The value of open bitcoin derivate positions that have been taken out by crypto traders and investors has surged in the last few weeks.

So-called “open interest” of bitcoin futures positions hit a new high for the year at close to $15 billion on Thursday, as per crypto derivatives analytics website coinglass.com.

Meanwhile, the open interest of bitcoin options positions was last around $14.4 billion and just below highs for the year.

The surge in demand for derivatives that traders and investors can use for hedging purposes is a sign that the health of the bitcoin market continues to improve after a series of major financial institutions, including BlackRock and Fidelity, applied for spot bitcoin ETFs earlier this month.

Experts have said these applications stand a better chance of being approved than past spot bitcoin ETF applications.

And the surge in open interest in bitcoin derivatives markets suggests that market participants are increasingly preparing for explosive price moves.

A rise in open interest can also itself be interpreted as a rise in bitcoin’s adoption amongst financial institutions.

Derivative markets are mostly driven by more sophisticated (institutional/professional) traders, rather than the retail crowd which tends to prefer trading on the spot market.

Bitcoin was last trading around $30,500, up around 12% for the month and up over 20% versus earlier monthly lows under $25,000.

The world’s largest cryptocurrency has surged higher in recent weeks amid spot ETF optimism, shrugging off concerns about the increasingly unfavorable US regulatory environment for the industry, as well as macro headwinds as traders up their Fed tightening bets.

Derivatives Traders Are Positioned For Bullish Moves

Analysis of the bitcoin derivatives market suggests that traders are increasingly demanding products that pay out in case of bullish BTC price moves.

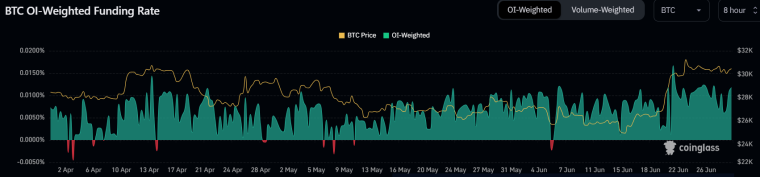

The open interest-weighted funding rate paid by those who take out bitcoin futures positions remains strongly in positive territory at around 0.011%.

That means those taking out bullish long bitcoin futures positions have to pay funding to those taking out bearish short positions, implying higher demand for the former.

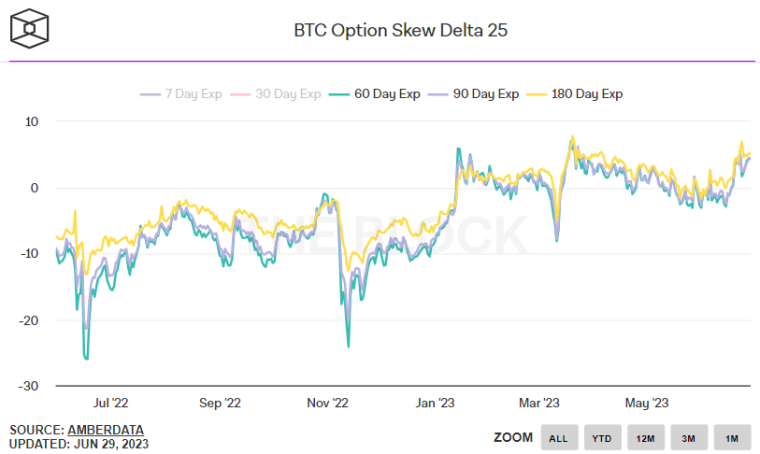

Elsewhere, the 25% delta skew of bitcoin options expiring in 60, 90 and 180 days are all close to their highest levels of the year at around 5, according to data presented by The Block.

A 25% delta skew of above zero means that bullish Bitcoin call options are trading at a premium versus equivalent bearish put options, suggesting investors disproportionately demand the former, and sentiment is net bullish.

Meanwhile, according to coinglass.com, 66% of all options open interest is in call options.

Moreover, of all the options trade that has happened in the past 24 hours, 72% was in call options.

Traders are expecting a volatile end to the quarter for bitcoin given that options worth nearly $5 billion are set to expire.

What This Means for the Bitcoin (BTC) Price?

The health of the bitcoin derivatives market is one a few signs pointing to further near-term gains for bitcoin.

Elsewhere, the tailwind of optimism surrounding spot bitcoin ETFs and “institutional adoption” is unlikely to fade anytime soon.

Moreover, bitcoin remains resilient to macro headwinds such as rising US bond yields as a result of increasing bets for Fed tightening as US economic data points to stronger than expected growth.

Bitcoin also tends to perform well in July, having rallied a double-digit percentage figure three years in a row now for the month.

Technicals are also supportive of continued upside.

Bitcoin’s strong bounce from its earlier monthly lows confirmed the 2023 uptrend, and that the 200DMA remains intact as strong support.

Bulls are hoping that BTC will soon pop to the north of recent highs in the $31,000s and push on towards major resistance levels in the $32,500, $33,000 and $34,000 areas.

Related Articles

- Bitcoin (BTC) Price Prediction 2023 – 2040

- Bitcoin Closes in on Strong Monthly Gain – Could Things Get Even Better for the BTC Price in July?

- Bitcoin Price Prediction: Institutional Interest Started the Rally But Retail Traders Will Drive the Real Bull Market

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards