Chinese electric vehicle (EV) company NIO has lowered car prices and has joined the price war in the industry after having previously denied that it would join the price war.

NIO has lowered the prices for its cars by $4,200 with immediate effect and has ended free battery swaps for new car buyers.

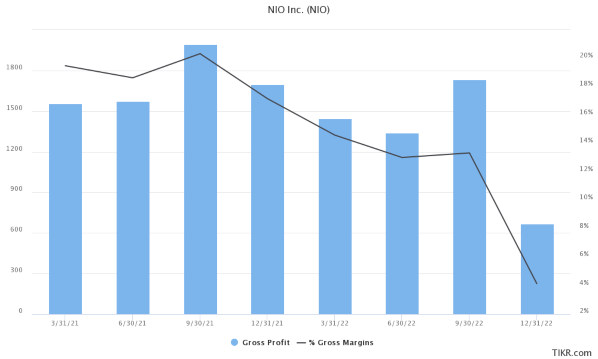

Notably, the development comes a couple of days after it released its Q1 2023 earnings where it reported a steep fall in its gross margins.

Its gross margin was a mere 1.5% in the quarter – down from 14.6% in Q1 2022 and 3.9% in Q4 2022. The company’s gross margin has fallen drastically over the last year amid rising input costs.

Other startup EV companies are also struggling with margins and Rivian expects to post positive gross margins only by the next year.

Tesla’s operating margins also fell to 11.4% in Q1 2023 as compared to 19.2% in the corresponding quarter last year after it lowered car prices multiple times in Q1 2023 and triggered an industry-wide price war with its action.

Notably, in April, NIO categorically denied that it would join the price war and in an interview its CEO William Li said “For us, we will certainly not join the price war.”

NIO said that it believes that the price for its vehicles is commensurate with the product and service proposition.

Li added, “There are many new products coming to market, which of course means fiercer competition for us. But for users, they have a more abundant selection.”

He said that NIO would instead add more battery swapping and charging stations to improve customer service.

NIO Joins the EV Price War Amid Falling Sales

Meanwhile, amid sagging sales, NIO seems to have changed its mind and has lowered car prices.

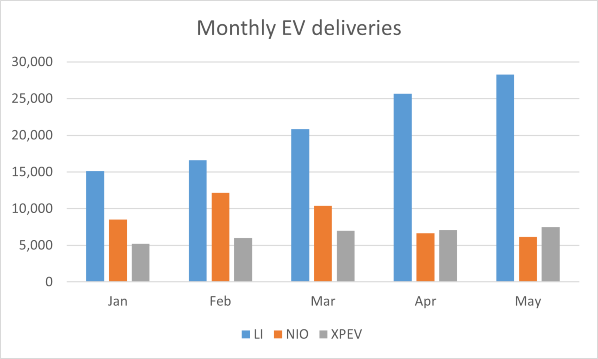

NIO predicted deliveries between 23,000 and 25,000 in the second quarter of 2023. It delivered 6,658 and 6,155 cars respectively in April and May and its guidance implies a YoY fall of between 8.2% to 0.2% in the second quarter.

Rival Xpeng Motors’ deliveries were below 10,000 in all the months this year but it expects the monthly average to rise to 20,000 in the fourth quarter.

For the last many months, Li Auto’s deliveries have consistently surpassed NIO and Xpeng Motors.

Li Auto delivered 28,277 vehicles in May which was 146% higher than the corresponding month last year.

It was the third consecutive month when Li Auto’s deliveries have surpassed 20,000 and its monthly sales in May were more than RMB10 million for the first time ever -which it said would help it reach the target of RMB100 billion in 2023.

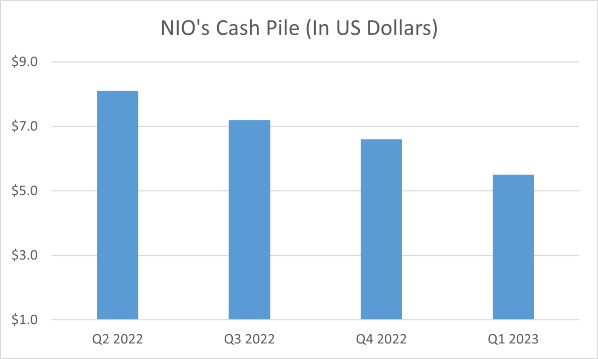

EV Companies Are Burning a Lot of Cash

Startup EV companies are burning a lot of cash and NIO is no exception. At the end of 2022, NIO held $6.6 billion in cash, cash equivalents, restricted cash, and time deposits. The balance however fell to $5.5 billion at the end of March.

During its earnings call last week, NIO said that it is cutting back on capex and some R&D projects.

Other EV startups are also battling with perennial cash burn. Rivian for instance reported a cash burn of $6.8 billion last year. Earlier this year, it raised $1.3 billion through a convertible note to boost its balance sheet.

Lucid Motors has also raised $4.5 billion through two rounds of stock sale over the last eight months. Nikola is also looking to raise more cash by selling shares but that proposal failed to get the requisite votes from shareholders prompting the company to reconvene the shareholder meeting next month.

Mizuho Maintained Its Buy Rating on NIO Stock

NIO stock has lost around a fifth of its value this year and is underperforming the markets. Tesla incidentally has more than doubled this year.

Tesla stock slumped to multi-month lows on the first trading day of 2023 but has since rebounded amid a buying spree from retail investors.

The more tesla falls the more Cathy wood buys 🤯 #TSLA pic.twitter.com/lJigxWGxuZ

— strengthPlan (@strengthPlan) January 4, 2023

Cathie Wood of ARK Invest also bought more Tesla shares this year.

Mizuho meanwhile reiterated NIO stock as a buy after the price cut announcement even as it lowered its target price by $5 to $20.

“Despite short-term headwinds, we believe NIO remains well-positioned with multiple upcoming ramps including its lowest cost SUV ES6, a multi-year EV adoption tailwind and market leadership in premium EVs in China, the largest EV market, EU/Global expansion, and an expanding product portfolio,” said Mizuho analysts in their note.

Related stock news and analysis

- 10 Most Eco-Friendly Crypto Coins 2023

- GM Too Joins Tesla Charging Network: Would Other Automakers Follow?

- Microsoft Moves Some AI Experts from China to Canada: Is It ‘Vancouver Plan’?

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops