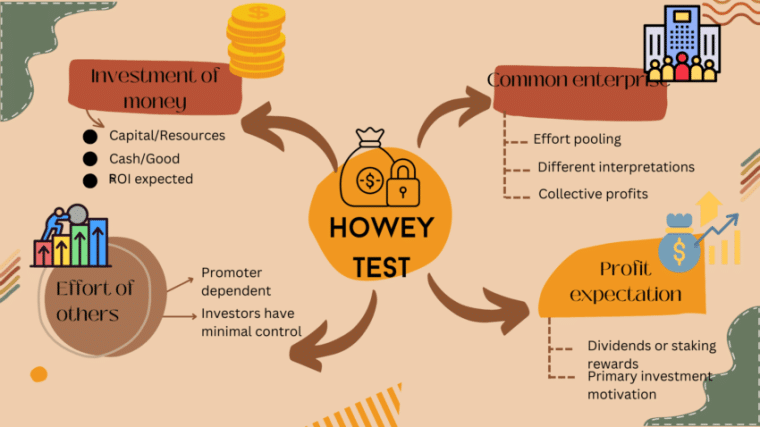

In the Coinbase case, they argued that the way crypto tokens are sold makes them securities, while in the Binance hearing, they generally classified cryptocurrencies as securities on their own. This latter point is particularly odd because the SEC has traditionally focused on investment schemes, like in the significant 1946 case SEC v. W.J. Howey Co., which the commission still uses to define a security.

Howey Company was selling citrus groves to buyers, providing that they would lease the land back to Howey for the promise of a cut of future profits. The SEC determined that this agreement was a security and thus needed to be registered with the commission.

In this case, the SEC didn’t ban oranges or citrus groves. They prosecuted the investment scheme built around these groves. This fits much better with its argument against Coinbase but doesn’t make sense with its case against Binance.

This inconsistency has not only perplexed jurists but also hinted at the SEC’s struggle to find a firm legal ground in these matters.

The Legal Implications of SEC’s Positions: How Could Crypto Be Impacted?

Kayvan Sadeghi, a securities litigator specializing in blockchain-related cases, noted the problematic nature of both arguments.

If crypto tokens are inherently securities, what happens if the issuing company ceases to exist? Under this blanket definition, trading such tokens might still count as participation in an illegal scheme.

On the other hand, focusing solely on the context of the sale leads to ambiguity, as noted by attorney Lewis Cohen.

This lack of clarity from the SEC makes it challenging for the courts and market participants to discern the legal boundaries for cryptocurrencies and its recent arguments are only making the problem worse.

How Could The SEC Position Shape The Crypto Industry?

The SEC’s wavering positions have significant implications for the entire crypto market.

Industry leaders view the SEC’s unwillingness to provide clear guidelines as a sign of hostility towards the legal proliferation of cryptocurrencies in the US

This uncertainty complicates the landscape for companies operating in the crypto space, as they cannot be sure which activities might suddenly be deemed illegal.

Another point of contention is the SEC’s differing treatment of cryptocurrencies like Bitcoin and Ethereum. It declared in 2018 that the 2 largest cryptos would not be considered securities but rather currencies. SEC Chairman at the time Jay Clayton noted that this was because “replacements for sovereign currencies” were not securities. However, the SEC still hasn’t specified what exactly makes BTC and ETH replacements for sovereign currencies or why other extremely similar cryptos aren’t.

Jay Clayton from SEC makes strong statements about ICO’s being Securities but his arguments wouldn’t hold if tested in a court.He uses the word “invest” for a “return” but theoretically you “buy” tokens for use. He uses muscle to justify his statementshttps://t.co/MDrffOm5om

— Ran Neuner (@cryptomanran) June 7, 2018

Indeed, the absence of a clear rationale for why some digital assets are acceptable while others are not only adds to the confusion and perceived inconsistency in the SEC’s approach.

The SEC’s lawsuits against Coinbase, Binance, and Ripple Labs are pivotal cases that will almost certainly set influential precedents for future regulatory actions in the crypto sector.

However, it is anticipated that a definitive resolution will only emerge after these cases reach the Court of Appeals, where more final legal precedents will be established.

The Bottom Line: A Pivotal Moment for Crypto Regulation

The SEC’s ongoing legal battles and its inconsistent stance on whether crypto tokens are securities represent a critical juncture for the cryptocurrency market.

As the industry awaits clearer regulatory guidelines, these legal proceedings will undoubtedly shape the future of digital asset trading and innovation.

The outcome of these cases will not only impact major players like Coinbase and Binance but also set the tone for how cryptocurrencies are treated under US securities law.