A new study published by liftoff found that midcore gamers now make up 35% of United States gaming revenue on iOS, even though they are much more difficult to convert than casual gamers.

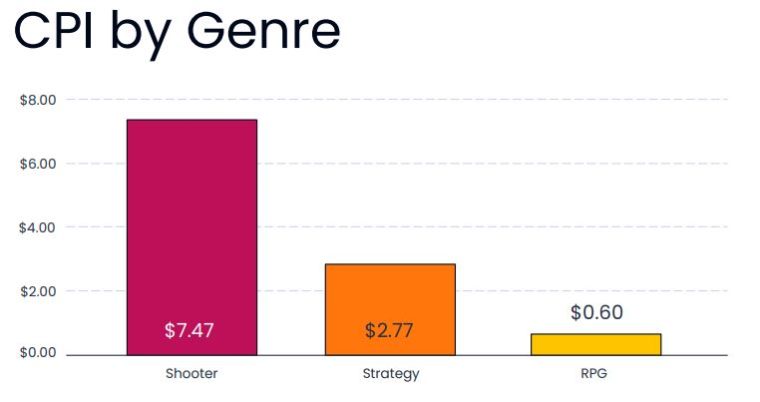

According to the 2023 Midcore Gaming Apps Report the most popular midcore games are strategy games. This could attribute to the average consumer price index (CPI) for midcore games which stands at about $2.

Shooting games stood at about $7.47 CPI and RPGs at $0.6.

What Are Midcore Games?

Midcore games combine aspects of both hardcore and casual games to attract a higher number of audiences. This makes them more inclusive as they contain exciting and intriguing features without being increasingly harder or more challenging to complete.

Midcore games often replace extreme or graphic representations with something more casual or a cue of pop-culture references.

Liftoff has defined three key midcore gaming genres:

- Shooter: key mechanics include shooting and combat that takes place in military, fantasy or sci-fi settings such as Call of Duty: Mobile.

- Strategy: the management of resources, buildings and troops such as Clash of Clans.

- RPG: narrative-driven games where players get to play out a scenario by controlling a character such as Marvel Strike Force.

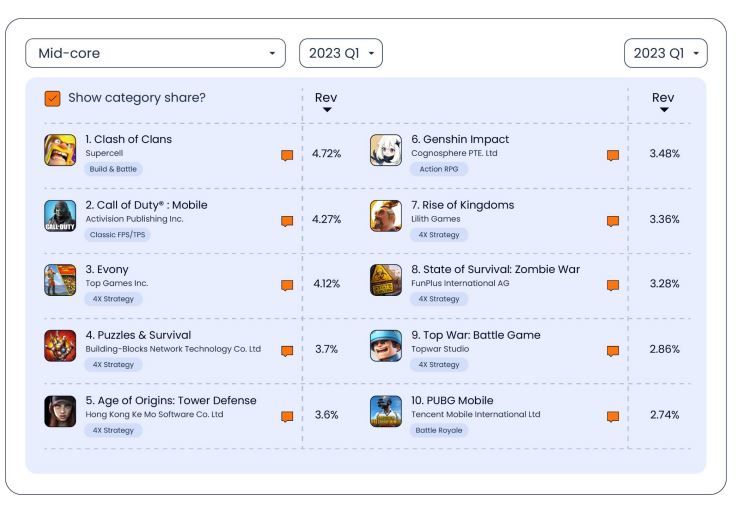

According to liftoff the top 10 midcore games on iOS for the first quarter of 2023 include Clash of Clans, Call of Duty: Mobile and Evony.

More Developers Looking at Midcore Game Market

The report notes that meanwhile the CPI (or cost per install) for midcore games is pricier on iOS ($2 as opposed to $1 for casual games), more developers continue to consider releasing midcore games rather than regular games. Developers have found that even though they can be harder to convert, once midcore gamers install the app, they earn the app more money in the long-run.

Last month we reported that hyper-casual gaming has seen a 37% increase in in-app purchases, meanwhile liftoff added that the number of mobile gamers is expected to grow to 172.5 million in the near future, and as the audience for mobile gaming grows, so does the market.

“While casual games still dominate the field, easy growth is tapering, especially for hyper casual titles. Apple’s IDFA changes introduced new user acquisition challenges for mobile apps. Post-pandemic, many hyper casual gamers have also peeled off, and engaged gamers are gravitating toward titles with more depth. Game developers are looking less to volume and more to the steady streams of revenue a dedicated following can bring.”

In addition, liftoff found that the CPI for midcore games is much higher during the summer months with it reaching a peak at $2.81 in August as opposed to falling down to $1.66 in October.

Moreover, statistics showed that out of all the midcore and casual games released in the past year on iOS, only five casual games are in the top-grossing 200 compared to ten midcore games, thus signifying that in the long run, midcore games could come out on top.

“To get a sneak peak into the midcore trends of tomorrow, look at Gen Alpha’s gaming habits. Roblox and Minecraft dominate their playtime, but each game is not a monolith. Developers and publishing teams can observe what specific Roblox experiences and Minecraft mods are trending today to extrapolate what genres and IP-styles might be popular in the next 2-5 years as Gen Alpha ages up,” Oliver Wang, the head of growth at Mushroom.gg said in the report.

Despite that, install costs stay twice as high for midcore games as their day 7 return on ad revenue (ROAs) makes up only 4.3% as opposed to the ROAs of casual games that stands at 7%. This is possibly due to the fact that midcore games are more engaging for longer.

In addition to midcore gaming seeing a surge, blockchain gaming has also been on the rise in 2023, a recent report by DappRadar noted.

Related Articles:

- Connecticut sports betting and igaming revenue rises for May despite lower handle

- Evolution Gaming Casinos – The Top Korean Casinos with Evolution Gaming Titles in 2023

- Mobile Gaming is an Afterthought For Many Gamers But it Makes 77% of The Entire Industry’s Revenue

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops