In 2024, Amazon’s streaming strategy will take a pivotal turn as ads will become part of the Amazon Prime Video viewing experience unless viewers pay $2.99 more every month.

This will lead to drastic changes to customer experience as well as the Prime Video subscription model. Analysts are already debating whether it will be a success like Netflix’s ad-supported streaming tier.

Next year, users in the UK, US, Germany, and Canada will start to see ads on their beloved Prime Video shows and movies, according to a Friday announcement from Amazon.

However, they can choose to dodge these ads if they’re willing to pay extra for an “ad-free” subscription tier, initially, this will come at an additional $2.99 (£2.44) per month for US Prime subscribers, with other countries receiving their pricing details later on.

Monetizing Streams: Amazon’s New Ad-Driven Strategy on Prime Video

Justifying the change, Amazon emphasizes its intention to pump more funds into creating quality TV shows and films, drawing parallels with similar strategies employed by competitors Disney+ and Netflix.

This may be difficult given the massive Hollywood writers’ strike that still has no end in sight.

As Netflix’s addition of its ad-supported model marked a noteworthy pivot from its original ad-free foundation, the move by Amazon further cements the trend of integrating advertising to offset the costs of high-quality content production.

Soon all major streaming services may be ad-supported.

Although Amazon claims its aim is to have “meaningfully fewer ads than linear TV and other streaming TV providers,” such a claim so too vague to be of much value.

And while live event broadcasts, such as sports matches, will retain their ads even for those paying the premium, the shift is clear—Prime Video is evolving.

Changing the Channel: How Amazon’s Ad Integration Might Reshape Streaming Wars

Streaming services experienced a recent decrease in subscribers, possibly due to economic pressures, notably, data from Kantar spotlighted a drop of two million in paid-for video streaming subscriptions in the UK last year.

As financial constraints tighten for many in the face of high global inflation, will an additional charge for an ad-free experience be embraced or rejected?

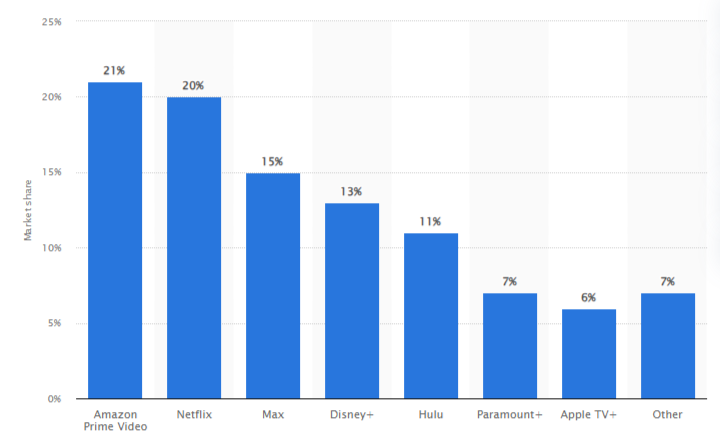

Amazon already has a robust customer base and is currently the leader in streaming in terms of market share with 21%, edging out Netflix at 20%. It also has staggering brand recognition, especially in the US and EU, with a whopping 94% brand recognition and 89% loyalty in Germany.

With a majority of U.S. respondents holding an active Prime Video subscription in 2021 and equal daily usage among both male and female users, there’s evidence of a solid foundation – but it’s also important to acknowledge that 46% hadn’t used the service at all.

At least a portion of Prime Video’s appeal lies in its ad-free experience as well as the fact that it is currently included with the broader Amazon Prime subscription, a staple of a massive percentage of households around the world.

As Amazon changes up its subscription model and inundates its customers with ads there may be repercussions on subscriber numbers. Subscribers aren’t likely to cut the entire Amazon Prime subscription but they may simply choose not to use Prime Video because of the ads.

Considering the trend of users leaving streaming services, possibly due to increasing living expenses, Amazon’s choice to add ads could have mixed results. While it may enhance their investment in content and production, it might also lead price-sensitive subscribers to rethink the value they receive.

Overall, as Amazon takes a new direction with its Ad-free Prime Video plan, it joins other big streaming services by adding ads. However, as Amazon keeps expanding its streaming options with innovations like AI, it’s clear they are working to keep their market position and stay up-to-date.

It remains to be seen how this calculated risk unfolds in the larger streaming market battle, with subscribers’ choices ultimately shaping the future of Amazon’s 2024 streaming strategy.