Bitcoin bears are in control in wake of a “hawkish pause” from the US Federal Reserve on Wednesday.

The Fed left interest rates unchanged at 5.0-5.25% as expected, but the BTC price was still last trading down about 2.5% on the day, having recently broken below key support in the mid-$25,000s.

While the Fed opted not to hike interest rates for an 11th consecutive time on Wednesday, analysts framed the policy announcement as hawkish.

The updated dot-plot summarising Fed policymaker expectations as to where interest rates will be in the years ahead showed that interest rates are expected to rise to 5.6% by the end of the year.

That was a big jump from the last dot-plot, where the median expectation of Fed policymakers was for interest rates to end 2023 at 5.1%.

Fed Tightening Bets Jump

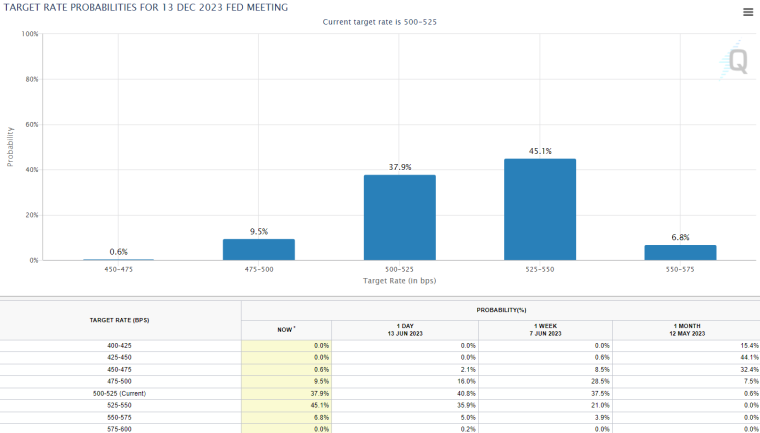

Markets responded by reducing bets on rate cuts from current levels by the year’s end and upped bets that interest rates end the year at higher than current levels.

For example, as per the CME’s Fed Watch Tool, the perceived likelihood that interest rates end the year at 5.25-5.5% was last at 45%, up from closer to 36% one day ago.

That put short-term government debt under pressure, with the 2-year yield briefly touching 4.8%, its highest since mid-March.

The DXY, meanwhile, rallied from session lows.

Bitcoin, meanwhile, came under pressure given its negative correlation to both the dollar and US yields.

A stronger dollar means USD-denominated bitcoin becomes more expensive for foreign buyers.

Higher yields, meanwhile, increase the opportunity cost of holding non-yielding assets like bitcoin.

Bitcoin on Verge of Breaking Below This Key Support Zone

Bitcoin now faces a precarious moment.

Prices just dipped below key long-term support in the $25,200-400 area and is also probing for a breakout below an uptrend that has been in play going all the way back to the end of 2022.

For a breakout to be confirmed, a daily close under these levels will be needed.

If this occurs, technicians fear that bitcoin’s next stop could be the 200-Day Moving Average at $23,688.

Below that, the next major support zone is the March low around $19,600.

Bitcoin’s drop comes as a widely followed weekly Moving Average Convergence Divergence (MACD) indicator recently sent a rare signal.

Related Articles

- Bitcoin (BTC) Price Prediction 2023 – 2040

- 18 Best Meme Coins to Buy in June 2023

- 10+ Best Crypto To Buy Now 2023

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards