If you follow US crypto news you have probably heard a politician like Elizabeth Warren decry cryptocurrencies, saying they are used to fund the fentanyl trade and to launder money, but is there any truth to their claims?

Sen. Jack Reed sponsored a bipartisan bill introduced to the Senate Tuesday that would try to regulate the crypto and decentralized finance (DeFi) markets further by strengthening Know Your Customer (KYC) and Anti-Money-Laundering (AML) regulations. While the full bill hasn’t been released at the time of writing, it seems likely that it would have the same effect on DeFi as the initial wording of Biden’s Infrastructure bill.

It may be aimed at forcing strict KYC and AML regulations on DeFi platforms, which would likely kill the already struggling US DeFi industry. Most DeFi applications simply can’t enforce KYC regulations especially, so it would likely lead to a widespread ban on these platforms and force them to move out of the US.

While legislators are right that money laundering and criminal activity happen on the blockchain, they often forget to mention the scale and context of such crime. Furthermore, the solutions posed in these bills would only act to kill the fledgling industry in the country, forcing the same apps to move elsewhere.

Does Crypto Support the Fentanyl Trade?

Elizabeth Warren, the US Senator who comically Tweeted that she was building an “Anti-crypto-army” in March, has called for a crackdown on crypto since reports found that it was being used to pay for fentanyl precursors (the chemicals used to produce fentanyl).

Fentanyl is an extraordinarily potent and thus deadly opioid analgesic that has found its way into the US illicit drug market, replacing heroin and other opioids. In 2021, about 70,000 Americans died from overdoses involving synthetic opioids other than methadone (mostly fentanyl). Much of this fentanyl is coming from the southern border, made by various gangs and cartels who source precursors from gray-area labs in China.

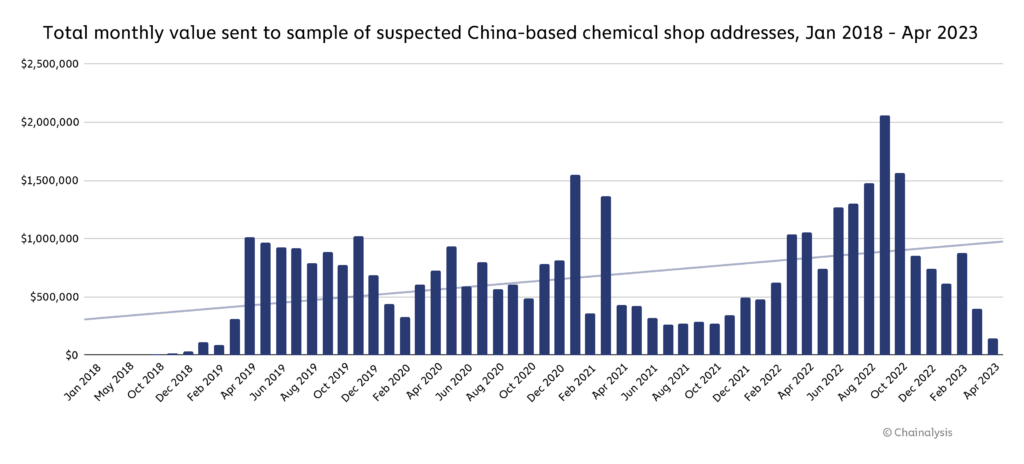

Chainalysis, a premier blockchain analytics group, claimed that about $37.8 million in cryptocurrencies have been sent to a few labs in China known to sell fentanyl precursors since 2018. This doesn’t mean that all $37.8 million were payments for fentanyl precursors (or that any of it was), however. Many of these labs synthesize just about anything you want them to, producing a large range of chemicals including legal (in some places) gray market drugs such as 1P-LSD, an analog of LSD with reportedly identical effects to the ‘real thing’.

Furthermore, $37.8 million is a paltry sum compared to the illegal drug trade in the US which is worth $100s of billions of dollars up to trillions of dollars, depending on the estimate. It’s important to remember that a large portion of that is now made up of fentanyl trade as it’s one of the most popular illegal drugs in the country.

So as much as Warren would love to shut down crypto, even the most extreme measures likely wouldn’t even put a dent into the fentanyl trade.

Is Crypto Used to Launder Money?

Those who are familiar with how blockchain technology and cryptocurrencies work may laugh at this question. The idea of a public blockchain is to have every single transaction stored in a distributed ledger for anyone and everyone to see, which is completely counter to money laundering.

In the early days of Bitcoin it was thought to be mostly anonymous and was used on dark net markets to buy drugs but now law enforcement agencies can track down transactions much easier due to KYC standards and better tracking techniques.

It gets even worse for launderers because one of the only ways to sell cryptocurrency for fiat currency is through centralized cryptocurrency exchanges. To set up an account and start trading with one of these exchanges in the US, you need to fill out extensive personal information, which is also clearly problematic for money launderers.

However, there are a few ways that money can be laundered with cryptocurrencies.

The one benefit to the blockchain for criminals is that you don’t have to tie your name to your wallet. You can create it without any personal information and can access it leaving little or no trail behind you. After this wallet is used to commit a crime, such as stealing cryptocurrencies from another wallet, they can take advantage of an on-chain tool called a mixer or tumbler.

Criminals send the funds they want to launder to mixers such as Tornado Cash where it is all mixed into the same wallets with clean funds deposited by other users. They receive a kind of receipt with the deposit and they later use it to pull out the funds (often using clean amounts so as not to match up perfectly with the deposit) from the mixer to a clean wallet.

These tools are in a bit of a gray area but they don’t seem to be inherently illegal. However, some, including Tornado Cash are sanctioned by the US, making it a crime for US persons to use them.

The money launderers can then send the clean funds to an exchange account in their or someone else’s name and trade them for USD or another fiat currency. Some play it even safer, choosing to work with shady over-the-counter desks that act as nesting services. They illegally allow the user to trade their crypto for cash without providing personal information.

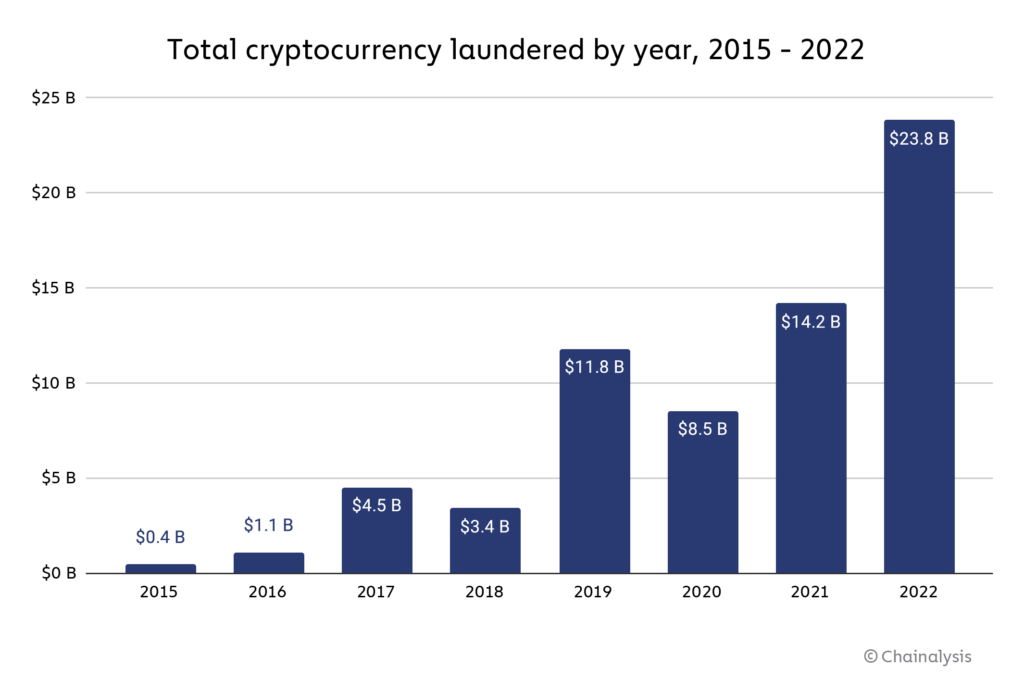

According to Chainalysis, over $23 billion in crypto was laundered in 2022. Now that sounds like a lot, and it is, but it’s insignificant in context. According to the United Nations Office on Drugs and Crime, somewhere between $800 billion and $2 trillion is laundered every single year. At the very lowest estimate, crypto makes up for less than 3% of the total amount of money laundered per year.

Chainalysis also notes that less than 1% of crypto transactions are related to illicit activity.

Before hitting the crypto industry with regulation so strict that it could entirely kill the US’ chances of leading the world in blockchain tech, politicians should probably look at the other 97%. This doesn’t mean that they shouldn’t look into cryptocurrency money laundering, there may be great ways to stomp out some of this criminal activity, such as sanctioning more mixers.

Related Articles:

- Interpol Will Fight Cyber Crime In The Virtual World Of The Metaverse

- 15+ Best Crypto To Buy Now – Which Is The Best Cryptocurrency to Invest in July 2023?

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards