For the past five years, Chinese tech giant Tencent has topped that chat for top publishers by consumer spending in the world. This year, the company has done it yet again by dominating the list of top publishers in 2022.

Tencent Tops The Charts

The annual Top Publishers Awards is a fete that recognizes and celebrates the most successful mobile companies from around the world. The analytics are facilitated by data.ai which has been tracking mobile companies for consumer spending for ten years now.

According to the analytics group’s 2022’s list, Tencent, which is behind many of the most popular mobile game titles in the world such as Arena of Valor, PUBG Mobile, and Crossfire, became the highest-performing mobile company. This is not a surprise as its games have amassed hundreds of millions of players globally resulting in its massive success.

Congratulations to all the winners of https://t.co/TH8VAU8Emi's 2023 #TopPublisherAwards! The Awards celebrate the top mobile companies by app store consumer spend in the last calendar year. Globally, the top 10 publishers are @TencentGames, @BytedanceTalk, @Google,@ATVI_AB,… pic.twitter.com/h1M0PLgwyD

— data.ai (@dataai) June 29, 2023

In second place was ByteDance, the company behind TikTok, which had risen up 5 ranks from the 2021 list. This growth was mainly due to TikTok’s growing popularity in the social media space over the last year which drove record consumer spend to the tune of $3.3 billion.

Another notable company was Google which came in third. Considering the size of the tech giant and its dominance in the global tech industry, it is intriguing that Tencent is able to maintain the highest consumer spending globally. This begs the question, how does Tencent make its money?

How Tencent Makes Money

Tencent is one of the largest tech companies in China, up on the list with Alibaba and Baidu. While Alibaba is known for its retail and e-commerce, Tencent is mainly known for its dominance in the video games and social media space.

However, the company also has a notable presence in advertising, streaming and cloud services, fintech, and other forms of entertainment. With all these divisions, the company was valued at $589.8 billion as of February 2022, making it the 10th most valuable company in the world at the time. Despite growing significantly since then, it has fallen to the 19th largest company in the world by market cap. Nevertheless, it is still the 2nd most valuable company in Asia, behind TSMC (assuming you don’t include Saudi Aramco).

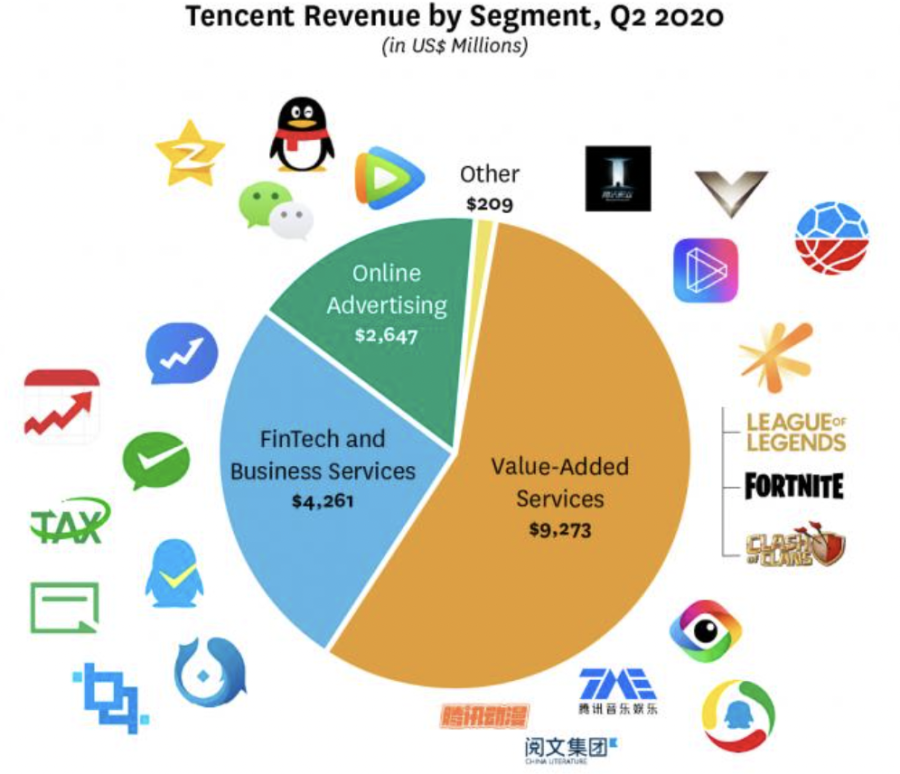

The company’s business segments can be divided into three: Value Added Services(VAS), Fintech and Business Services, and Online Advertising.

How Tencent Takes Advantage of Value Added Services

Value-added services are simply extra features offered in addition to the standard product (for a price). As of 2019, VAS accounted for over 50% of the company’s revenue. This segment entails its gaming apps, any movies or video content based on its games as well as social media apps and services.

The company has a massive market share in the mobile games industry seeing as it owns five of the ten most popular global mobile games. Due to the increased popularity of titles such as Honour of Kings, QQ Speed Mobile, and Peacekeeper Elite, Tencent has seen a CAGR of about 24%.

Under social media, Tencent offers WeChat (Weixin) and QQ. WeChat is unlike the usual messaging apps since it has additional features such as WeChat Pay. Due to the direct link to bank accounts, WeChat users easily spend money on other features such as special stickers or on advertised products.

Tencent Utilizes WeChat Ecosystem to Power Its Financial and Business Services

Tencent also has a hand in fintech and business services which account for about 25% of the company’s revenue. In addition to WeChat Pay, the Chinese company also offers wealth management services through Licaitong.

The platform provides options such as money market funds, bond funds, index funds, investment-linked insurance funds, hybrid funds, and overseas funds to over 100 million customers.

In collaboration with other investors, Tencent also owns WeBank which is a privately owned digital bank. The bank offers retail and SME customers savings, loans, and investment services in China.

Businesses can also receive cloud and cloud computing services from Tencent. The company offers a database platform, Tencent Database SQL, as well as a customer relationship management service to enterprises.

The Last Piece of the Tencent Pie: Online Advertising

Lastly, Tencent is also a large player in the online advertising industry which contributes at least 16% of the conglomerate’s revenue. Advertising by Tencent is mostly driven by its social platforms (mostly WeChat), which are more substantial, or through traditional media.

Tencent employs a wide variety of advertising strategies including short videos, similar to those on TikTok and all throughout the Weixin platform (the mainland version of WeChat). Moreover, the platform allows users to communicate with vendors or even order products after clicking on advertisements, driving more sales.

Aside from these major segments, Tencent also generates revenue from other activities such as investments, producing and distributing films, and licensing copyrights.

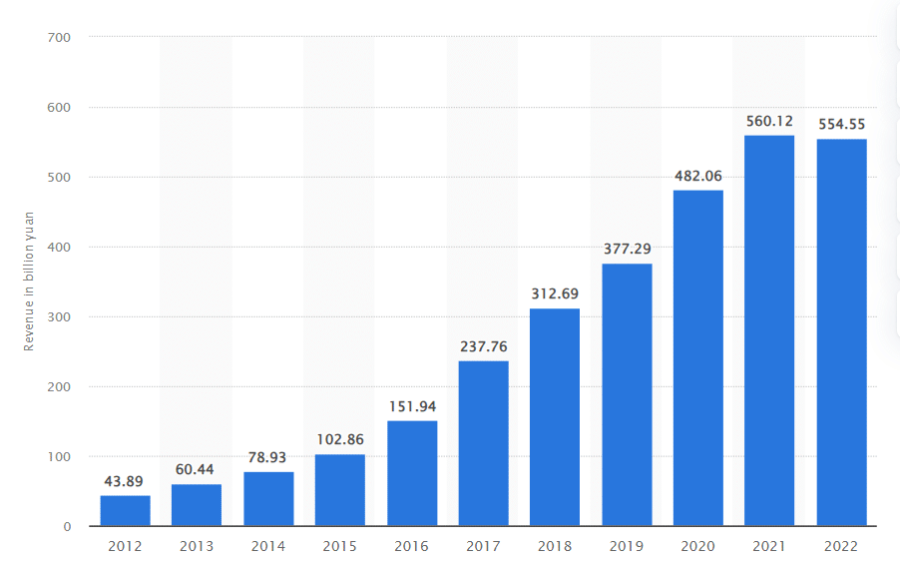

According to Statista, Tencent reported a total revenue of 554.55 billion yuan ($81 billion) from all its streams of income in 2022. While this was a 5.6% decline from the previous year, the company is still among the most profitable companies in the world.

Related Articles:

- Invest in Stocks

- US Ecommerce Marketplaces Will Generate $384 Billion in 2023 Says New Forecast – Here’s Why It’s Up 10% This Year

- Roblox is Already One of the Most Popular Games Globally and Its User Growth is Speeding Up – Daily Active Users Up 22%

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops