There has been a splendid rally in US tech stocks as investors have poured money into AI plays. Morgan Stanley analysts expect Microsoft’s market cap to rise above $3 trillion amid the AI success.

The US stock markets had a strong first half and the Nasdaq 100 gained almost 40% to have its best first-half performance ever. The Nasdaq Composite also rose 31.7% and had the best start to the year in four decades.

The S&P 500’s performance was relatively muted with around 15% returns but that’s because of the broad-based composition of the index – unlike the Nasdaq which is tech-heavy.

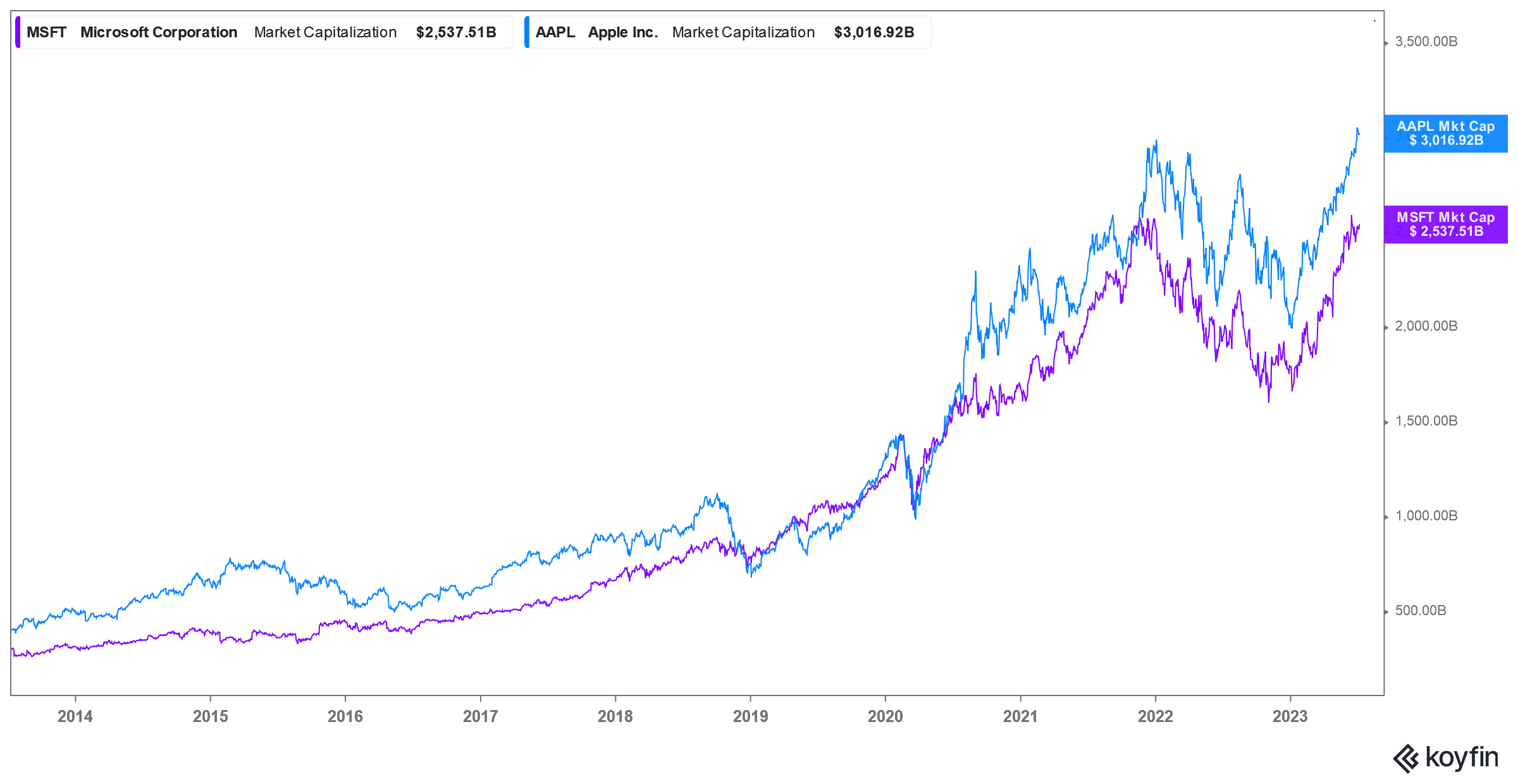

In June, Apple reached a new milestone when its market cap based on closing prices surpassed $3 trillion. The company’s market cap had hit $3 trillion on the first trading day of 2022 also but it could not hold onto the feat for long and the closing market cap was below $3 trillion.

The iPhone maker has been the most valuable company for the most part since 2011. However, there have been periods when Microsoft’s market cap surpassed that of Apple including in October 2021 when Microsoft briefly surpassed Apple to become the world’s most valuable company.

Currently, Microsoft’s market cap is just above $2.5 trillion but Morgan Stanley analysts expect its market cap to rise to $3 trillion.

Morgan Stanley analysts led by Keith Weiss named Microsoft stock as a top pick and assigned a target price of $415 which would imply its market cap rising to $3 trillion over the next year.

Morgan Stanley Says Microsoft Could be the Next 3 Trillion Dollar Company

“Generative AI looks to significantly expand the scope of business processes able to be automated by software, and Microsoft stands best positioned in software to monetize that expansion, which accompanied with a still reasonable valuation makes MSFT our Top Pick in Large Cap Software,” said Weiss in her note.

Microsoft could soar 22% and will top a $3 trillion valuation as it's best positioned to monetize generative AI, Morgan Stanley says https://t.co/uuyh0EYXj0

— Insider Business (@BusinessInsider) July 7, 2023

The brokerage believes that Microsoft still looks reasonably valued based on the price-to-sales-to-growth (PEG) ratio and said that the multiple “remains in line with historical averages, despite the unrivaled generative AI positioning.”

The PEG ratio is typically used to value growth stocks and it standardizes the PE multiple for the company’s expected growth.

Notably, Microsoft is looking to integrate OpenAI technology into its Office apps like Word, Excel, and PowerPoint.

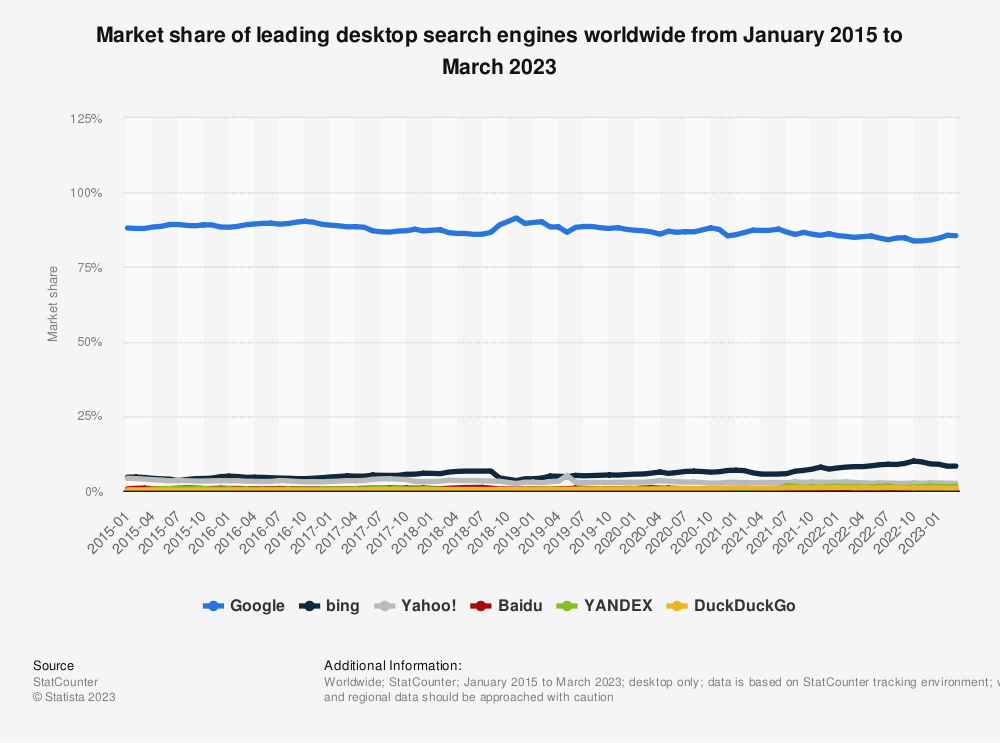

The company has already integrated ChatGPT into its Bing browser but so far it hasn’t been able to dent Google’s domination in the industry.

If anything, Bing’s market share has come down after peaking at 9.92% in October last year.

AI Euphoria Has Supported the Rally in US Stocks

All said the AI euphoria has helped propel US stock markets, especially the tech names higher.

Notably, Nvidia is among the companies that are benefiting from generative AI as it is leading to higher demand for its high-end chips.

Nvidia’s market cap surpassed $1 trillion amid the AI euphoria and it joined the ranks of Apple, Amazon, Alphabet, and Microsoft. C3.ai which is a rare pure-play listed AI company has also tripled this year.

As multiple tech companies battle slowing revenue growth, the pivot to AI looks like a prudent strategy.

US Tech Companies Are Pivoting to AI

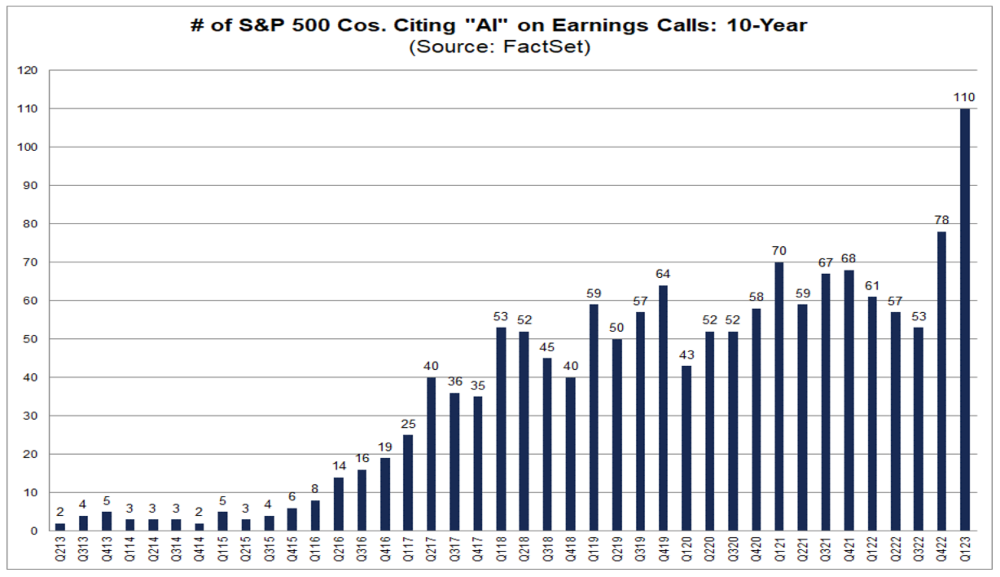

AI has been the buzzword in the US corporate world and according to FactSet, 110 S&P 500 companies used the word “AI” in their Q1 2023 earnings call – which is over thrice the ten-year average and the highest level since 2010.

Watch out for an increasing number of S&P 500 companies mentioning AI during their earnings calls as we enter the second quarter earnings season.

Coming back to Microsoft, Weiss is optimistic about the company’s Azure cloud business also and said, “Given the strong positioning of Azure OpenAI Services and CIOs preference for hyperscalers as the partner to begin incorporating Generative AI technology, Microsoft likely emerges as an early ‘Picks & Shovels’ beneficiary.”

Apart from Weiss, two more analysts see Microsoft’s market cap rising above $3 trillion. The list includes Redburn which has a street-high target price of $450 on the stock.

Related Stock News and Analysis

- AI Is Actually Creating Jobs In San Francisco, Not Replacing Them

- Best AI Crypto Tokens & Projects to Invest in 2023

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops