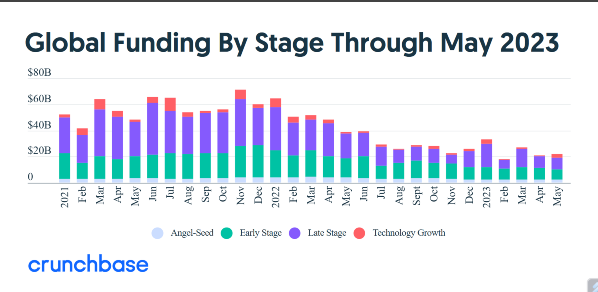

Global Venture Capital (VC) funding fell 44% YoY to $22 billion in May according to Crunchbase. Markets are now looking forward to AI startups for a revival in VC funding.

The funding slowdown impacted startups across the value chain including seed-stage, early-stage, and late-stage companies with the funding down between 41%-48%.

The results are somewhat divergent from Europe where early-stage companies did relatively well in the first half of the year.

According to VC firm Atomico, in the first half of 2023, the total funding for European startup companies that raised less than $15 million dipped 21.3% YoY to $8.2 billion – which is much better than the funding slump in late-stage companies.

Crunchbase noted that in April and May, monthly VC funding is averaging above $20 billion which is way below what we saw in 2021 and the first half of 2022.

It however noted that the current levels are in line with 2018-2020 levels – which were incidentally higher than the previous years.

Meanwhile, in a refreshing sign for the startup ecosystem, May recorded 10 unicorns which were twice of April and the first time since November that new unicorns reached double digits.

That said, the number of new unicorns in May was less than a third of what it was in the corresponding quarter month year.

VC Funding Falls in May Amid Risk-Off Environment

Meanwhile, the risk-off environment has taken a toll on VC funding in 2023. For instance, between Vision Fund 1 and 2, SoftBank invested only $0.4 billion in the March quarter – the third consecutive quarter when the quarterly investment was below $1 billion.

During the heydays of the tech boom, it was not unusual for SoftBank to invest over $1 billion in a single company only.

Andy Vermaut shares:Fashion Giant Shein Raises $2 Billion but Lowers Valuation by a Third: Online fashion giant Shein raised $2 billion in its latest fundraising round that values the company at $66 billion, about a third less than a year… Thank you! https://t.co/qUGfCDwjMR pic.twitter.com/0Ma6ypTTh3

— Andy Vermaut (@AndyVermaut) May 17, 2023

That said, some billion dollars plus deals are still happening and according to Crunchbase fashion retailer Shein was the biggest deal of May as the company raised $2 billion albeit at a valuation of $66 billion – which is two-thirds of the previous valuation of $100 billion.

Shein is the fourth largest private company with TikTok-parent ByteDance being the largest.

Can AI be the Saviour amid Falling Startup Funding?

AI has been a bright spot in an otherwise lukewarm VC market. Not only are listed AI stocks outperforming the broader markets with Global X Robotics and Artificial Intelligence ETF up almost 38% YTD – but the startup AI universe is also seeing relatively better interest from investors.

Crunchbase noted that eight of the 38 unicorns this year are AI companies. Builder.ai, CoreWeave, and Anthropic are among the AI companies that raised funds in May.

Builder.ai – an AI startup that helps those without any coding knowledge build applications – raised $250 million in its Series D funding led by Qatar Investment Authority (QIA). Microsoft also invested in the company last month.

Most tech companies are either investing in building their own AI capabilities or backing startup AI names.

Sensing the opportunity in generative AI, Roundhill Investments launched the Generative AI & Technology ETF (NYSE: CHAT) last month.

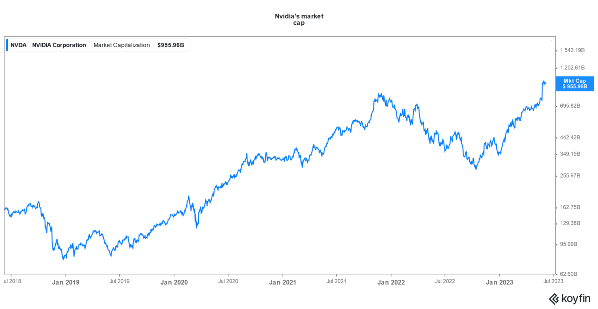

The AI euphoria was on full display last month as Nvidia’s market cap surpassed $1 trillion after sales of AI chips boosted its earnings.

VC markets are also looking forward to more AI deals to revive the market in an otherwise gloomy market for startups.

Related stock news and analysis

- How to Buy AiDoge Token – Easy Guide

- Gaming Startups Raise $1.1 Billion from VCs in Q1 2023

- Reddit Lays Off Employees Amid Profitability Push: Is an IPO Coming Next?

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops