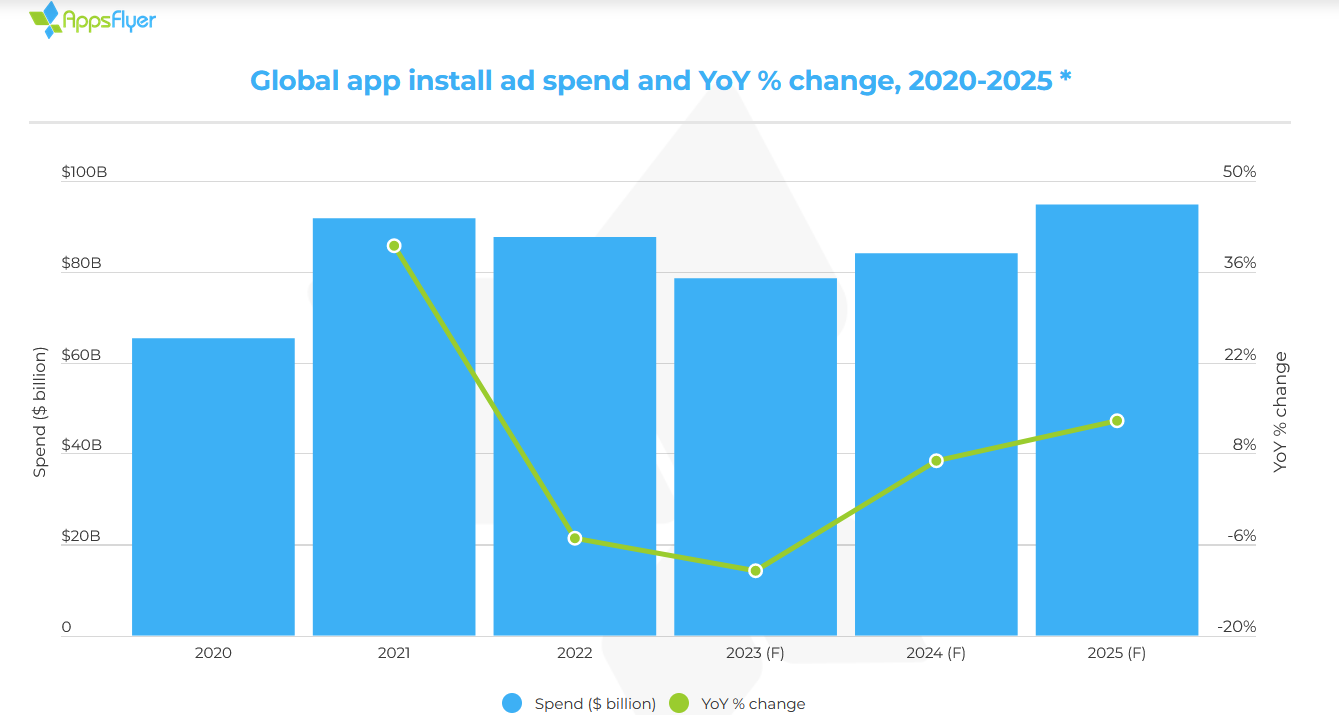

Global app install ad spending which is the money spent by mobile apps to acquire new users and increase the downloads of their apps has been in a downtrend since 2021. However, AppsFlyer estimates that the market would rebound 20% by 2025.

In 2021, apps cumulatively spent $91.8 billion on app install ads – a YoY rise of 40%. The rebound came from a low base as the spending fell sharply in 2020 as businesses scaled back their investments due to the COVID-19 pandemic.

Global app install ad spending fell 5% in 2022 and AppsFlyer predicts that spending would fall another 10% in 2023 and reach $78.5 billion.

However, it predicts spending to rise 7% and 13% respectively in 2024 and 2025 which in absolute terms would mean a spending of $94.9 billion in 2025.

While the 20% rebound from 2023 levels looks encouraging, it would mean a CAGR of less than 1% which is significantly below the global GDP growth rate.

The global mobile app marketing spending activity has been tepid for multiple reasons. In 2021, Apple introduced the App Tracking Transparency framework which hampered marketers’ ability to monitor their campaigns.

Apple App Tracking Feature Hampered Ability to Monitor Spending

Notably, while the new feature meant that users had more control over their data, it also meant revenue loss for many app companies.

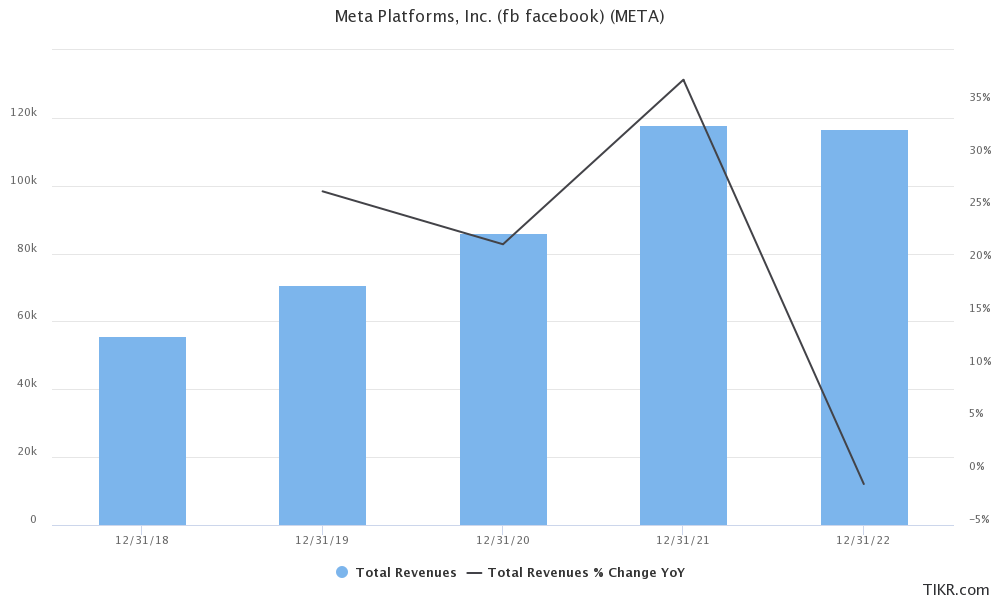

Meta Platforms for instance estimated that it lost $10 billion in revenues in 2022 due to the Apple privacy rules. In 2022, Meta Platforms’ revenues fell 2% YoY – the first time in history when the Mark Zuckerberg-led company posted a yearly fall in revenues.

Meanwhile, Meta Platforms has shown signs of a turnaround and after reporting a yearly fall in revenues for three straight quarters, it reported a 2.6% rise in its Q1 2023 revenues.

Meta has now also launched its Twitter-like app Threads which reached the milestone of 100 million users in five days and outsmarted the previous record held by ChatGPT. The milestone came despite the app not being available in the EU due to data privacy issues.

In the short term, Meta sees AI as a key opportunity but Zuckerburg believes that metaverse would drive the company’s long-term success.

The company’s massive metaverse investments have however been a sore point with many investors as the business segment lost $13.7 billion in 2022 – which was even wider than the $10.2 billion loss in 2021.

Global Economic Slowdown Takes a Toll on Ad Spending

The global economic slowdown, multi-decade high inflation, and the war in Ukraine also took a toll on app install ad spending.

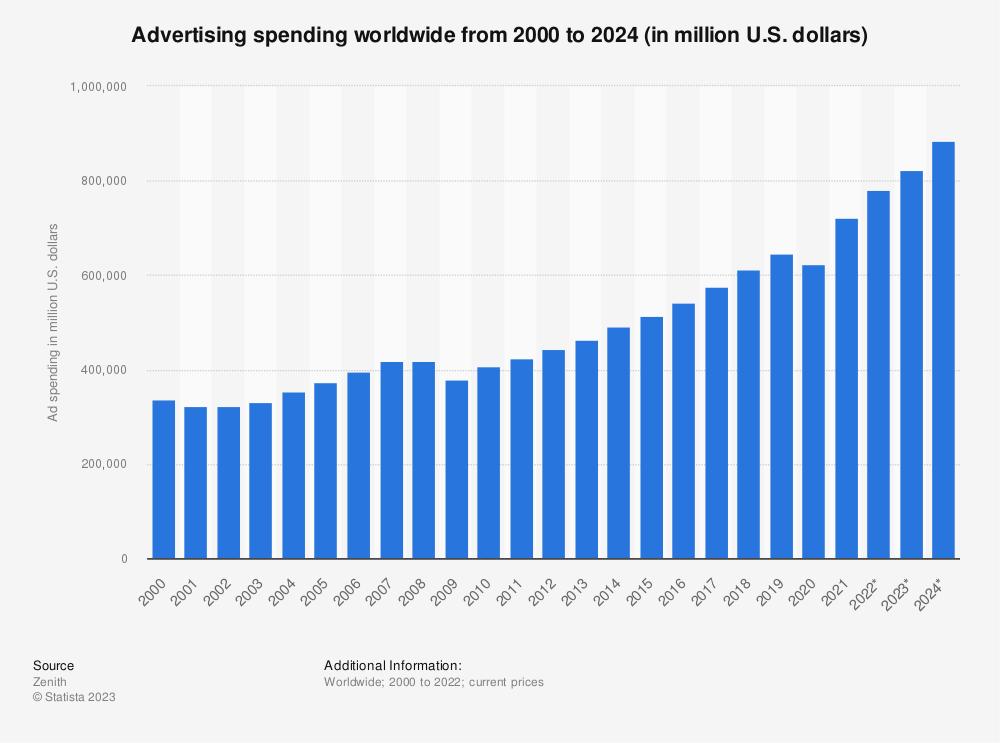

It is not that only the app install ad spending is coming down and we have a broader downtrend in the ad industry.

Media investment group GroupM predicts in its new report that global ad spending would rise 5.9% in 2023 while digital ad spending would rise 8.4% – the slowest pace of growth since the 2009 financial crisis.

YouTube’s revenues have also fallen on a yearly basis for the last three quarters. In Q1 2023, its revenues fell to $6.69 billion – as compared to $6.87 billion in the corresponding quarter last year.

Amid falling revenues, YouTube is now looking to crack down on ad blockers and is limiting access for users who use an ad blocker.

How generous of them and the website operators? Currently, this is optional, but it may become a permanent feature unless you turn off the ad blocker. YouTube is about to restrict views to 3 videos per day, or you need to disable Adblocker or buy YT premium. The battle between…

— The Best Linux Blog In the Unixverse (@nixcraft) July 6, 2023

Google search revenues have also fallen YoY for two consecutive quarters. The company’s overall revenues meanwhile still grew YoY – thanks to the continued growth in its cloud business.

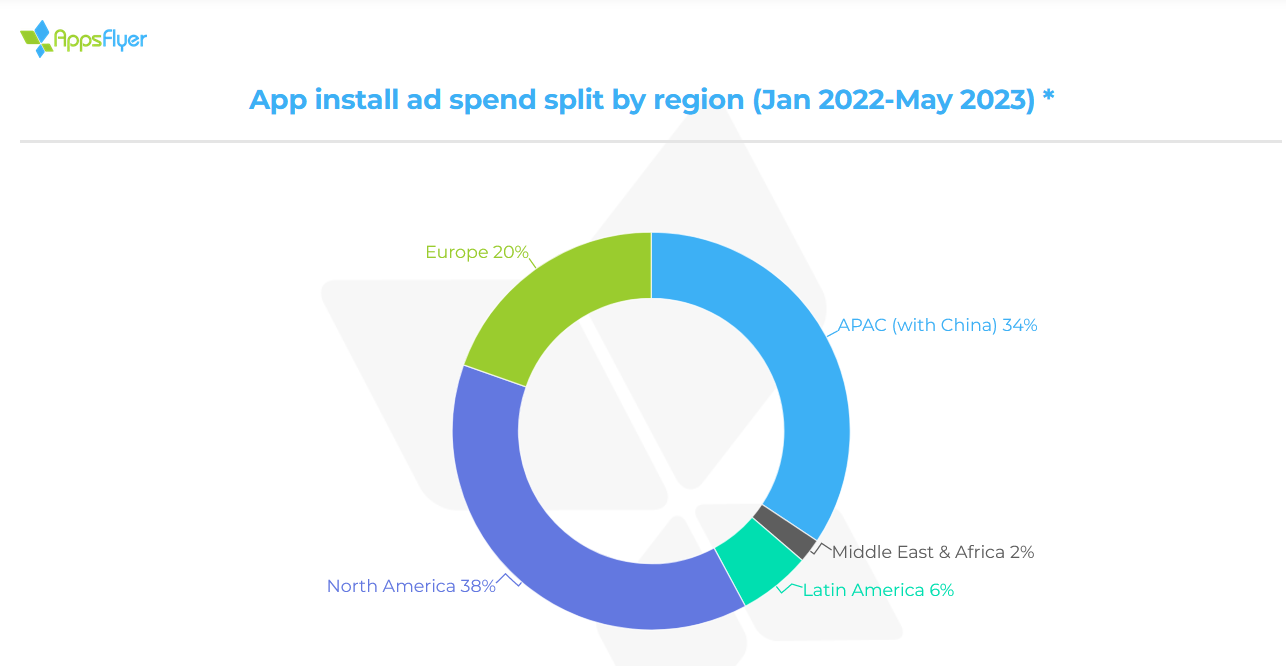

The Bulk of App Install Ad Spending Comes from North America

According to AppsFlyer, between January 2022 and May 2023, 38% of the mobile install ad spending came from North America while Asia Pacific (with China) accounted for 34%. Europe accounted for a quarter of global app install ad spending while Latin America’s share was 6%

AppsFlyer believes that the economic recovery and innovation in privacy-enhancing technology (PET) would drive the growth in global app install ad spending.

The report concludes, “The road ahead is expected to be a bumpy one. But as the headwinds of the economic slowdown are expected to subside at some point in 2024, we expect app install ad spend to surge in the post-downturn reality.”

All said, recession fears haven’t yet abated as interest rates in the developed world are still quite high. While inflation has come off globally, recession fears continue to remain elevated as Central Banks look in no mood to cut rates in a hurry.

While a recession is invariably negative for stocks some stocks can actually be recession-proof.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops