The world of cryptocurrencies is excited as institutional adoption of Bitcoin gains remarkable momentum. This surge in institutional interest is underscored by the highest weekly inflow of crypto investment products since July, signaling growing confidence in Bitcoin’s value as a sought-after asset.

Amidst this evolving crypto landscape, Bitcoin (BTC), the leading cryptocurrency, displays resilience and stability around the $30,000 mark.

BTC has demonstrated consistent growth throughout July, achieving impressive gains of at least 20%. The convergence of institutional adoption and Bitcoin’s positive trend has captivated the attention of market participants worldwide, sparking intrigue about the future trajectory of this digital currency.

#Cryptocurrency at the moment #Bitcoin currently above $30K. pic.twitter.com/dF1xBixJoP

— CoinMarketCap (@CoinMarketCap) June 27, 2023

Although it experienced a minor decline yesterday, resulting in a 0.9% decrease, this dip followed Bitcoin’s recent peak of over $31,300 last Friday. However, these declines proved to be temporary, as Bitcoin swiftly regained its strength.

Bitcoin has slid about 3% after rallying to a one-year high on Friday above $31,300. NEAR Protocol’s NEAR token has rallied 10% on the day as the Foundation said it would partner with Alibaba Cloud. @LedesmaLyllah and @godbole17 reporthttps://t.co/oNmO0TGXX7

— CoinDesk (@CoinDesk) June 26, 2023

However, the increase in Bitcoin’s value was preceded by influential financial giants like BlackRock expressing their interest in cryptocurrency. This sparked optimism in the crypto market, as several filings for Bitcoin exchange-traded funds (ETFs), led by BlackRock, instilled confidence in investors and reignited interest in digital assets.

Investor Expectations Dampened as Bitcoin ETF Approval Process Lengthens

As time passed, investors began to realize that gaining approval from the Securities and Exchange Commission (SEC) for these ETFs would likely be a lengthy process, potentially taking several months or even longer.

This realization dampened the initial excitement and contributed to decreased investor confidence, particularly in Bitcoin, amidst the prevailing uncertain economic sentiment.

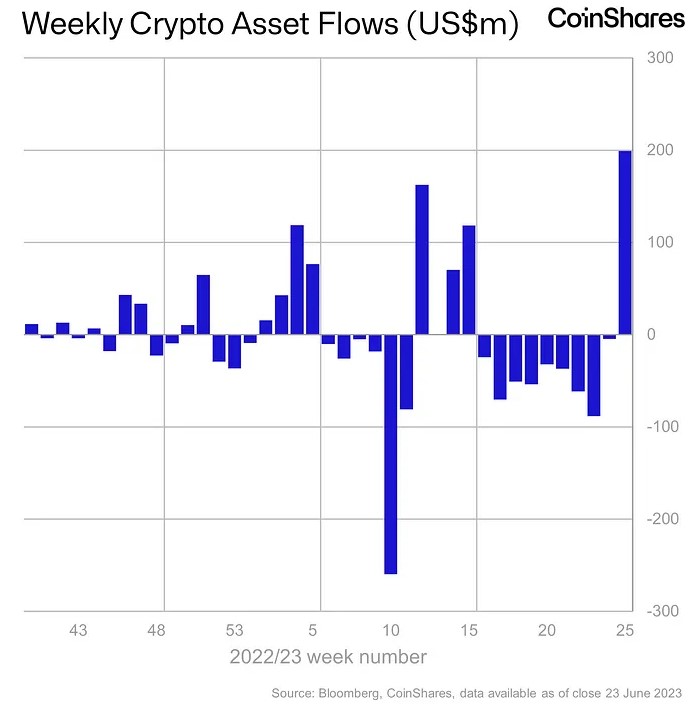

On a positive note, regulated exchanges saw a significant surge in inflows to digital asset investment products last week, reaching the highest level since July 2022.

CoinShares, a prominent analytics firm, reported a substantial influx of $199 million into crypto-based investment products, with Bitcoin leading the way at $187 million.

#DigitalAssets investment products saw the largest single weekly inflows since July 2022, totalling $199M#Bitcoin was the primary beneficiary, seeing $187M inflows last week

This turn in sentiment didn’t trickle down to #altcoins with only very minor inflows#Crypto pic.twitter.com/w3Rq5ycbvO

— Satoshi Talks (@Satoshi_Talks) June 26, 2023

These impressive figures indicate a positive trend in the market, showcasing investors’ increasing confidence and interest in cryptocurrencies.

Digital Asset Investments and Positive Sentiment Boost Bitcoin

According to a recent report by CoinShares, investments in digital assets traded on regulated exchanges have experienced a significant surge. Notably, inflows into crypto-based investment products have reached their highest level since July 2022, with a remarkable $199 million invested, predominantly in Bitcoin.

This influx of investment has led to a recovery of losses incurred in 2022, with the total assets under management in crypto investment products surpassing an impressive $37 billion.

London-based ETC Issuance GmbH’s Bitcoin exchange-traded product, BTCE, attracted the highest weekly inflows of $77.3 million, while ProShares’ Bitcoin Strategy ETF (BITO) in the US saw inflows of $60.4 million.

However, it is essential to highlight that this positive sentiment has been fueled by the anticipation of spot Bitcoin ETF approvals, with BlackRock’s application being a major catalyst.

This renewed optimism, combined with institutional investors entering the market through regulated investment products, signifies a growing interest and confidence in digital assets, particularly Bitcoin. The news of increased investments and positive sentiment can potentially drive up Bitcoin’s price further.

Bitcoin Price Prediction

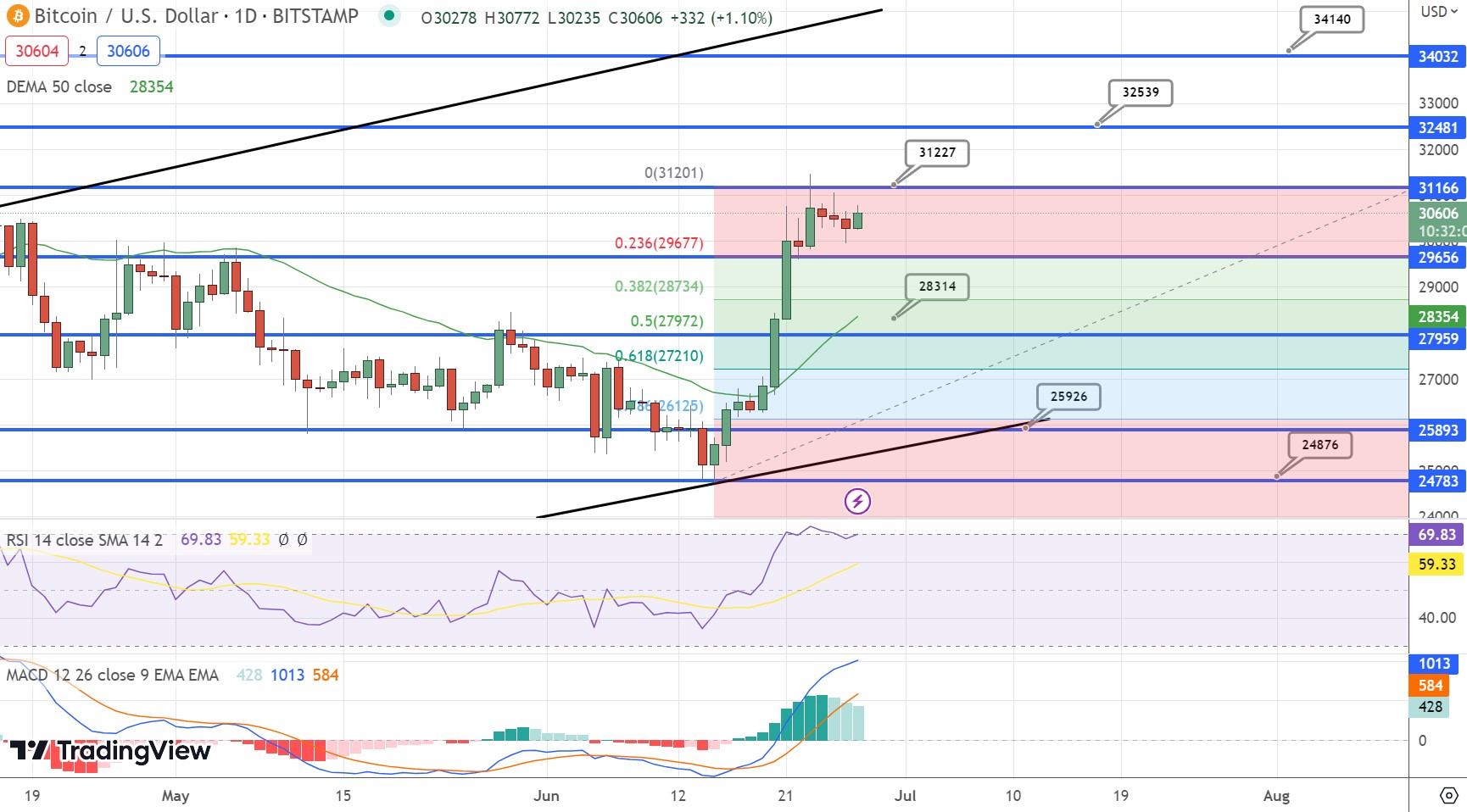

The BTC/USD pair faces strong resistance at $31,000 with signs of weakening bullish sentiment. A minor correction is expected, finding support at $29,600, followed by potential targets at $28,250, $28,200, and $26,750.

The RSI and MACD indicators indicate neutrality, allowing room for a corrective move. Alternatively, breaking above $31,000 could lead to targets around $32,500 and $34,000.

Related New

- Bitcoin Cash Price Skyrockets Over 100% Over Past Week – These Pioneering Altcoins Are Set to Rally Next

- Bitcoin Price Prediction: Here’s How Rising US Treasury Yields and Continued Institutional Interest Could Spark the Next Bull Market

- Bitcoin Price Prediction: TradFi Set to Light the Fire Under Bitcoin – Is 40K Next?

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops