This indicates a temporary dominance by sellers. After a significant drop of over 5 percent, Bitcoin swiftly recovered and trades sideways at approximately $26,700.

Recent actions by the US Securities and Exchange Commission (SEC) against major crypto exchanges Binance and Coinbase have introduced uncertainty in the cryptocurrency market, directly impacting Bitcoin (BTC) prices.

Bullish Outlook for Bitcoin in Summer Despite Lawsuits and Uncertainty

Even with lawsuits and regulatory issues, Bitcoin is likely to see a strong summer as big investors have begun to buy during the market downturn. This optimistic view is backed by upcoming economic reports like the Consumer Price Index (CPI), Producer Price Index (PPI), and the US Federal Reserve Interest Rate Decision.

US Inflation (CPI), YoY % Change

Jun 2022: 9.1%

Jul 2022: 8.5%

Aug 2022: 8.3%

Sep 2022: 8.2%

Oct 2022: 7.7%

Nov 2022: 7.1%

Dec 2022: 6.5%

Jan 2023: 6.4%

Feb 2023: 6.0%

Mar 2023: 5.0%

Apr 2023: 4.9%

May 2023 (Cleveland Fed Forecast): 4.1%

Jun 2023 (Cleveland Fed Forecast): 3.3% pic.twitter.com/S4lvwTwktu— Charlie Bilello (@charliebilello) June 7, 2023

Analysts, including Credible Crypto, suggest that reclaiming the $27.5k level could pave the way for new all-time highs for Bitcoin. However, the recent developments involving Binance and the SEC have caused panic in the global crypto market, leading to a decline in prices for Bitcoin, Ethereum, and other popular altcoins.

Positive Crypto Derivatives Market Signals Bullish Impact on BTC Price

Investors in the crypto derivatives market are expressing optimism as a trend indicator points to a positive upward movement for Bitcoin and Ether.

Traders with long-term interests in these cryptocurrencies are willing to pay fees to those looking to short-sell them, which is a promising sign for the overall market outlook.

Despite the ongoing SEC lawsuits, funding rates have remained positive since May, indicating a favorable sentiment among market participants.

Additionally, the recent skeptical comments made by SEC Chair Gary Gensler regarding digital currency have had minimal impact on the prices of Bitcoin and Ether, which have shown relative stability. This news suggests the potential for a positive influence on BTC prices.

Bitcoin Price Prediction

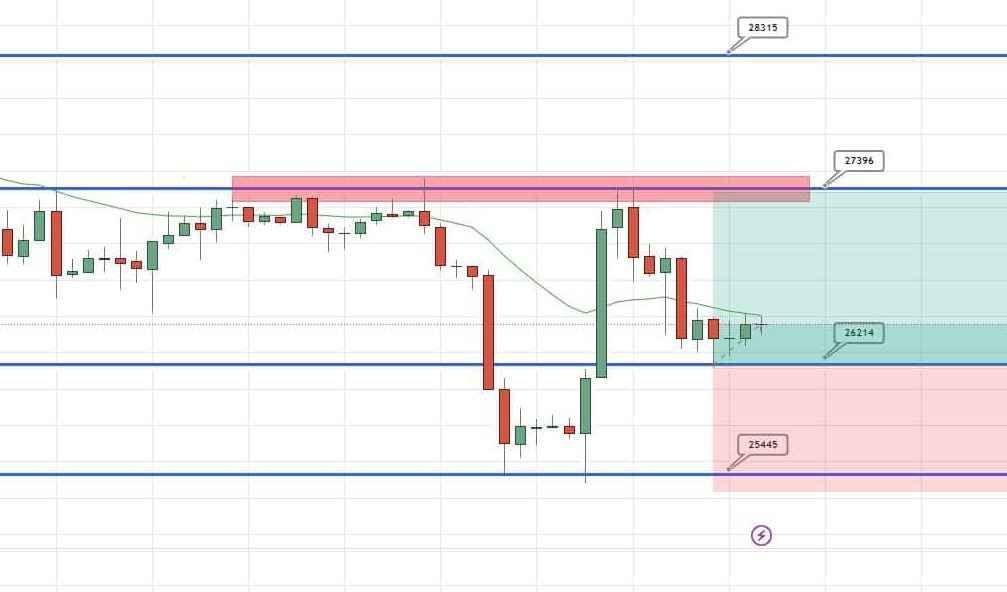

Bitcoin, the dominant cryptocurrency, has found support around $26,200, as indicated by the formation of doji and hammer candles on the hourly timeframe. This suggests a potential weakening of bearish sentiment and exhaustion among sellers.

The $26,200 level is a significant support level for Bitcoin. However, there is a divergence between the relative strength index (RSI) and the moving average convergence divergence (MACD) indicators. The RSI is currently in the oversold zone, while the MACD remains in the buy zone.

Additionally, the 50-day exponential moving average acts as resistance near $26,500, putting pressure on Bitcoin’s price. It is advisable to wait for a breakout from the current trading range before making any significant trading decisions.

If Bitcoin breaks below the $26,200 support level, it may continue its downward trend towards $25,400. Conversely, a confirmed breakout could create selling opportunities, potentially driving Bitcoin towards $24,750.

On the other hand, if Bitcoin manages to hold above the $26,200 support, it could target resistance levels at $26,000 and $27,400. Breaking through the $26,500 resistance level is crucial for further upward movement.

Related News:

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops