Autonomous driving is among the emerging technologies that might shake up the economy in the coming decades. However, elected representatives have more or less taken a back seat in shaping industry regulations, leaving the job to obscure unelected officials.

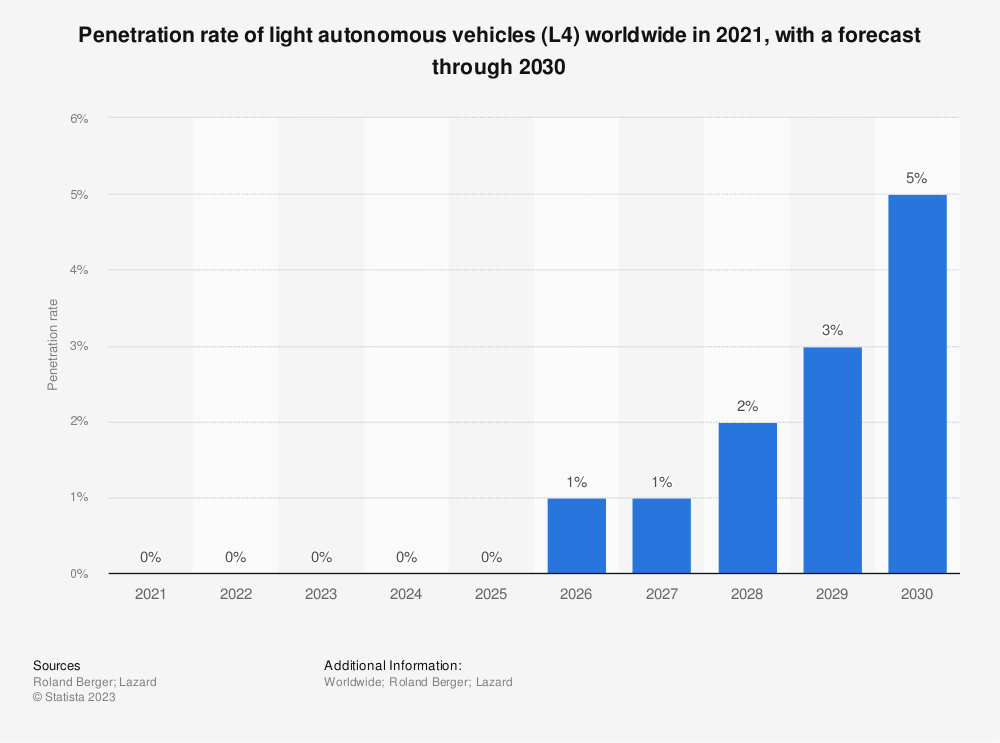

Tech companies as well as carmakers see a massive opportunity in autonomous driving. The optimism is not unfounded as one in every 10 cars is expected to be self-driving by 2030.

According to MarketsandMarkets, the global market for self-driving cars is expected to more than triple between 2021 and 2030 and reach 62.4 million units.

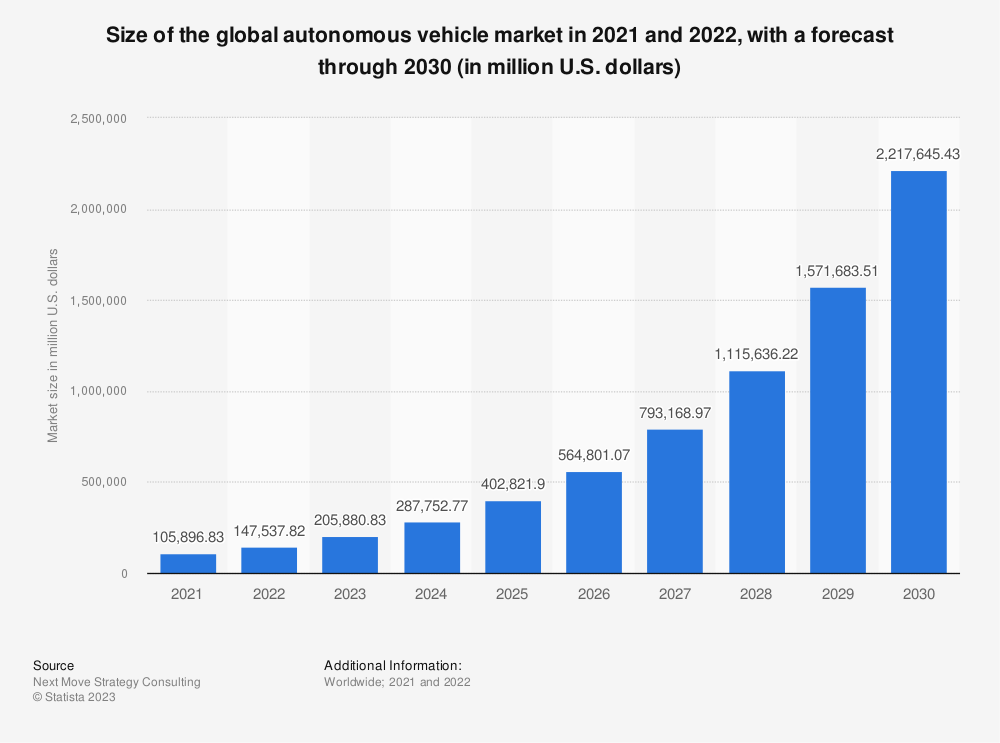

Next Move Strategy Consulting estimates that the market size of the autonomous driving industry would hit $2.3 trillion by 2030.

Meanwhile, as companies expand their autonomous driving and robotaxi operations, lawmakers have been found wanting amid a lack of concrete regulations as well as their appreciation of the impact of robotaxis on the economy as well as existing infrastructure.

According to an MIT Technology Review report, robotaxis “could make automotive transportation so cheap and easy that people decide to make more trips by car, increasing congestion and undermining public transportation.”

This might add to the congestion on city roads and increase parking problems. Another aspect that regulators might need to consider is the impact of robotaxis on the labor market.

Uber had 5.4 million drivers and couriers on its platform in 2022 and is estimated to have over 1 million drivers on the platform in the US. Last month, Uber partnered with Waymo for robotaxis.

Robotaxis Could Have a Major Impact on the Economy

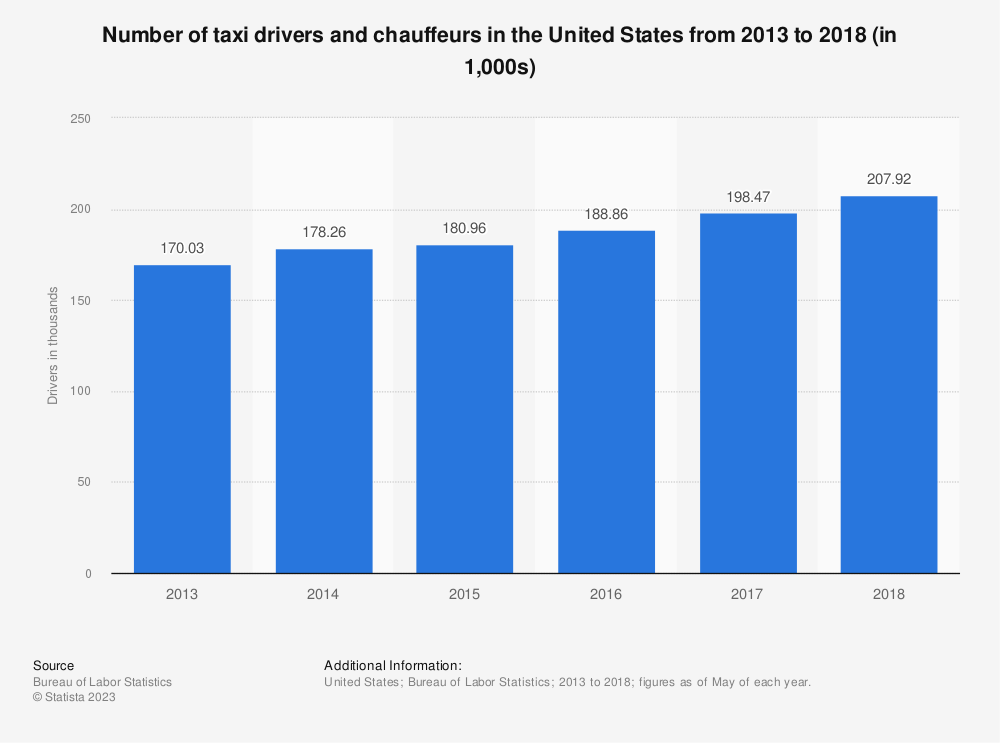

Also, according to Statista, over 200,000 people were employed as taxi drivers or chauffeurs in the US at the end of 2018 – which highlights their importance to the economy.

Millions of jobs globally are at stake due to the rapid adoption of robotaxis. Also, regulators would also need to contemplate if robotaxis are to be allowed in the most congested parts of the cities.

Chinese regulators are meanwhile taking a more active interest in robotaxis and autonomous driving.

Earlier this month, it permitted Xpeng to roll out the self-driving to “ring-road” and “main high-speed roads.” It is not yet clear whether Xpeng can roll out the service to all the roads in Beijing.

We are taking smart assisted driving to new heights. One journey at a time.

Check out a demo video of how XPENG smart EVs navigate through the bustling streets of Beijing using visual-based XNGP* technology.#FutureMobility #TechnologyForAll pic.twitter.com/gsf3jkvb30

— XPENG (@XPengMotors) June 20, 2023

However, while Chinese robotaxi companies have operations in the US in the form of R&D workers, testing cars on US roads, and collaborating with US companies, China is not very open to non-Chinese autonomous companies.

China is Not Very Welcoming Towards Foreign Autonomous Companies

Tesla incidentally does not have permission to offer its full self-driving (FSD) in Chinese cities. Notably, in 2021, the world’s second-largest economy banned Tesla cars from some government compounds over “spying concerns” as the cars come fitted with cameras to assist with self-driving.

While Musk denied that Tesla cars could be used for spying, it did not cut ice with China. He even started a new data center in China to store all data collected in the country locally.

Notably, Tesla CEO Elon Musk once predicted that the company would have 1 million robotaxis by 2020 – the company still does not have robotaxi operations – nor is its FSD “fully autonomous” as the name suggests.

This year, Dawn Project released a 30-second commercial calling out Tesla for what it said was “deceptive marketing.”

Over the last many years, Musk has been promising full autonomy in Tesla cars but the software is still not L4. Musk meanwhile believes that Tesla leads competitors by a wide margin when it comes to autonomous cars. The Tesla CEO is also working on his AI startup named TruthGPT.

Robotaxi will be here faster than the majority of the people realize. It will shock people once Tesla announces it. pic.twitter.com/XDnaWCr7nh

— Tesla Synopsis (@TeslaSynopsis) June 21, 2023

In the US, Alphabet-backed Waymo and General Motors-backed Cruise are testing autonomous cars in select cities.

Autonomous Driving Companies Are Posting Massive Losses

Meanwhile, while markets are optimistic about the outlook for autonomous cars and their impact on the economy – companies in the sector are losing billions of dollars every year.

According to a report from Automotive News, investors have poured a whopping $160 billion towards self-driving companies over the last dozen years.

Cruise, which is backed by General Motors, lost $500 million in Q2 2022 and $900 million in the first half of 2022. Its accumulated losses surpassed $5 billion last year while the daily losses averaged around $5 million.

Last year, Ford wrote off its $2.8 billion investment in autonomous driving startup Argo AI – which eventually wound up its operations.

All said, robotaxis looks set to shake up the economy with the penetration of L4 autonomous cars expected to rise to 1% in 2026 and further to 5% by 2030.

So far, the job of framing regulations for the nascent industry was left to unelected officials. However, as the penetration of autonomous cars starts rising, elected officials might also contemplate regulating the industry.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops