U.S. officials are planning a trip to Taiwan to discuss the specifics of new artificial intelligence (AI) chip export restrictions, mainly targeting China, with Taiwanese companies. This was announced by Taiwan’s Economy Minister Wang Mei-hua on Monday.

Wang Mei-hua told Reuters that the lengthy new U.S. regulations are complex and require clarification.

We think that them (the U.S.) coming to Taiwan, to explain things to companies, getting a face-to-face understanding of the thinking of U.S. enforcement agencies, having on-site communication on the details, is something Taiwan needs.

She also noted that due to Taiwan’s significant role in chip manufacturing, it is advantageous for local firms to receive firsthand information about the new controls from U.S. authorities.

Taiwan, which hosts TSMC, the world’s leading contract chip manufacturer, along with numerous other semiconductor companies, already imposes its own export limits to China. China considers Taiwan, a democratically-governed island, as part of its territory.

Backdrop of U.S.-China Tech Tensions

In October, the Biden administration tightened restrictions on sales of advanced AI chips to China, focusing on specific models such as Nvidia’s A800 and H800. This move is part of efforts to prevent Beijing from using U.S. technology to bolster its military capabilities.

Previously, the U.S. had prohibited the sale of the advanced Nvidia H100 chip. Nevertheless, Chinese firms bypassed this limitation by purchasing less powerful versions, namely the H800 or A800 models. The updated regulations extended the ban to these less advanced chips as well.

Taiwan’s Semiconductor Industry

Taiwan is a key player in the world’s semiconductor market, largely due to the Taiwan Semiconductor Manufacturing Company (TSMC).

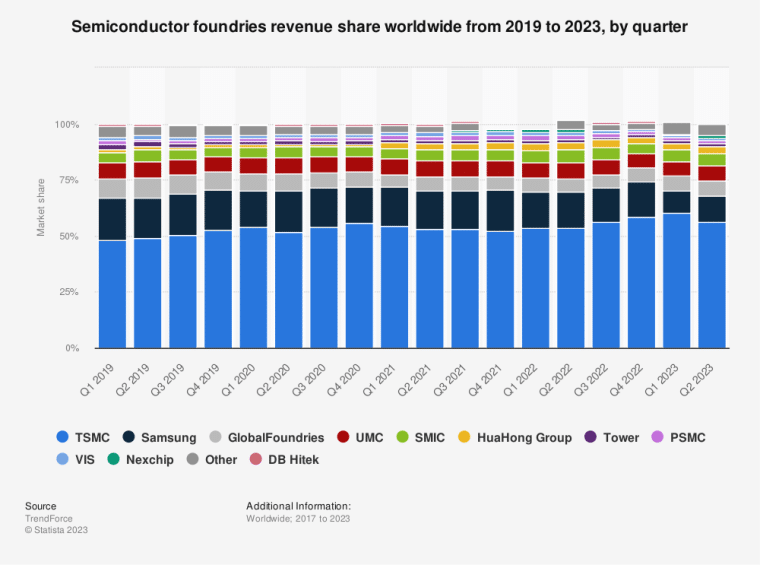

As of mid-2023, TSMC led the global semiconductor foundry market with an impressive 56% market share, far ahead of its nearest competitor, Samsung, which held 12%. The top ten semiconductor foundries globally, including TSMC, together earned $26.25 billion in the second quarter of 2023.

Other important Taiwanese companies, like United Microelectronics Corporation (UMC), also play a major role in the industry, holding 6% of the global market share as of the second quarter of 2023.

Economic Impact on Taiwan

The U.S. restrictions on AI chip exports to China could have significant economic implications for Taiwan. The semiconductor industry is a cornerstone of Taiwan’s economy, contributing significantly to its GDP and employment. Given the interconnected nature of the semiconductor supply chain, U.S. restrictions could affect Taiwanese companies in several ways:

- Loss of Business with Chinese Companies: Many Taiwanese semiconductor firms have substantial business dealings with Chinese tech companies. Restrictions on exporting certain chips to China could lead to a decrease in orders, impacting revenue.

- Global Trade Relationships: Taiwanese companies might need to navigate complex international trade waters. They may have to balance compliance with U.S. regulations with maintaining relationships with Chinese clients, possibly affecting Taiwan’s broader trade relationships.

- Adaptation and Diversification: These challenges could push Taiwanese companies to adapt by diversifying their client base and exploring markets beyond China. This might lead to new opportunities but also requires navigating new market dynamics and potential initial setbacks.

China’s Response to U.S. Chip Export Policies

China strongly criticized the U.S. for its new regulations on AI chip exports, calling them unfair. After the U.S. decision in October 2023, Chinese stock markets saw a drop, showing how big of an impact these U.S. rules have on China’s technology sector.

Big Chinese tech companies had already stored up chips, expecting U.S. restrictions. For example, Baidu has enough chips to keep training its Ernie Bot for a couple of years. However, smaller AI companies in China are struggling because they can’t hoard chips since they don’t have enough cash flow. As a result, they have to look for other options, slowing down development.