Despite the flurry of criticisms that Netflix faced due to its new password-sharing policy this year, a remarkable rebound has occurred in the company’s fortunes. The streaming giant’s strict approach to account sharing did not stop the growth of its subscriber base–on the contrary: Netflix said on Wednesday it added approximately 6 million new subscribers from April to June this year, more than doubling the forecast by industry analysts.

Launched in May in the US, UK, and 100 other countries, the policy mandates an additional $7.99 a month for customers sharing their password with someone outside their household, or $6.99 for those willing to have an account with adverts. Despite early threats from disgruntled customers to switch to competitors like Disney Plus and Max, the password sharing initiative seems to be succeeding.

https://twitter.com/FrankieFante66/status/1663407623289585664

Sharing Is Not Always Caring: Netflix’s Password Policy Reboots Growth

Shaking off a significant subscriber loss from the previous year, Netflix has turned the tide with two pivotal moves: releasing a less expensive version of its service loaded with advertisements and clamping down on password sharing, an issue largely overlooked during times of exponential growth.

In the three months leading up to the end of June, Netflix saw an addition of 5.9 million subscribers, far surpassing Wall Street’s expectations of 2 million. The company reassuringly stated, “The cancel reaction was low,” during a briefing with investors on Wednesday.

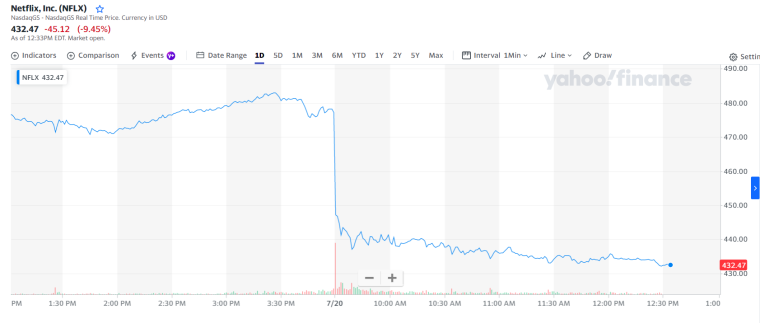

However, the new policy’s triumph didn’t save Netflix’s shares from plummeting by over 8% in after-market trading post the announcement of softer-than-expected revenue. The company’s quarterly earnings saw a slight 3% increase from the previous year, amounting to $8.2 billion. While falling short of the estimated $8.3 billion, Netflix has projected an optimistic $8.5 billion for the current quarter.

The company’s password sharing crackdown is an apparent response to the realities of the costly streaming model Netflix pioneered. Amid the current market cool-down, investors’ focus is shifting from rapid subscriber additions to actual profits, as competitive heat intensifies with Disney and others contending for the customer base.

Cash-Flux and Screen Bucks

Unlike its competitors such as Disney+ and Paramount Plus, Netflix is raking in profits. Wednesday’s report showed a 3% year-over-year increase in quarterly net income, totaling $1.5 billion. Despite a widespread labor strike stalling Hollywood’s movie and television production, Netflix raised its free cash flow projection for the year from $3.5 billion to $5 billion.

https://twitter.com/paolopescatore/status/1681757890456035329

Analyst Paolo Pescatore of PP Foresight regards these results as “a strong endorsement” of Netflix’s password strategy, while warning that the crackdown is only a “short-term measure.” He further commented that Netflix “needs to consider its pricing strategy for the mid to long term.”

After a slump last year, Netflix shares surged in 2023, climbing over 60%. The company communicated to shareholders in a letter, “While we’ve made steady progress this year, we have more work to do to reaccelerate our growth.” As the Netflix password sharing crackdown continues, the coming months will indeed reveal if this strategy sustains its current momentum.

Related:

- 90+ Netflix Statistics You Need to Know – Revenue, Products, and More

- Netflix Considers Diving Into Live Sports Streaming

- Netflix Subscriptions Spike after Password Sharing Crackdown: Would the Gains Sustain?

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards