The Bitcoin (BTC) price has experienced a rollercoaster in terms of price action in the last two days.

The price was sent tumbling from the upper $26,000s to the mid-$25,000s on Monday after the US Securities and Exchange Commission (SEC) announced it is suing Binance over acting as an unregistered securities exchange and over the mismanagement of customer funds.

Prices then saw a short-lived blip lower to sub-$25,500 levels early on Monday after the SEC announced that it is also going after Coinbase with similar charges, before charging higher during the US trading session.

BTC was last changing hands across major exchanges to the north of the $27,000 level, with analysts citing safe-haven demand (after all, the SEC refrained from labeling bitcoin as a security) and technical buying as bitcoin hit key support as supportive for the price.

New Long Leverage is Also Behind the Rebound

Notably, the sharp price rebound on Tuesday is not being driven by a squeeze on short positions (i.e. shorts being stopped out).

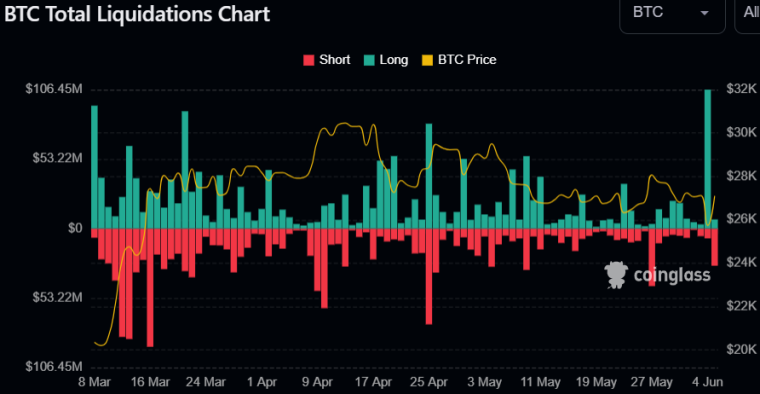

That is evident in data presented by coinglass.com, which shows that leveraged short Bitcoin futures positions worth only around $28.5 million were liquidated on Tuesday.

That stands in stark contrast to Monday’s sharp drop, which resulted in over $100 million in liquidated leveraged long Bitcoin futures positions.

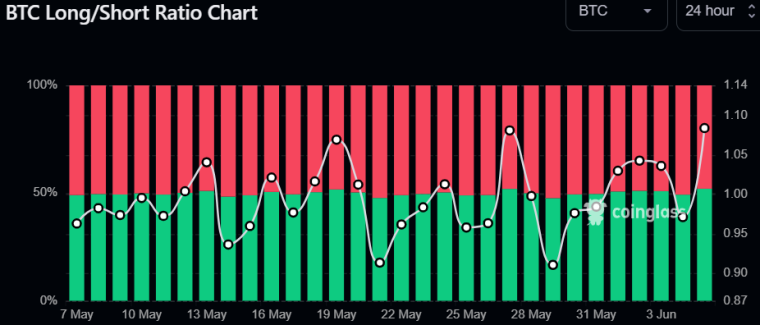

Meanwhile, coinglass.com’s BTC long/short ratio jumped sharply on Tuesday to at least a one-month high of 1.0842.

At the same time, CryptoQuant’s measure of leverage in the Bitcoin market rose to its highest since early March above 0.25.

They calculate this metric by dividing cryptocurrency exchange open interest in bitcoin positions by their bitcoin reserves, which gives an idea as to the leverage that exchange users are employing in their trading.

“Increasing in values indicates more investors are taking high leverage risk in the derivative trade,” CryptoQuant explains.

Taken together, coinglass.com’s long/short ratio and CryptoQuant’s so-called Estimated Leverage Ratio (ELR) suggest that the latest rebound in bitcoin has been driven, at least in part, by leverage-wielding dip-buyers.

Whilst the fact that the rebound hasn’t been driven by a short squeeze is good news, as it implies the rebound is being driven by organic demand, the fact that this new demand is employing a lot of leverage is a concern.

That’s because a rise in leveraged long positions in the bitcoin market raises the risk of a long squeeze, which could trigger, or worsen any future near-term price drops.

Where Next for the BTC Price?

Options markets suggest that, despite the turnaround in the price action on Tuesday, investors continue to demand a premium for protection against further short-term price drops.

That’s evident in the 5% delta skew of options expiring in 7 days falling to multi-month lows.

That is consistent with the fact that, as per chart analysis, bitcoin remains very much locked within a downwards trend channel that has been in play since yearly highs were hit above $31,000 in April.

BTC will need to muster a clean break to the north of its 21, 100 and 50-Day Moving Averages and the downtrend from the yearly highs before any discussions of a near-term retest of yearly highs in the $31,000s can be entertained.

For now, price risks remain towards rallies being sold and bitcoin retesting recent lows in the mid-$25,000s.

Related Articles

- Bitcoin (BTC) Price Prediction 2023 – 2040

- How to Buy Bitcoin in 2023 – Safely & With Low Fees

- 10+ Best Crypto To Buy Now

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards