BlackRock’s Bitcoin exchange-traded fund (ETF) bid has helped partially stem the crypto market’s recent bleeding.

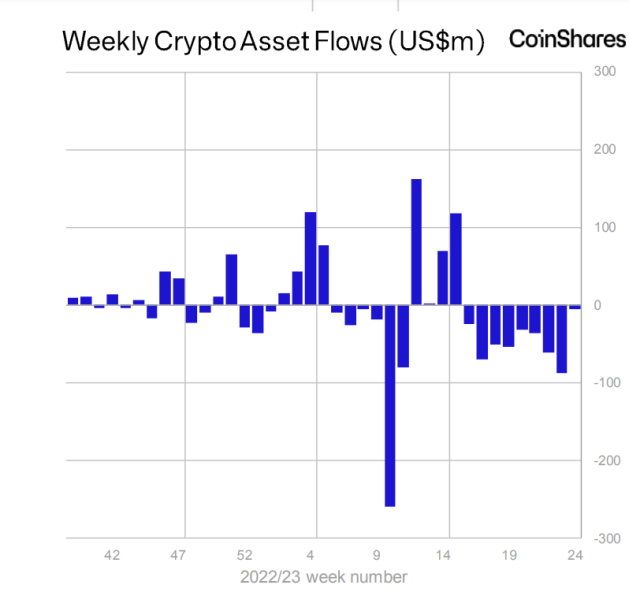

According to CoinShares’s latest digital asset fund flows report, around $5.1 million was withdrawn from digital asset funds last week, with outflows continuing for the ninth week in a row.

However, this is significantly less than the $88 million pulled out of funds the previous week after high-profile SEC lawsuits against Coinbase and Binance labeled multiple altcoins as securities.

Total withdrawals have reached $423 million over the past nine weeks.

CoinShares attributes the change to BlackRock’s Bitcoin ETP bid, despite last week’s minor inflows not offsetting earlier outflows.

“The end of the week saw minor inflows following the news that one of the world’s largest asset managers has applied for Bitcoin ETP in the U.S., although these inflows were not enough to offset outflows seen earlier in the week,” CoinShares Head of Research James Butterfill wrote in the report.

Digital asset funds saw most of last week’s outflows from products tracking the price of Ethereum, which lost $5 million.

On the other hand, Grayscale is responsible for over 85% of weekly inflow after its flagship fund Grayscale Bitcoin Trust (GBTC) saw a renewed wave of interest amid BlackRock’s application for a spot bitcoin ETF.

GBTC jumped more than 12% before markets closed on Friday, with share prices reaching $15.12, according to data from Yahoo Finance.

Investors also bought the dip on altcoins like XRP, Cardano, and Polygon, acquiring $1.1 million, $0.6 million, and $0.2 million worth of each altcoin, respectively.

The price of XRP has increased by 4.7% over the past month following the release of the Hinman documents, which shed light on a former SEC director’s speech.

However, Cardano and Polygon have fallen around 17% and 31% over the past month, respectively, as they were categorized as securities in the SEC lawsuits.

Regulatory Pressure And Rate Hikes Scare Away Investors

The crypto industry has been under regulatory pressure over the past few weeks, and hawkish statements from the Federal Reserve hinting at more rate hikes have made investors cautious, Butterfill said in an earlier report.

Earlier this month, the SEC sued both Binance, the world’s largest cryptocurrency exchange, and Coinbase, the largest US-based cryptocurrency exchange.

The commission filed 13 charges against Binance and its US affiliates, ranging from allegedly operating as an unregistered exchange to offering unregistered securities.

The regulator also levied similar charges against Coinbase, claiming it operated as an exchange, broker, or clearing agency without the required registrations.

In each case, the SEC noted that several tokens listed by the exchanges are unregistered securities, including dozens of popular cryptocurrencies.

Likewise, the Federal Reserve has projected that another two quarter percentage point rate hikes are on the way before the end of the year after the central bank decided to leave interest rates unchanged last week.

After raising interest rates ten times in a row, the Fed kept interest rates unchanged in the range of 5% to 5.25%. Powell confirmed on Wednesday that there are at least two more 25 basis point hikes this year. The market expects only one rate hike in July#xauusd #gold #fx #fed pic.twitter.com/ZUULC4s0pI

— Erin (@Erin_FXgold) June 19, 2023

The Fed’s hawkish sentiment is usually bad for cryptocurrencies because they are seen as a high-risk, high-reward investment. As the Fed raises interest rates, it makes traditional assets more attractive and puts pressure on digital assets.

Still, US investors deposited $3.7 million worth of funds last week, followed by Germany with $2.7 million.

Investors in Sweden and Switzerland withdrew $3.3 million and $5.8 million from digital asset funds, respectively.

Meanwhile, despite positive regulatory changes for crypto in Hong Kong, there haven’t been significant inflows in the region so far this year.

What is the Difference Between BlackRock’s Spot Bitcoin ETF and GBTC?

Last week, BlackRock filed an application with the SEC to launch the iShares Bitcoin Trust, a spot bitcoin fund intended to allow investors to get direct exposure to the flagship cryptocurrency in a secure way.

While some may believe that the two products are similar, the reality is that they have certain differences that set them apart.

For example, BlackRock’s iShares product is technically a trust but allows for redemptions similar to an ETF, whereas the GBTC does not, according to Noelle Acheson, editor of Crypto is Macro Now.

“The market hears ‘trust’ and thinks it will be like GBTC with no redemptions, but that’s not the case here,” he added.

The key difference between a bitcoin ETF and a trust lies in the ability to buy bitcoin at the end of the trading day to bring the fund’s assets in line with its trading price, which only an ETF can do.

The primary disparity between a Bitcoin ETF and a trust lies in their ability to adjust holdings.

An ETF can purchase Bitcoin at the end of the trading day to match the value of its trading price, a feature not possible with a trust. As a fixed portfolio, a trust often trades at a premium or discount to its underlying assets’ value since there is no capability to adjust its holdings.

GBTC, for instance, has been trading at roughly a 40% discount to net asset value, causing Grayscale to seek the SEC’s approval for a Bitcoin ETF.

Read More:

- Best Crypto to Trade Right Now in June 2023

- 17 New Cryptocurrencies to Invest In June 2023

- 15+ Best Crypto Under $1 for 2023 – Micro Caps Reviewed

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops

AiDoge (AI) - Meme Generation Platform

- Create & Share AI-Generated Memes

- Newest Meme Coin in the AI Crypto Sector

- Listed on MEXC, Uniswap

- Token-Based Credit System

- Stake $AI Tokens to Earn Daily Rewards