Cryptocurrency derivatives traders on the popular prediction market platform Polymarket anticipate that US regulators will be signing off a spot bitcoin exchange-traded fund (ETF) within weeks – assigning an 89% probability of such approval materializing by January 15th specifically.

Polymarket facilitates bets on economic, political, and social outcomes allowing anonymous users to essentially “vote” on the likelihood of key events. Among crypto enthusiasts, few developments have consumed more anticipation than Wall Street launching the long-awaited spot Bitcoin ETF product.

The ETF would enable both institutional and retail investors easy exposure to Bitcoin’s price action without having to sign up for a cryptocurrency exchange or own crypto directly. As context, the SEC has rejected over a dozen spot Bitcoin ETF proposals in recent years based on concerns over insufficient regulation and the potential for manipulation.

All-Time-High Confidence in Bitcoin ETF Approval

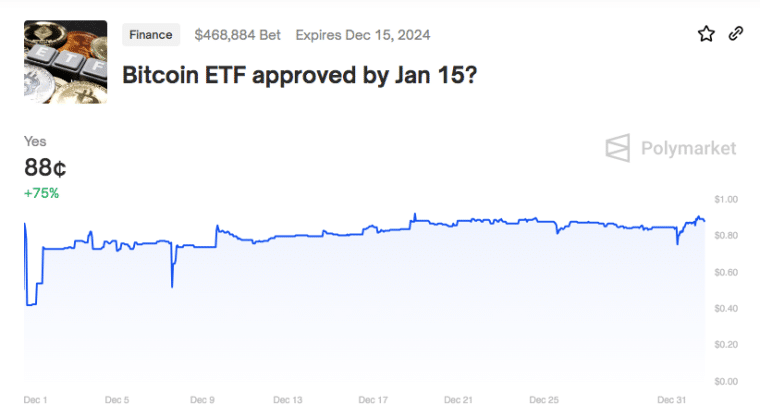

Polymarket user activity signals that enthusiasts believe the multi-year impasse is nearing a conclusion. On January 3rd, “yes” shares for the platform’s “Bitcoin ETF approved by Jan 15” contract traded at around 89 cents – equating to a robust 89% confidence of approval materializing within two weeks.

That optimism rocketed higher throughout December as speculation of imminent positive SEC notifications to ETF applicants gained momentum. Compared to a roughly 50% approval probability one month ago reveals that investors agree that the time has come for a spot ETF to becomes available.

If the prediction proves accurate, asset managers like BlackRock Ark Invest, SkyBridge Capital, and Fidelity stand ready to unleash spot Bitcoin ETFs upon US investors immediately. Reports point out that 14 companies are standing by to receive notices from the SEC regarding their BTC ETF applications.

Some Traders Are Using Polymarkets to Hedge Their Exposure to BTC Against Another Delay

Naturally, many crypto investors share enthusiasts’ sunny outlook, as Bitcoin (BTC) has surged by over 55% since October largely on anticipation surrounding imminent ETF product releases. Top tokens like Ether have posted similar or better returns.

However, a segment of Polymarket traders did purchase “no” shares at 11 cents as insurance against SEC decision delays. If ETF approval hopes get pushed back, some analysts suggest that Bitcoin could retreat possibly by 20% or more – making small hedges worthwhile.

One user explained their cautionary positioning by saying: “I’m buying No [shares] as insurance against my Long positions. If the ETF isn’t approved, markets will dump hard.”

So far traders have bet nearly $470,000 worth of activity around the ETF contract. As a decentralized platform, Polymarket uses “outcome shares” allowing owners to essentially bet on “yes” or “no” decisions. Shares redeem for $1 if the chosen outcome occurs or become worthless otherwise.

Whatever decision the SEC makes it will likely come soon. Reuters reported earlier this week that the regulatory body may notify issuers as early as Tuesday or Wednesday that they are cleared to launch their ETFs next week.

Polymarket Emerges as Leading Crypto Prediction Portal

In just two years, Polymarket has established itself as a highly visible portal among crypto for speculators who place wages on events from regulations to technical milestones and even elections.

The ETF prediction contract represents one of Polymarket’s most heavily traded offerings, underscoring the significance that the approval or disapproval holds for broader crypto adoption.

While risks around manipulation and lack of transparency exist in growing digital betting ecosystems, thus far Polymarket continues to attract users through free trading and an engaging user experience.

Of course, US regulators still need to formally green-light spot bitcoin ETFs to validate traders’ optimism. Yet, volume trends and contract probabilities suggest confidence in the fact that crypto’s evolution remains decidedly sturdy entering 2023 despite lingering macroeconomic turbulence.

Digital asset enthusiasm persists precisely due to Bitcoin’s reputation as an inflation hedge and store of value amidst global uncertainty.

Key Background on Prediction Markets

While the public’s familiarity with prediction markets like Polymarket is still nascent, the format traces back over three decades.

In essence, prediction markets aim to forecast event probability through financial incentives tied to accurately betting on outcomes. As assessments become quantifiable via exchanged contracts, prediction markets can effectively aggregate opinions on event likelihoods across geography and demographics.

Polymarket specifically focuses on economic, political, and social events to tap “the wisdom of crowds” for insight into the most debated current issues.

Also read: Institutions Rush to Prepare for Imminent ETF Approval

By allowing anyone to create and trade contracts on anything from celebrity gossip to central bank policy, prediction markets reveal valuable data about public sentiment right up to when fate actually decides, reveals its hand, and the bets settle.

Blockchain integration makes the entire process transparent while keeping users anonymous and unable to manipulate outcomes that are tied to real-world events.

Some moral questions persist around effectively gambling on issues like political elections, pandemics, or global conflicts – especially as money attracts foul play. Yet, proponents argue that the information revealed through “putting one’s money where their mouth is” offers utility if consumed ethically.

In crypto’s case, the opportunity to gain financial exposure to key sector developments without direct asset ownership attracts speculators. The Bitcoin ETF approval wager represents just one particularly visible junction where insights into probabilities hold value.