Beginning in 2024, the electric vehicle (EV) tax credit rules in the US are set for yet another revamp and while they would make the claiming the credit a lot more seamless, the list of vehicles eligible for the $7,500 tax credit would also narrow to just 10 vehicles.

Under the previous rules, the car buyers paid the full price for the electric car initially and then claimed the credit later while filing the taxes. However, under the new rules, car buyers would get the rebate only while buying the vehicle. Importantly, around half of the car dealers in the US have signed up to be ready to provide point-of-sale rebates which would be available later in the year.

New EV Rules Should Help Increase Adoption

The new rules could help in increasing EV adoption as many EV buyers are more comfortable with the initial rebates as compared to the tax credits. Incidentally, a 2022 survey by George Washington University showed that on average, EV buyers were happy with the upfront rebate even if it was up to $1,440 lower than the tax credit that they claimed later.

Despite the Biden administration’s efforts to increase EV adoption, the pace has been slow. EVs accounted for just about 7.5% of new car sales in the US in the first 11 months of 2023 while new energy vehicles (NEVs) which include both plug-in hybrid vehicles and battery electric cars account for around a third of new car sales in China.

The new EV tax rules are like a rebate and according to the IRS, the car buyers would be eligible for them even if they don’t owe any taxes for the year. However, if their income is higher than the prescribed limits then they would need to pay back the credit that they received while buying the car.

The rules mandate that if the car buyers opt for a point-of-sales rebate, they need to provide their Social Security number to the car dealer and also add the vehicle identification number on their Form 1040. They also need to report the EV purchase in their tax returns.

Inflation Reduction Act of 2022

In 2022, the US passed the Inflation Reduction Act of 2022 which among others expanded the scope of EV tax credits. Under the previous rules, the tax credits were based on cumulative sales by automakers, and Tesla, General Motors, and Toyota had already surpassed that limit. After the new rules, all variants of Tesla Model 3 and Model Y were eligible for the EV tax credit.

The Inflation Reduction Act did away with the carmaker-specific limit but included several other conditions for cars to be eligible. Firstly, the car has to be necessarily assembled in North America to meet the EV tax credit. There are also sourcing rules for battery components as well as minerals and these have to be sourced from trusted partners.

The rules are meant to wean away the US EV industry from its dependency on China which has been a major sourcing destination for both key battery minerals as well as components. The Treasury Department said, the new rule “provides clarity and certainty around the IRA’s foreign entity of concern (FEOC) requirements,” and separately lists China, Russia, Iran, and North Korea as FEOCs.

According to the new rules, “beginning in 2024, an eligible clean vehicle may not contain any battery components that are manufactured or assembled by a FEOC, and, beginning in 2025, an eligible clean vehicle may not contain any critical minerals that were extracted, processed, or recycled by a FEOC.”

NEWS: GM says it expects its Cadillac Lyriq and Chevrolet Blazer EV will temporarily lose eligibility for a U.S. EV tax credit starting Jan. 1.

They are losing the credit because of two minor components. GM added it has pulled ahead sourcing plans for qualifying components in…

— Sawyer Merritt (@SawyerMerritt) December 22, 2023

Fewer Models Will Be Eligible For Full Tax Rebate

Meanwhile, as the revamped rules come into force, fewer EV models would be eligible for the full $7,500 rebate. According to the Street, only the following 10 models would be eligible for the full rebate.

- Chevrolet Bolt EV

- Chevrolet Equinox EV

- Ford F-150 Lightning

- Tesla Model 3 Performance

- Chevrolet Silverado

- Tesla Model Y Performance

- Chrysler Pacifica PHEV

- Chevrolet Blazer EV

- Cadillac LYRIQ

- Tesla Model X

Importantly, the list does not include the base Tesla Model Y which was not only the best-selling EV in 2023 but also the best-selling model across all vehicles. It was the first time an electric car took the crown of the best-selling model globally. Meanwhile, for Tesla, the new EV tax credit rules come at a time when it is battling slowing growth amid tough macro conditions and high interest rates.

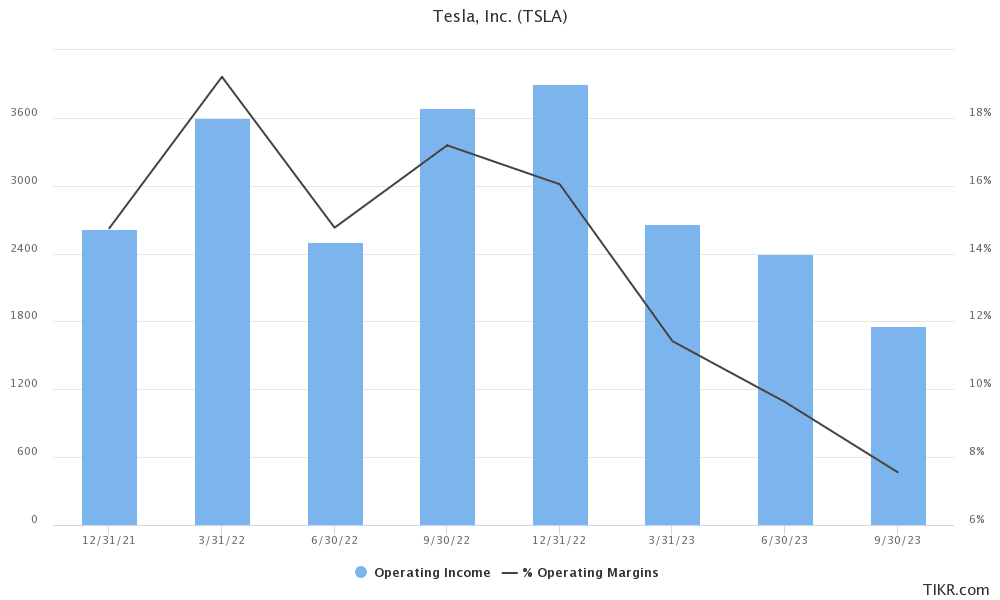

The Elon Musk-run company has slashed vehicle prices multiple times over the last year to spur sales. While these price cuts have helped Tesla increase deliveries, they have also led to margin compression and its operating margins have fallen to single digits and have more than halved from their peak.