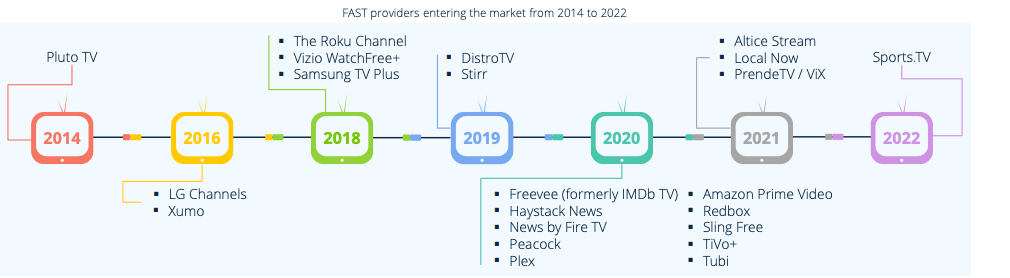

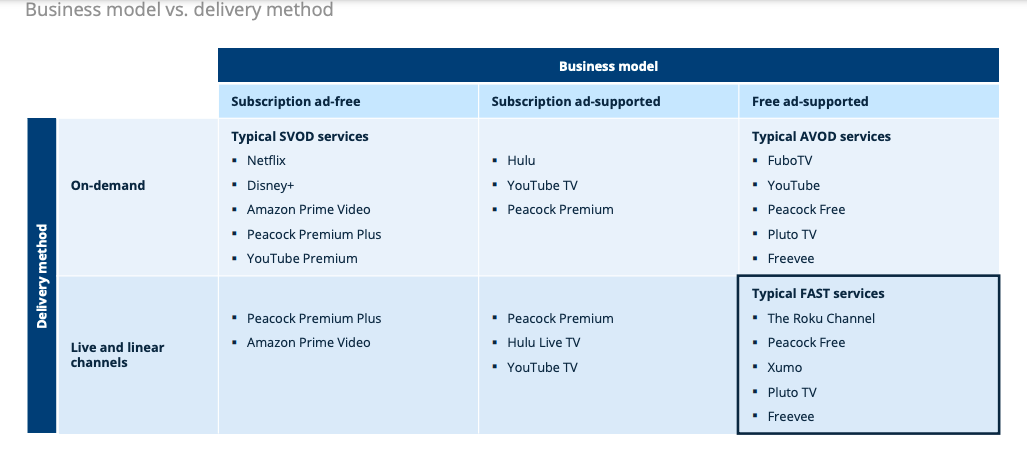

The streaming wars are heating up, with more and more companies entering the fray. In recent years, the rise of free ad-supported streaming platforms (FASTs) has been witnessed. These platforms offer a wide variety of content, including movies, TV shows, and live news, all for free.

Fast Penetration Growth and Popular Platforms

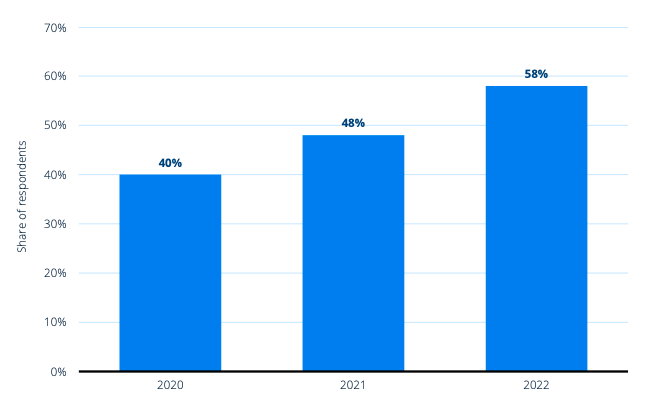

The year-on-year growth of FAST penetration has increased by nearly 10 percentage points. In today’s highly competitive streaming landscape, there is a strong and consistent demand for ad-supported content.

As of April 2022, the penetration rate of FAST services in the United States reached almost 60 percent, marking a significant increase of around 20 percentage points compared to the share of FAST viewers recorded two years prior.

Share of FAST platform viewers in the U.S. from 2020 to 2022

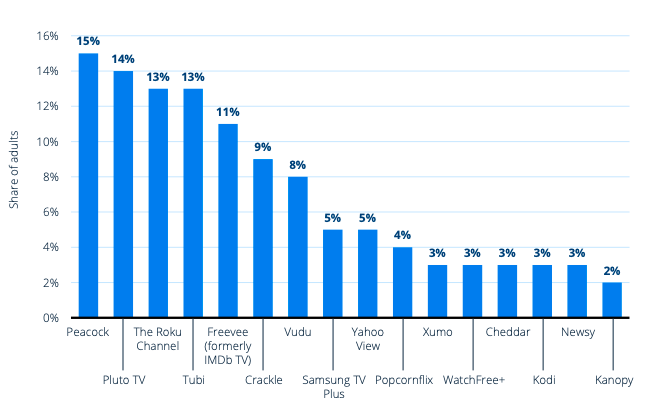

Based on a survey of U.S. adults conducted in 2021, the most popular free streaming services were provided by prominent media and tech players. The top five platforms were Peacock (NBCUniversal), Pluto TV (Paramount Global), The Roku Channel (Roku), Tubi (Fox Corporation), and Freevee (Amazon).

Share of adults who use free video streaming services in the U.S. in 2021, by platform

Insider Intelligence asserts that, although the number of viewers on these platforms is significant, it does not provide an accurate representation of the time spent by viewers on the platforms.

According to the media’s analyst Ross Benes, who recently shared insights on “Behind the Numbers: The Daily” podcast, these platforms attract a large number of viewers, but their viewing durations are relatively short. He said:

“They are maybe watching a movie or TV show here and there. I doubt there’s a lot of people spending four hours a day with [these services], so you can’t compare them to Apple TV or Paramount.”

Growth and Revenue Projections for the Free Ad-Supported Streaming TV (FAST) Market

The Free ad-supported streaming TV (FAST) market is anticipated to generate a revenue of US$7.20 billion in 2023, with a projected annual growth rate (CAGR 2023-2027) of 13.22%. This growth trajectory is expected to result in a market volume of US$11.83 billion by 2027.

When compared globally, the United States is expected to generate the highest revenue, reaching US$6,158.00 million in 2023. Looking at user numbers, it is expected that the market will have approximately 1.10 billion users by 2027. In 2023, the user penetration rate is estimated to be 11.8%, and it is predicted to increase to 13.8% by 2027.

Factors Driving the Growth of the Free Ad-Supported Streaming TV Market?

According to Statista, the growth of the free ad-supported streaming TV market is influenced by several significant factors. Firstly, the increasing prevalence of connected devices such as smart TVs, streaming boxes, and mobile devices has made it more convenient for viewers to access free streaming content.

Moreover, the availability of high-quality content produced by established networks and studios has made free streaming services more attractive to audiences.

Additionally, advancements in ad targeting and personalization have facilitated advertisers in reaching specific target audiences, leading to increased investments in the free ad-supported streaming TV market.

Lastly, the ongoing trend of “cord-cutting,” where individuals cancel traditional cable TV subscriptions, is expected to persist and contribute to the growth of the free ad-supported streaming TV market.

Based on projections, the free ad-supported streaming TV market is anticipated to continue its upward trajectory and achieve a compound annual growth rate (CAGR) of 9.10% until 2027.

Are FASTs Poised to Overthrow Paid Streaming Sites

It is currently too soon to conclude if FASTs are ready to surpass paid streaming platforms, but there are a few factors that could give them an edge.

First, the free nature of FASTs is a significant appeal, particularly for budget-conscious consumers. This is a big draw for many consumers, especially those who are on a tight budget.

Second, FASTs have a wide variety of content. In addition to movies and TV shows, many FASTs also offer live news, sports, and other programming, making them more attractive option for consumers who are looking for a one-stop shop for all of their entertainment needs.

Third, FASTs are easy to use, as most of them can be accessed through a variety of devices, including smartphones, tablets, and smart TVs. This makes them convenient for consumers who want to watch their favorite shows on the go.

However, FASTs face challenges, including reliance on advertising revenue resulting in disruptive ads for viewers, as well as lower production values compared to paid streaming services, which may discourage some viewers.

Overall, it’s too early to say for sure whether FASTs will overthrow paid streaming sites. However, they have a number of factors in their favor. It will be interesting to see how the streaming wars play out in the years to come.

Related Articles

- NIO Too Joins the EV Price War Amid Falling Vehicle Sales

- Reddit’s Early Success Was Built on Lies and Thousands of Fake Profiles

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops