In the ever-evolving landscape of Edtech startups, the last six months have been turbulent, presenting both challenges and opportunities. The venture capital funding levels witnessed a significant decline. However, there is a glimmer of hope as the European Union (EU) has become a popular destination for struggling Edtech companies.

EdTech Market in Flux: Challenges and Glimmers of Hope

The global Edtech market has experienced its share of uncertainties, most evident in Chegg’s fluctuating stock performance. According to BrightEye Ventures, the company attributed negative results to the impact of students turning to free Chat-GPT instead of subscribing to Chegg’s course preparation materials.

However, amidst the challenges, a MENA-based Edtech company, My Tutor Source, successfully raised $100 million for the first time, signaling growth and potential for homegrown startups in the region. Meanwhile, later-stage funding rounds like Degreed and Begin secured substantial amounts, ranging from $80 million to $100 million.

Additionally, a European company, Hack the Box, made it to the top 10 with a remarkable $55 million Series B raise, highlighting the strength of European players in the Edtech landscape.

Europe, in particular, demonstrates resilience and promise in the Edtech sector. The recently announced $1.7 billion privatization of Kahoot!, a Norway/UK-based Edtech firm, led by a Goldman Sachs-led group, sets the stage for a robust start to H2 2023.

💥The H1 European #Edtech Funding Report 2023 is out! Headlines include:

💪~1/3 of global deals done in Europe

📈More funding in H1 2023 vs H2 2022

🇬🇷Largest European deal: @hackthebox_eu $55M

🇬🇧UK stays on top with France, Germany, Greece and Spain top 5https://t.co/Cau4UhKd16— Brighteye Ventures 🇪🇺 (@brighteyevc) July 20, 2023

This significant cash offer represents a compelling >10X multiple on revenue, indicating growing M&A activity as companies prioritize exits over raising down rounds and facing potential risks of becoming stagnant.

Unpacking the Edtech Funding Numbers

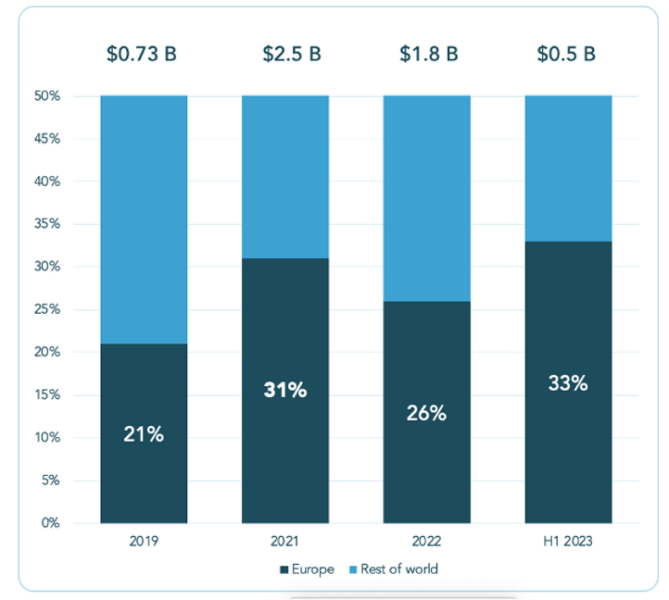

Despite the challenges, European Edtech retains its position as a substantial player, accounting for one-third of global Edtech deals. While overall funding and deal count may have seen a decline, Europe’s Edtech market demonstrates resilience and stability when compared to other major markets in North America and Asia.

The first half of 2023 proved to be more promising than the latter half of 2022 for the European Edtech ecosystem. Despite the smaller pie, funding increased in H1 2023, totaling $0.5 billion compared to $0.4 billion in H2 2022. Additionally, higher average deal sizes contributed to this positive momentum, signifying potential growth prospects.

Shifting Landscape of Mega Deals

The era of mega deals appears to have subsided, with only one company globally raising over $250 million in H1 2023. According to BrightEye Ventures, this deal involved Byju’s, focusing on growth rounds rather than massive fundraising efforts for expansion.

Similarly, the European landscape saw a decline in mega deals, with the largest deal amounting to $55 million, secured by Hack the Box.

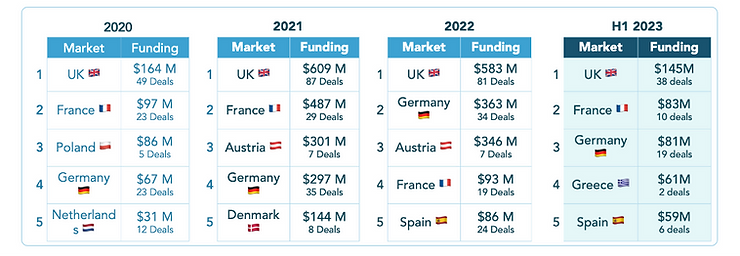

Despite the funding and deal slowdown, the UK retains its leading position in the European market, maintaining a considerable lead over France and Germany, which occupy second and third places, respectively.

Furthermore, Southern European markets, notably Greece and Spain, showcase increasing momentum, with Hack the Box playing a vital role in elevating Greece’s prominence in the sector.

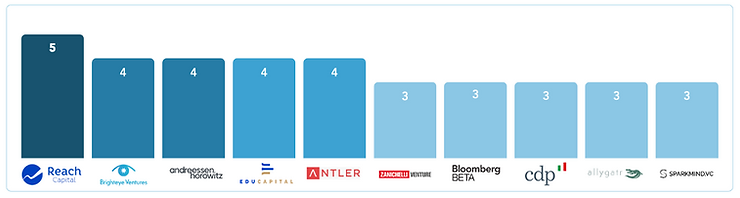

Edtech Specialists Stepping Up

In a time of uncertainty, specialist investors in Edtech have become more active than generalists, seeking solid investment theses. Notably, Andreessen Horowitz ranks among the top Edtech investors globally, standing shoulder-to-shoulder with Brighteye Ventures, both having made significant contributions to the Edtech sector.

While the sector faces challenges, Europe emerges as a promising haven, capturing one-third of global Edtech deals. The region’s resilience, steady funding growth, and the emergence of specialist investors provide hope for a vibrant future.

As the industry looks ahead to H2 2023, companies will face the test of seizing opportunities or remaining afloat, while ensuring capital-efficient growth post-funding. The European Edtech landscape holds the potential to foster innovation, transforming education and learning experiences across the continent and beyond.

Related Articles

- Best Stocks to Watch on Reddit – The Top Reddit Stocks

- OpenAI Adds Much Needed Custom Instructions Memory Function to Save You Tons of Time

- Online Reviews Are So Muddled and Full of Fakes That They Are Less Than Useful

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops