At current levels just to the north of the $30,000 mark, bitcoin (BTC) is on the cusp of closing out June with solid gains of around 11%.

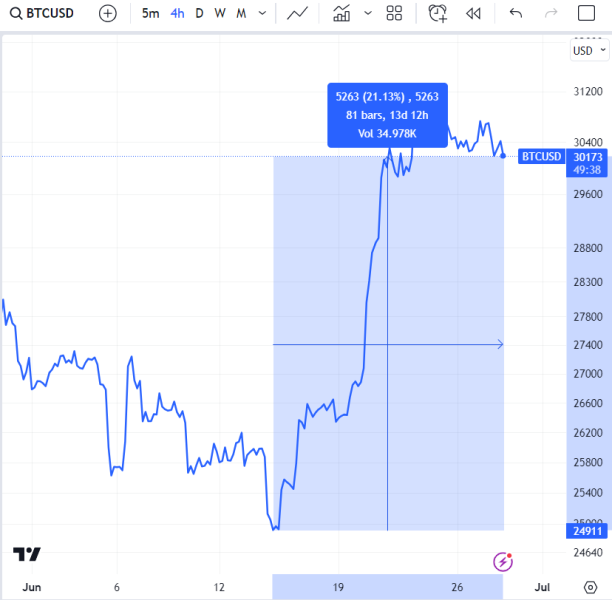

The world’s oldest and largest cryptocurrency by market capitalization has seen an impressive more than 20% recovery from earlier monthly lows to the south of the $25,000 level.

Up until mid-June, BTC had been suffering as a result of concerns regarding the US Securities and Exchange Commission (SEC)’s increasingly aggressive stance against the crypto industry, as well as concerns about a still hawkish US Federal Reserve.

But mid-month news that the world’s largest asset manager BlackRock had filed an application for a spot bitcoin Exchange Traded Fund (ETF) triggered a quick turnaround in sentiment and a rebound to fresh highs for the year above $31,000.

Thanks to BlackRock’s sizeable influence on Wall Street and politically, and thanks to a newly proposed “surveillance sharing agreement” that would reduce the risk of market manipulation, analysts deem BlackRock’s ETF application as much more likely to secure SEC approval than prior similar ETF applications.

The approval of a first spot bitcoin ETF would be a landmark moment for the US crypto industry and could trigger substantial inflows of institutional capital into the bitcoin market.

Things to Get Even Better for Bitcoin in July?

The bitcoin bulls are taking a breather as the end of the quarter approaches, with prices unmoved from $30,000-$31,000ish ranges over the past few sessions.

But things could be about to get even better for bitcoin in July.

That’s because, in recent years, July has been a strong month for BTC.

According to bitcoinmonthlyreturn.com, prices rose 24% MoM.

In 2021 and 2022, BTC prices rallied 18.6 and 17%.

And the conditions appear to be there for a continuation of June’s price pump.

A flood of other major financial institutions such as Fidelity have followed BlackRock in filing spot bitcoin ETF applications, so this is a theme that is likely to provide ongoing tailwinds.

Meanwhile, with markets already pricing in a strong likelihood of further interest rate hikes from the Fed this year, the scope for a “hawkish surprise” that could weigh on the bitcoin price is low.

As per the CME’s Fed Watch Tool, money markets place a more than 80% probability on another 25 bps rate hike in July and a near 30% likelihood that US interest rates end 2023 at least as high as the 5.50-5.75% range.

Technicals are also on bitcoin’s side.

The strong bounce from mid-June’s sub-$25,000 lows confirmed that the 2023 uptrend remains strongly intact.

Many technicians expect bitcoin to break convincingly above yearly highs in the $31,000s in the coming days/weeks and press on towards the next major resistance zones such as at $32,500, $33,000 and $34,500.

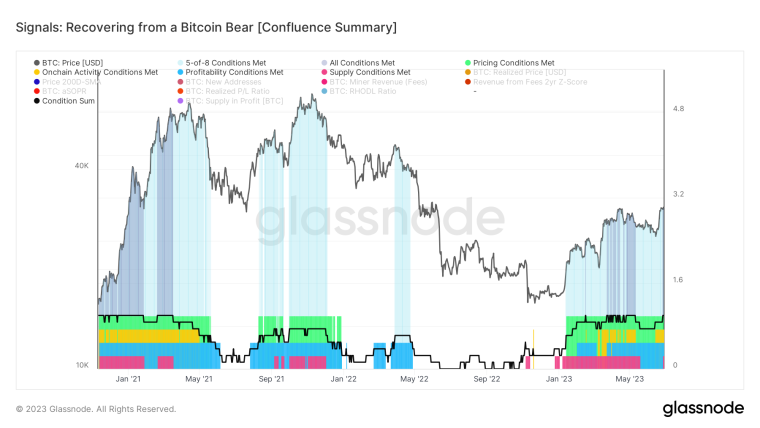

On-chain metrics are also sending bullish signals.

Crypto data analytics firm Glassnode’s widely followed Recovering from a Bitcoin Bear dashboard, which tracks eight on-chain and technical indicators, is currently flashing that BTC are in the early stages of a bull market.

As the end of June approaches, price risks seem tilted to the upside for July.

Related Articles

- Bitcoin (BTC) Price Prediction 2023 – 2040

- Meme Coin Price Predictions: Steady Bitcoin Could Mean Return of Meme Coin Season

- Bitcoin Price Prediction: TradFi Set to Light the Fire Under Bitcoin – Is 40K Next?

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards