Coinbase, the largest US-based cryptocurrency exchange, is looking to transform into a “super app” that offers a broad range of financial services beyond just digital assets.

CEO Brian Armstrong shared this vision during the recent State of Crypto Summit on Thursday, where he noted that crypto has many more use cases beyond trading and speculation, citing decentralized social media, messaging, merchants accepting NFTs, and simple interfaces for DeFi as examples of industries that could benefit from cryptocurrencies.

“In Coinbase’s case, we want to be that super app, but it’ll be based on decentralized protocols, not just money but decentralized social, messaging, merchants accepting NFTs out there, simple interfaces for DeFi,” the crypto boss said. “It should work in a more global way.”

Armstrong said it sees institutions as being key players in helping the crypto industry move forward.

With traditional finance players such as BlackRock filing for a spot Bitcoin ETF and Fidelity backing a crypto exchange, he believes that the incorporation of institutions into the crypto would further drive the sector’s growth.

“If you want more fiat money flowing in, you need institutions engaged,” Armstrong said.

However, he added that, unlike retail investors, institutional players and firms have different sets of requirements for qualified custodians, auditing, cybersecurity, and more.

More Than Half of Fortune 100 Firms Have Adopted Crypto

Coinbase mentioned that it is already seeing an increase in institutional investors.

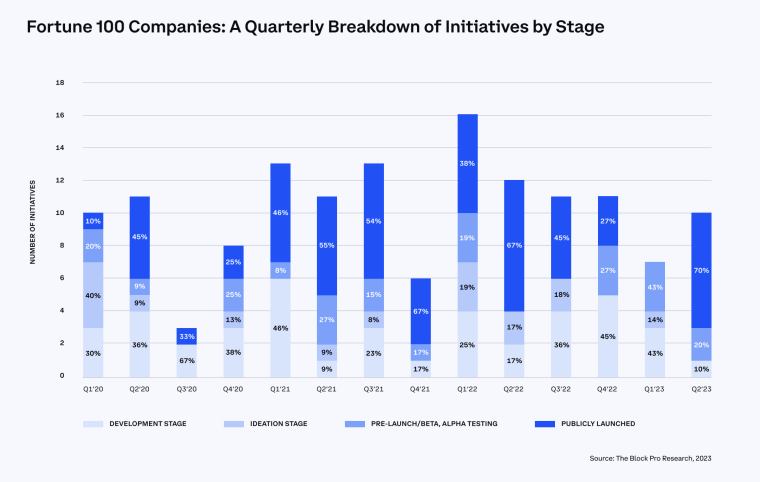

According to a new report conducted by the exchange, more than half of the Fortune 100 companies have pursued crypto, blockchain, or Web3 initiatives since the start of 2020.

Furthermore, 83% of Fortune 500 companies have crypto-related initiatives on the books, indicating that interest in the crypto space is growing significantly.

Despite regulatory challenges in the US, Coinbase is looking to expand beyond crypto trading and into industries such as decentralized finance, identities, NFTs, and stablecoins.

Armstrong believes that stablecoins, in particular, have significant potential, offering access to a digital dollar for those who do not have access to stable currencies, and facilitating cross-border payments that are often costly through traditional providers like banks.

“Stablecoins help facilitate online trading, but another use case [is for] people who don’t have access to stable currencies; it gives access to a digital dollar or something like that,” the crypto veteran stated.

Looking towards the future, Armstrong sees opportunities for crypto to be used in decentralized social media, gaming in the metaverse, and coins that are not backed by fiat currencies.

Despite some negative rhetoric surrounding the crypto industry, Armstrong is optimistic about its future and believes that it holds significant potential for growth and innovation.

Twitter Aspires to Become a Super App Too

Coinbase’s super app ambitions follow a similar move by social media giant Twitter, which is reportedly acquiring tech talent-hiring platform Laskie.

This acquisition is seen as the first step towards Musk’s ambition of transforming Twitter into a super app by paving the way for the social media platform to compete with LinkedIn as a professional social networking platform.

A super app, or everything app, is a multi-functional platform providing various services ranging from social media and online shopping to money transfers, food deliveries, and even video games.

China’s WeChat, with its overwhelming success, is often held as the paradigm of a super app.

Given that Twitter already has a robust network of users, the challenge lies in encouraging them to use the platform for other services.

Moreover, Elon Musk’s controversial online persona may pose a stumbling block for Twitter’s super app aspirations.

Super Apps Are On The Rise

Social media companies such as Facebook, TikTok, and Snapchat are evolving from being just social networks to super apps that allow users to shop, bank, and entertain themselves.

The concept of super apps, which originated in China with WeChat, enables users to do more than just message friends or view updates. For instance, WeChat allows users to buy cars and take out loans among other things.

According to a report from The Verge, commerce done via mini-apps reached $240 billion in 2021.

Western social media companies have started to catch up, with Meta adding shopping features and Instagram repositioning away from photo sharing.

WhatsApp, which is owned by tech giant Meta, has added a directory to allow users to find local businesses, while Twitter has launched audio rooms and a newsletter service.

TikTok has introduced its own shopping feature and opened up its platform for developers to create app experiences for the video feed.

Snapchat is furthest along in becoming a super app, having introduced mini-apps, such as games and meditative features, and now hosts over two dozen of them.

Read More:

- Best Crypto to Trade Right Now in June 2023

- 15+ Best Crypto Under $1 for 2023 – Micro Caps Reviewed

- Best Crypto to Buy Right Now on Reddit in 2023

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops