Li Auto (NYSE: LI) delivered 28,277 vehicles in May which was 146% higher than the corresponding period last year. Could the company challenge the dominance of BYD and Tesla in China’s EV market?

This is the third consecutive month when Li Auto’s deliveries have surpassed 20,000 and its monthly sales in May were more than RMB10 million for the first time ever -which it said would help it reach the target of RMB100 billion in 2023.

Xiang Li, Li Auto’s CEO, and co-founder of Li Auto said “Our smart electric vehicles and organizational processes are the two most critical strengths of Li Auto.”

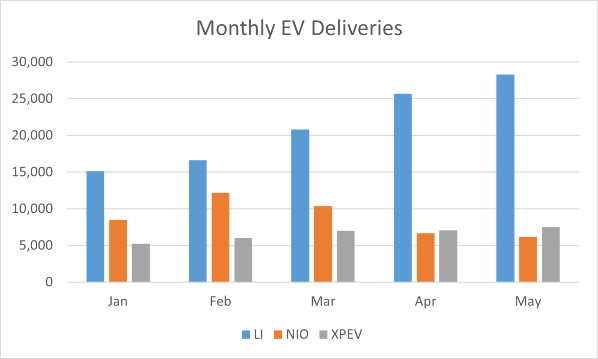

Notably, over the last few quarters Li Auto has consistently outperformed NIO and Xpeng Motors in terms of deliveries. For instance, in May NIO delivered only 6,155 cars while Xpeng Motors managed to sell only 7,506 cars.

While Li Auto’s monthly delivery run rate is now running above 20,000 -both NIO and Xpeng Motors’ deliveries are sagging below 10,000. In Xpeng Motors’ case, the deliveries have been below 10,000 in all the months this year.

Xpeng Motors expects its monthly deliveries to average 15,000 in the third quarter and rise further to 20,000 in the fourth quarter. It is also working on a low-cost vehicle platform.

During the Q1 2023 earnings call last month, Xpeng Motors CEO He Xiaopeng said, “during the first quarter of 2023, I took actions to make changes to our strategy, organizational structure and senior management team decisively.”

he added, “I am fully confident in taking our Company into a virtuous cycle driving product sales growth, team morale, customer satisfaction, and brand reputation over the next few quarters.”

Li Auto Outsold Both Xpeng Motors and NIO in May

Meanwhile, despite launching several new models, Xpeng Motors’ and NIO’s sales have sagged. In May, Li Auto’s deliveries were twice what both NIO and Xpeng Motors collectively delivered in the month.

In terms of cumulative deliveries also both these companies now trail Li Auto -and the gap is only widening with every passing month.

Li Auto’s cumulative deliveries reached 363,876 at the end of May. In contrast, the metric stood at 333,410 and 283,893 respectively for NIO and Xpeng Motors.

At one point it looked that Xpeng would overtake NIO in terms of cumulative deliveries but after multiple months of sub-par deliveries, it now trails both NIO and Li Auto by a big margin.

Li Auto deliveries for May 2023:

+146% year on year with 28,277 new cars delivered.

+ 10% compared to April, when Li Auto delivered 25,681 cars.

Accumulated total since launch: 363,876 cars.

Li Auto didn’t breakdown the number any further, they only said that they predict… pic.twitter.com/icnwHUaQhp

— Tycho de Feijter (@TychodeFeijter) June 1, 2023

While Li Auto has now surpassed ahead of NIO and Xpeng Motors -it still trails market leader BYD by a wide margin. Also, its deliveries are still lower than what Tesla sells in China.

BYD sold 1.85 million new energy vehicles (NEVs) last year – most of which were in China and almost equally distributed between hybrids and battery electric vehicles (BEVs).

Can LI Challenge BYD’s Dominance in China

Tesla on the other hand sold 1.31 million BEVs last year and has set a target of producing 1.8 million vehicles this year. The company’s CEO Elon Musk has said that Tesla’s annual production capacity would reach 20 million units by the end of this decade.

Cathie Wood of ARK Invest – who’s among the most vocal Tesla bulls – raised Tesla’s 2026 base case target price to $2,000 which would imply a market cap of around $5 trillion.

Wood bought more Tesla shares this year – a decision that paid off well looking at the 92% YTD rise in the stock.

BYD is backed by Warren Buffet’s Berkshire Hathaway which is the company’s biggest stockholder.

Musk who laughed at BYD’s cars in 2011 recently admitted that the company is “highly competitive.”He also said that Tesla might try advertising its cars -something it hasn’t done so far.

Meanwhile, in order to challenge the dominance of BYD and Tesla in China’s EV market Li Auto would need to do a lot more.

The company’s trajectory has been impressive so far even as multiple startup EV companies have faltered. The real battle lies ahead however as Li tries to reach scale and tries to enter into the league of major EV producers.

Related stock news and analysis

- 10 Most Eco-Friendly Crypto Coins 2023

- Xpeng Electric Vehicle Deliveries Drop by 47% in Q1 2023

- Meta Too Asks Employees to Return to Office: Would More Companies Follow?

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops