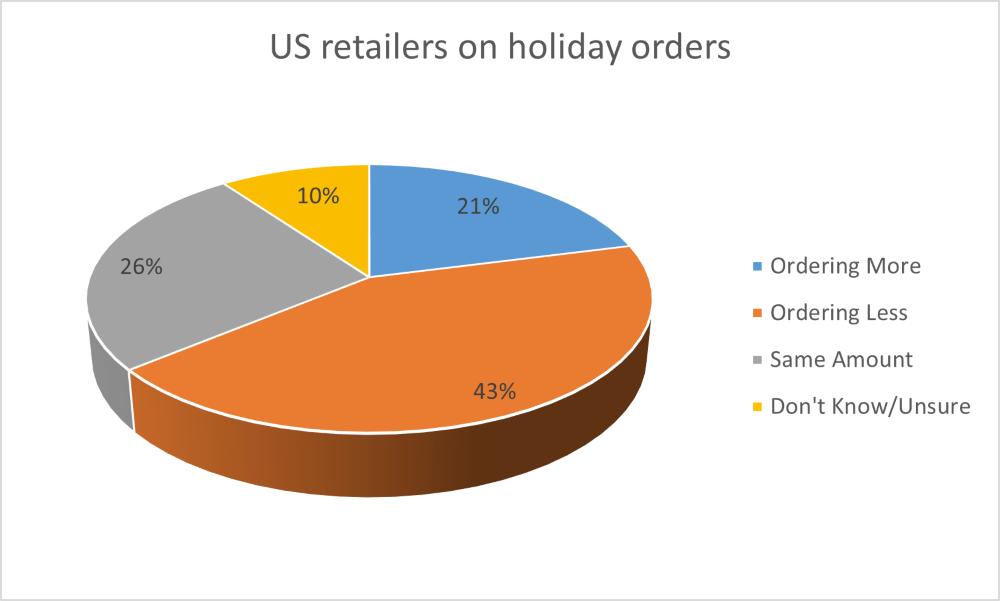

CNBC Supply Chain Survey shows that most US retailers foresee a weak holiday season this year despite the fall in inflation. Here are the key takeaways from the survey which was conducted among 147 respondents between May 24-June 11.

The National Retail Federation, American Footwear and Apparel Association, United National Consumer Suppliers, and Council of Supply Chain Management Professionals were among the respondents in the survey.

The survey showed that 43% of respondents are ordering less inventory for this year’s peak shopping season as compared to the last year. Only 21% of retailers are ordering higher while 26% are ordering the same amount. The remaining 10% were not sure about their plans.

Among those who are ordering less this year, 16% are ordering between 1%-5% lower as compared to the last year. The remaining are equally split between 6%-10% lower, 11%-15% lower, and over 15% lower.

Among those who are ordering more, 16% expect to order between 1%-5% higher as compared to the last year while 42% expect orders to rise between 6%-10%. 16% of respondents expect their orders to rise between 11%-15% while the remaining 26% say their orders would rise 16% as compared to the last year.

Some pockets might see a bigger contraction as compared to the industry average and Stephen Lamar, President, and CEO, of the American Apparel & Footwear Association said, “Cleary, inventory and inflation concerns remain top of mind for apparel and footwear executives as we enter peak shipping season.”

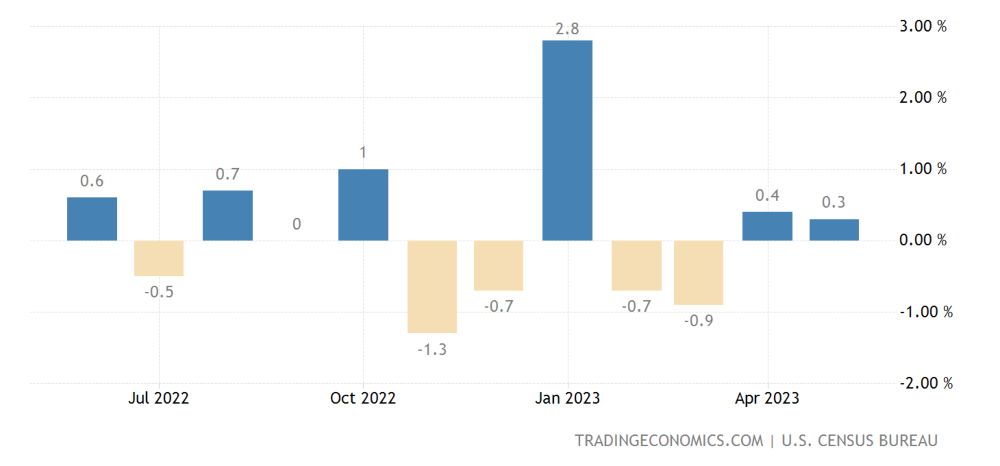

Notably, US retail sales rose 0.3% in May which was better than the 0.1% decline that analysts were expecting. Despite recession fears and a 500 basis point rate hike by the Fed, US retail spending has held off relatively well.

US Inflation Has Dropped to 4%

US annualized inflation fell to 4% in May. While it is still high by historical standards and twice the 2% that the Fed targets – it has fallen gradually after peaking at 9.1% last June.

While high inflation is invariably a negative for stocks – especially the growth names – some investment strategies can outperform in high inflation.

US Inflation Rate (CPI), YoY % Change

Jun 2022: 9.1%

Jul 2022: 8.5%

Aug 2022: 8.3%

Sep 2022: 8.2%

Oct 2022: 7.7%

Nov 2022: 7.1%

Dec 2022: 6.5%

Jan 2023: 6.4%

Feb 2023: 6.0%

Mar 2023: 5.0%

Apr 2023: 4.9%

May 2023: 4.0%

Jun 2023 (Cleveland Fed Forecast): 3.2%— Charlie Bilello (@charliebilello) June 16, 2023

Amid high inflation, US consumers have been downtrading in terms of both quality and quantity.

Notably, 71% of respondents believe that consumers would cut down on holiday spending due to high inflation. 22% of respondents replied in the negative while the remaining 7% were not sure.

In several baskets especially apparel, retail companies have been resorting to heavy discounting to clear their inventory.

Most Retailers Expect Heavy Discounting This Holiday Season

Retailers expect heavy discounting this holiday season as well and two-thirds of the respondents in the CNBC survey said that they expect consumers to look for discounts this year. 13% expect strong consumers while 19% were unsure.

Only 1% said that they expect consumers to “trade up” and buy more expensive products.

Notably, last year also there was heavy discounting and Amazon also did two Prime Day sales instead of one.

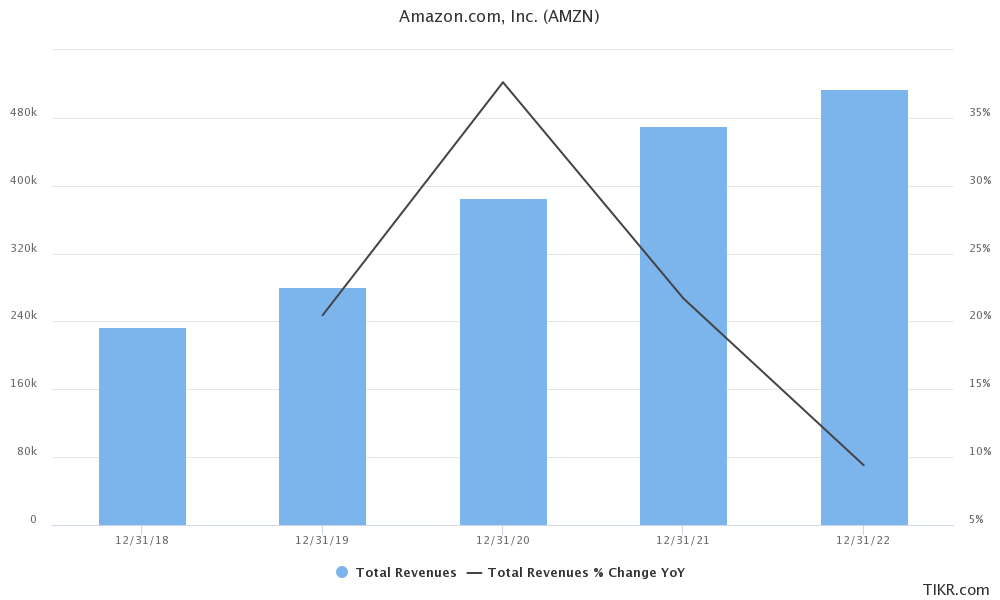

Despite the two Prime Days, Amazon’s North American sales increased only 13% YoY to $315.9 billion. The company’s consolidated sales only increased by around 9% – which is the lowest ever.

Amazon stock has underperformed tech peers over the last two years as it was almost flat in 2021 even as the S&P 500 soared almost 27%.

The stock has gained traction in 2023 and is up 48% so far – outperforming the S&P 500 as well as the tech-heavy Nasdaq. Mizuho has a buy rating on Amazon and last month listed the stock as a top pick for the second half of 2023.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops