In the volatile cryptocurrency domain, stability is often an elusive concept. Currently, Ethereum (ETH), the second-largest cryptocurrency globally, finds itself amidst an intensifying controversy revolving around regulatory clarity as the U.S. Securities and Exchange Commission (SEC) flexes its enforcement muscles.

The SEC recently embarked on a series of lawsuits against two titans in the crypto exchange realm, Coinbase and Binance, accusing them of offering assets deemed as securities without the mandatory registration.

High-profile cryptocurrencies like Solana (SOL), Cardano (ADA), Binance Coin (BNB), and Polygon (MATIC) have found themselves ensnared in this ongoing legal spectacle, casting shadows of uncertainty over Ethereum’s future market performance.

Twitter’s founder and Bitcoin proponent, Jack Dorsey, further stoked the flames of this dispute when he made the audacious claim that Ethereum should be classified as a security.

clowns. pic.twitter.com/S8AiJwuMem

— Udi Wertheimer (@udiWertheimer) June 6, 2023

Dorsey’s tweet ignited a heated debate on social media, casting a tangible effect on Ethereum’s market value.

Impact of SEC Actions and Rising Jobless Claims on Ethereum’s Price

Dorsey’s assertion, irrespective of whether it gains regulatory endorsement, has contributed to a climate of uncertainty that often causes investors to retreat from affected assets.

Furthermore, Ethereum’s value isn’t just being challenged by cryptocurrency-specific turbulence. Broader economic elements have also exerted their influence.

The U.S Labor Department recently reported a significant uptick in jobless claims, indicating a potential deceleration in labor market dynamics.

With the release revealing a higher than anticipated 261,000 new applications for unemployment benefits, therefore exceeding economists’ forecast of 235,000.

This spike has instilled fears of a looming recession and exerted additional downward pressure on Ethereum’s price.

Reflecting on the recent U.S. Initial Jobless Claims, Ryan Brandham, Head of Global Capital Markets, North America at Validus Risk Management explained the data could reveal larger fundamental cracks emerging in the US economy.

“The figures we’ve seen today, reaching 261k, mark the highest print in over a year,” commented Brandham.

“Even though it’s a single data point, it could signal a potential weakening in a labor market that has remained quite resilient to interest rate hikes thus far.

“For today’s session, the USD is marginally bearish, and overall, this may diminish the likelihood of a rate hike in the June FOMC meeting.”

Ethereum (ETH) Price Analysis: Heading South?

In light of the legal headwinds tearing through the industry, Ethereum is currently trading at $1,844 (+0.66%) as topside resistance seems to be forming an unbreakable ceiling of resistance on the short time frame (STF).

The recent downtick, triggered in part by Jack Dorsey’s comments, has seen Ethereum price slip back below the MA20 for the first time in two weeks.

Price now seems descendant, with more than a month of ranging behaviour risking a decisive move to the downside.

The loss of MA20 support is a big blow to Ethereum bulls, with weeks of tough fought consolidation giving way to fundamental pressures.

Worse still, unlike many other leading cryptocurrencies such as ADA, the downtick has done little to cool-off Ethereum’s RSI oscillator.

On the fence at 48.81 – the RSI offers few clues for price action on the STF.

The MACD offers more clues, showcasing bearish divergence to -1.63, adding to the bearish case for STF movements.

Ethereum On-Chain Analysis: Huge Accumulation Underway?

With Ethereum technical analysis offering few clues on likely price direction, turning to Ethereum on-chain analysis can offer insight into the supply dynamics underpinning price action.

Beginning with a glance at Net Transfer Volume, which provides insights into the day-to-day influx of Ethereum to and from exchanges, an image of deep accumulation emerges.

Sparked largely by fears that the SEC lawsuits will end access for US investors to major exchange platforms, huge outflows of Ethereum from exchange wallets are taking place.

Indeed, since Monday 1,447,896 ETH (worth $2.6bn) has flooded into cold-storage as investors race to take self-custody.

These shocking outflows could induce a serious supply shock, potentially revealing an emerging bullish case.

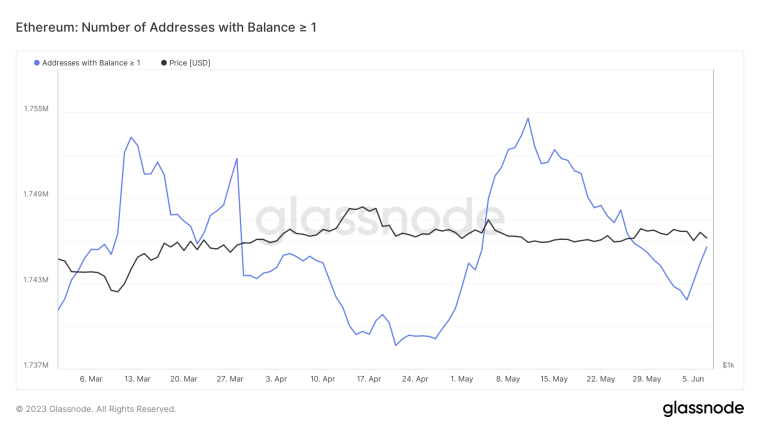

Further evidence for this can be found in the number of wallet addresses containing >1 ETH, which has witnessed a 0.21% increase in addresses over the past week – a minor increase – suggesting the majority of this outflow pressure on exchanges comes from active holders.

So while ostensibly there is a view of a huge emerging accumulation window, it is important to understand these outflows haven’t come from new market entrants – and likely have been fuelled by active crypto users holding their Ethereum in hot wallets.

Ethereum Open Interest Analysis: Traders Remain Optimistic

With so much fundamental carnage in the space, looking at the sentiment of traders can help inform the STF Ethereum price prediction.

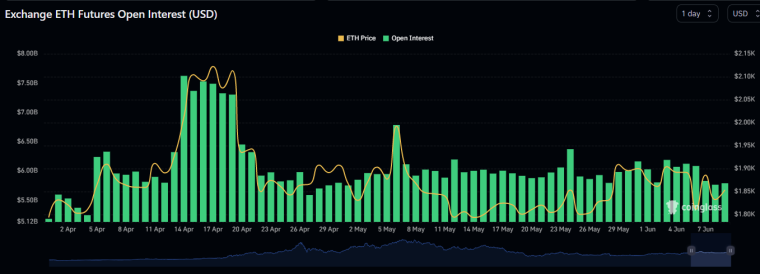

Across all exchanges, open interests appear to be in decline, with traders reluctant to bet big on such unusual market conditions.

This suggests a level of concern rather than an active sentiment, with open interest sat at the lowest level since mid-April.

Curiously much of this interest remains with Binance, suggesting continued faith in the firm.

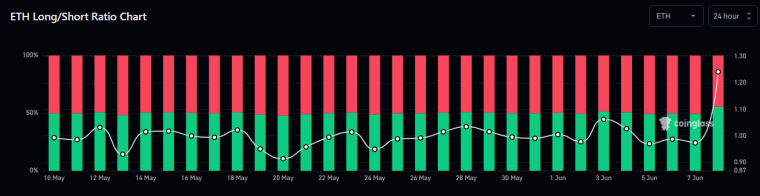

As for Ethereum’s long short ratio, which provides insight into the underlying contracts of open interest across exchanges, sentiment appears surprising bullish

With the ratio currently sat at 1.24, it appears 55.39% of open derivates contracts are longs from here – suggesting a majority of market participants believe that Ethereum price will surge despite the legal headwinds.

This could be due to the fact that Ethereum has so far gone unnamed in the SEC crusade, highlighting its potential as a regulator-proof asset.

Ethereum Price Prediction: Reward Structure Sours

With a perfect storm of headwinds rapidly arriving in Ethereum markets, many feel it is only a matter of time until Ethereum is named in the SEC’s cases.

Against a background of a softening US labor market, Ethereum faces an STF upside target at $1,900 (+2.82%) reclaiming poised position above the MA20.

Downside risk is more significant with a return to $1,750 (-5.3%) firmly on the cards if negative sentiment continues to grow.

This leaves Ethereum facing a risk: reward ratio of 0.53 – a troubling STF price prediction.

Stay tuned with Business2Community for the latest cryptocurrency price predictions.

RELATED:

- Expert Analysis: Is it Too Late to Buy Ethereum?

- Bitcoin Price Prediction: Remarkably Bullish Market Sentiment Suggests a Rally Is Coming

- GameStop Unexpectedly Fires its CEO Matthew Furlong

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens