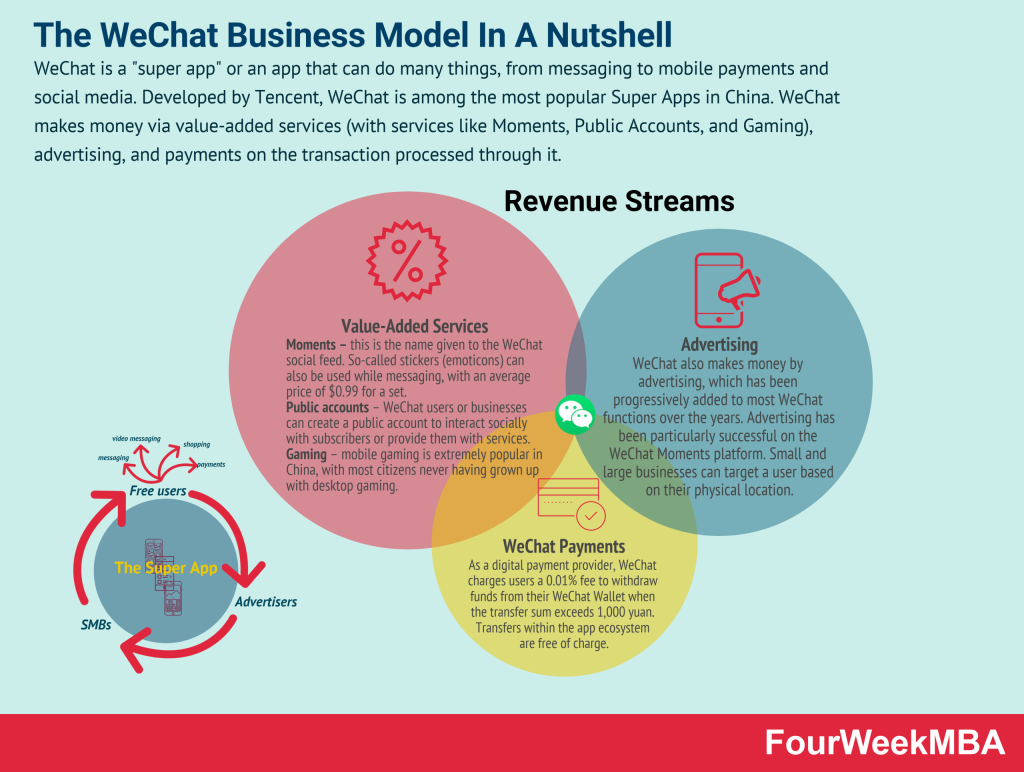

WeChat is well-known for its incredible popularity and the incredible revenue its ecosystem of ads, payments, and value-added services generates for its parent company Tencent. Value-added services are simply extra features offered in addition to the standard product (for a price).

WeChat started off as a simple voice messaging app with no frills called Weixin in early 2011. It took a tiny team of a mere 7 engineers 3 months to build the app. By 2012, it had over 100 million registered users.

With a little luck and a brilliant team of engineers building out a massive suite of ludicrously profitable value-added services, WeChat grew to be one of the most profitable (and popular) apps in the world.

How Tencent Discovered WeChat’s Profit Potential

WeChat was sitting pretty at one of the largest messaging apps in the world in 2014 with 300 million monthly active users, but it wasn’t yet the revenue powerhouse it is today. That all started to change when Tencent decided to digitize a popular company (and Cantonese) tradition called Red Packets (or red envelopes).

On the first day back to work after every Chinese New Year, Tencent would give employees a red packet with a bit of cash. By 2014, Tencent was a massive company with many thousands of employees, making the process of giving out physical packets of cash exhausting.

Managers were having trouble delivering all the packets so they asked for a digital solution. WeChat Red Packets was a huge hit immediately. More than 5 million users used the feature from New Year’s Eve 2014 to 4 pm on the day after.

The feature was quickly extended to allow for normal everyday payments and further boosted with partnerships with services like Didi (a top ride-share app). Soon the digital Red Packets and WeChat Pay in general became ubiquitous in China. More than 1 billion Red Packets were sent during the New Year’s Holiday in 2015.

The Evolution From WeChat Pay to the WeChat Super App

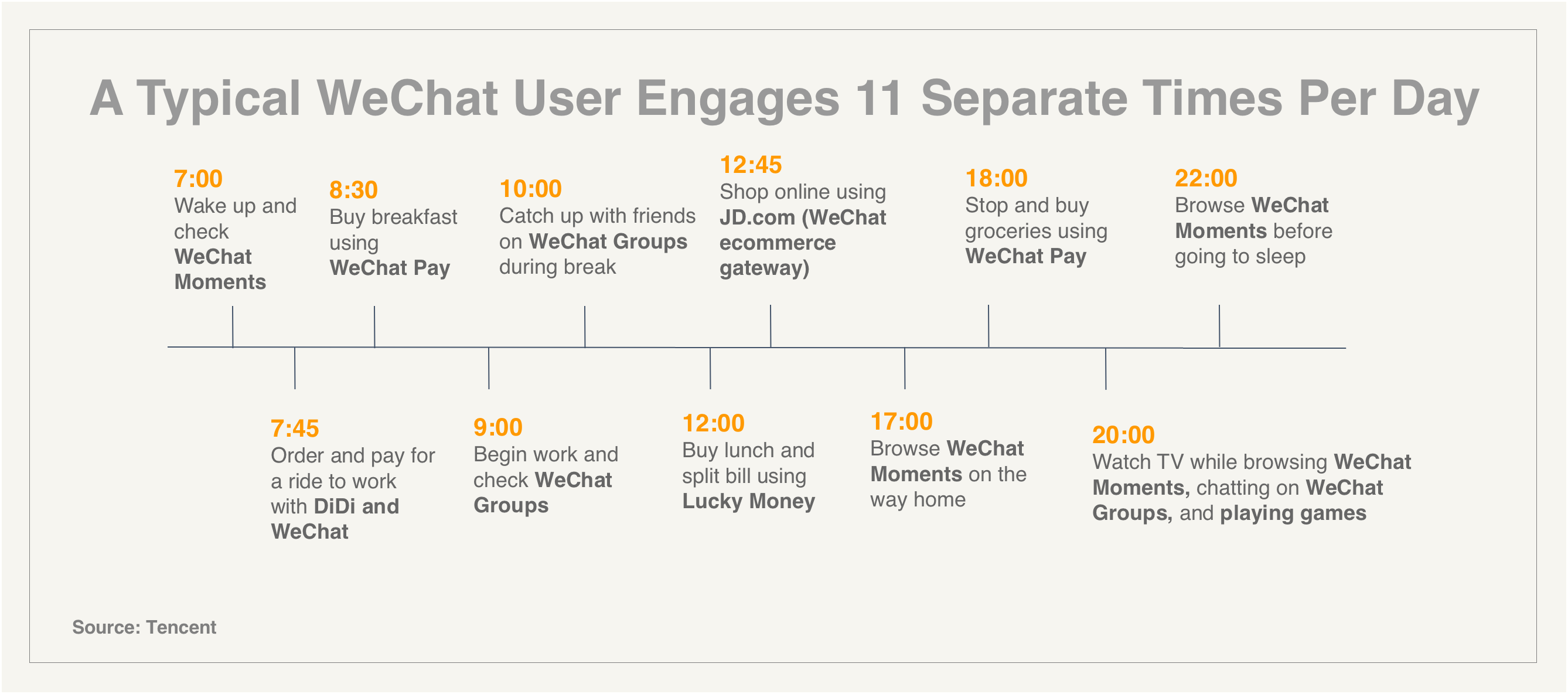

Soon nearly everyone in China had WeChat Pay set up on their phone and connected to their bank accounts. This is what set WeChat up to ratchet up its revenue even more by using value-added services. It continued to partner with vital services to try to stuff WeChat into its users’ days as many times as possible.

Tencent estimated that a typical user of the app engages with it 11 times per day. WeChat engineers made sure to add value-added services to each and every feature in the app.

Because people use these features so often and they already have their bank accounts connected to the app, they sometimes splurge a dollar or two to get goodies like special stickers for messaging or bonus content in popular games.

To add even more services and to make them even easier to use, WeChat launched Mini Programs (or mini-apps).

These mini programs were designed specifically to be as frictionless as possible for both the user and the creator. WeChat users could scan a QR code at a local store or restaurant and be directed to its mini-app without having to download it or search for it in an app store. Of course, payments would go through WeChat, which charges a 0.01% fee on every transaction.

Business owners wouldn’t need to know how to code to create one of these WeChat apps either, lowering the bar to have your own mini-app dramatically. Mini programs were launched in 2017, and by the end of the year, there were about 580,000. Before 2022 there were over 3.5 million mini-apps in WeChat, many of which were generating significant revenue for the app.

Mini-apps generated $240 billion in commerce within WeChat in 2020 alone.

To give a basic overview of WeChat’s business model, it built a super app where its users can do nearly everything they need to do through the app, ensuring that it had a way to profit from every feature. Of course, it also advertises to its users, giving the app another massive revenue stream.

According to Tencent, the app’s revenue more than doubled from $8.37 billion to $17.49 billion between 2017 and 2021 off of the success of this ecosystem of payments, value-added services, and advertising.

Other tech companies are eyeing WeChat’s brilliant all-encompassing business model and trying to turn their apps into super apps of their own.

Related Articles:

- Best Tech Stocks to Watch in 2023 – How to Buy Tech Stocks

- Instagram Testing User Control Feature to Improve How It Serves Users Content

- Grocery Delivery App Instacart Adds ChatGPT-Powered In-App AI Search Tool

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops