Bitcoin (BTC) rallied slightly on Monday to probe the $31,000 level once again as financial markets brace for the release of key US inflation data on Wednesday that could really shake things up.

Trading conditions in broader financial markets were relatively quiet on Monday.

Analysts cited deflationary producer price index numbers out of China, which economists say is exporting deflation to the rest of the world and aiding central banks like the Fed, ECB and BoE in their fight against inflation, as helping the BTC price at the margin on Monday.

Others pointed to 1) a bullish forecast from UK multi-national bank Standard Chartered for bitcoin to hit $120,000 by the end of 2024, 2) positive commentary from the BlackRock CEO on bitcoin as an asset, 3) US dollar weakness and 4) BTC buying at above support in the form of the 21-Day Moving Average as also helping the bitcoin price on the day.

But when all was said and done, bitcoin was not able to muster a lasting push to the north of the $31,000 level on Monday.

That’s very much in fitting with the $29,500-$31,500ish range that the cryptocurrency has been stuck within now for nearly three and a half weeks.

While optimism regarding spot bitcoin exchange-traded fund (ETF) applications from Wall Street heavyweights such as BlackRock and Fidelity helped lift the BTC price from under $25,000 to the $30,000/$31,000 area in June, the hawkish tone of the US Federal Reserve regarding the need for further rate hikes has kept the bulls at bay in recent weeks.

The bank signaled at its last meeting that two further rate hikes are likely (taking interest rates to 5.50-5.75%) amid stickier-than-expected inflation and a robust US labor market.

Just this weekend, three Fed officials were touting their support for further tightening, likely dissuading any bitcoin buying above $31,000 on Monday.

Upcoming US inflation data could have a big impact on the market’s expectations for further Fed tightening and thus the bitcoin price.

Here is Where the Bitcoin (BTC) Price Could Be Headed Next

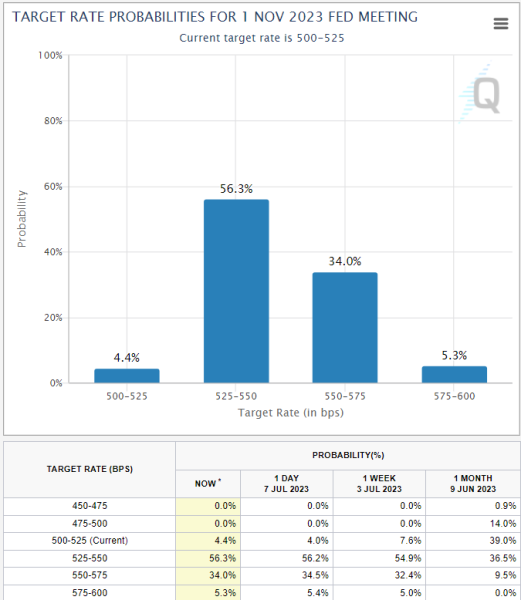

According to the CME’s Fed Watch Tool, money markets imply a near 100% chance that the central bank hikes interest rates by 25 bps this month to 5.25-5.5%.

However, despite the Fed’s guidance for two more rate hikes, money markets only imply odds of around 40% that the Fed will have implemented a second rate hike by the November meeting.

An upside surprise in Wednesday’s Consumer Price Index report could trigger a significant shift in pricing towards two more (rather than one more) rate hikes and that could send bitcoin quickly back to sub-$30,000 levels.

For reference, headline CPI is seen dropping to 3.1% YoY in June from 4.0% last month, while Core CPI is seen dropping to 5.0% YoY from 5.3%.

Conversely, a downside surprise, particularly if it was in the core CPI metric (which is more closely monitored by the Fed), could trigger the opposite market reaction for bitcoin, sending it to fresh year-to-date highs above $31,500.

That would reflect markets further pricing out the likelihood that the Fed actually goes through with its guidance for two more interest rate hikes.

In terms of key levels to watch, a break below $29,500 support would open the door to a quick retest of support around $28,500.

Any drop to this sort of area may be pounced on by longer-term dip-buyers, with bitcoin in a clear uptrend for 2023.

Meanwhile, a break above $31,500 yearly highs would open the door to a push higher towards the next major resistance zones around $32,500, $33,000 and $34,500.

Related Articles

- How to Buy Bitcoin in 2023 – Safely & With Low Fees

- Bitcoin (BTC) Price Prediction 2023 – 2040

- 15+ Best Crypto To Buy Now 2023

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards