The global consulting firm Accenture plans to invest $3 billion over the next three years to expand its artificial intelligence capabilities. The investment aims to help both Accenture and its clients capitalize on AI to drive growth and efficiency.

The bulk of the investment will go towards expanding Accenture’s Data & AI practice. The firm intends to double its AI workforce to 80,000 employees through hiring, acquisitions, and training. It will develop new industry-specific AI solutions, platforms, and pre-built models for companies across 19 industries.

Accenture´s CEO Julie Sweet said that this substantial investment will enable the company to help its clients move from simply being interested in AI to actually implementing and gaining value from the technology “in a responsible way with clear business cases.”

The plan includes launching the AI Navigator for Enterprise platform and the Center for Advanced AI. The AI Navigator will guide clients in developing AI strategies and responsible use of AI. The Center for Advanced AI will focus on maximizing the value of generative and emerging AI technologies.

Paul Daugherty, group chief executive of Accenture Technology, said that 40% of work hours will be transformed by generative AI over the next decade. “Our expanded Data & AI practice combines our expertise to create industry solutions that will help clients harness AI’s full potential,” he said.

Also read: Best AI Crypto Tokens & Projects to Invest in 2023

Accenture Uses AI to Build Their Customers’ “Digital Core”

With a presence in over 120 countries and more than 700,000 employees worldwide, Accenture is arguably the largest consulting firm in the world and its footprint is visible in many industries and economies.

One of Accenture’s main business strategies as explained in its annual report is to help its customers build their “digital core”, which implies a transition toward a cloud environment, the adoption of artificial intelligence, and advanced data analytics.

Also read: 30+ OpenAI Statistics for 2023 – Data on Growth, Revenue & Users

The company also cites AI among its “five key forces of change” along with other groundbreaking technologies. Accenture believes that the adoption of AI will create “new ways of working and engaging with customers, employees, and partners, and new business models, products, and services”.

During the first semester of the 2023 fiscal year, Accenture brought in total revenues of $31.6 billion resulting in a 5% increase in USD terms. North America continues to be the most important region for the business in terms of revenue, followed by Europe.

Meanwhile, the products industry is by far the most profitable segment for Accenture followed by financial services, healthcare, and communications & media.

Tech Companies and VCs are Dumping Billions into AI as Well

Multiple large tech companies have been investing in AI either directly or via the acquisition of startups. Just yesterday, Salesforce Ventures, the investment arm of the popular CRM software developer, announced that it will be doubling the size of its AI fund to $500 million.

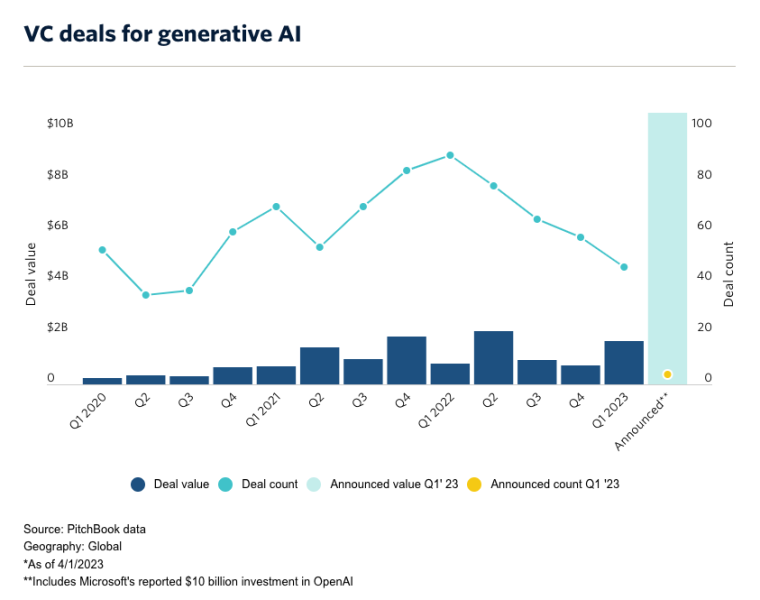

Meanwhile, Microsoft (MSFT) invested over $10 billion into OpenAI – the developers of the popular generative AI tech ChatGPT – while Google has amassed a stake in one of the most prominent competitors of the latter – Anthropic.

Amazon is not wasting any time either as it recently launched a generative AI service called Bedrock, which can be operated and deployed within its Amazon Web Services (AWS) cloud environment.

During the first quarter of 2023 alone, startups in the AI industry reportedly raised over $1.7 billion from a total of 46 different deals according to a report from Pitchbook. This is more than twice what these same companies raised from venture capitalists during the same period a year ago.

According to Lu Zhang, founder and managing partner for the Fusion Fund, the AI industry is not yet crowded but it is “getting more competitive” by the day.

In a complex macroeconomic environment, AI is a bright light in what is an overall shadowy sky and tech-savvy entrepreneurs could take advantage of the hype to raise capital despite not necessarily having a sound prototype or a go-to-market strategy.