The once global leader in chipmaking, Intel, is facing a double challenge as it tries to cope with the rising demand for artificial intelligence (AI) solutions and the falling demand for its core products.

Intel’s revenues have been hit by the glut of semiconductors that accumulated in the market after the supply disruptions of the previous years, Fortune reported in January after the Q4 earnings call.

The Silicon Valley-based company has been forced to slash its expenses and fend off rivals in the semiconductor industry as it seeks to regain its edge in the technology market.

Intel is in A Mud Hole – CEO Pat Gelsinger

Intel’s troubles started about a decade ago when executives made an unfortunate decision in regard to an emerging technology – extreme ultraviolet lithography, according to a report by the Financial Times.

The company missed out on a once-in-a-lifetime opportunity to advance its chipmaking capabilities when it dismissed a novel technology.

This technique uses extremely short wavelength ultraviolet light to carve miniscule circuits on silicon wafers, the raw material for making chips that power devices like smartphones and PCs.

Intel officials thought the technology was too risky and opted for older lithography methods for its next chip generation. This decision proved to be costly, especially now that the US has made chip innovation a national priority in its quest to rival countries like China and Taiwan.

“We didn’t get into this mud hole because everything was going great,” Gelsinger told the Wall Street Journal. “We had some serious issues in terms of leadership, people, methodology, et cetera that we needed to attack.”

Intel’s slack to adapt to the changing landscape in the semiconductor market is mainly self-inflicted. This gave a chance for smaller companies to scramble for Intel’s market share both in the US and abroad.

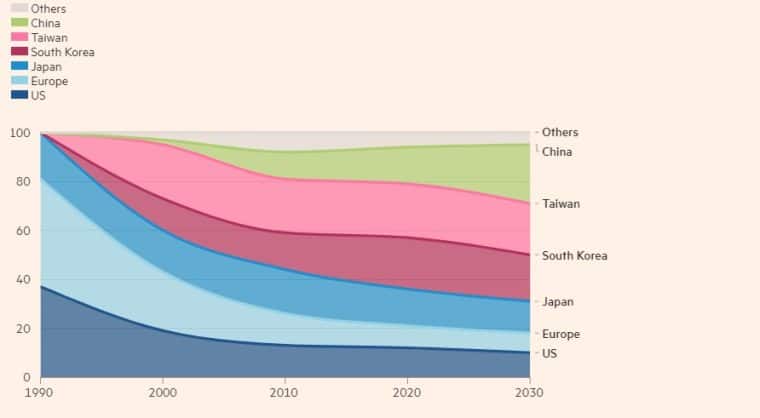

Taiwan Semiconductor Manufacturing Company is currently the largest chipmaker in the world. The company has been strong since the 1990s, but it has recently increased its market share after becoming the first leading chip maker to widely adopt new technology. Samsung is also a strong competitor for the top spot, highlighting South Korea’s presence in the global market.

Intel under the leadership of Gelsinger is betting on the multibillion-dollar investments in new factories, which will produce its own chips and chips designed by other companies.

However, according to a related report by the Wall Street Journal (WSJ) the “contract-manufacturing operation, called a “foundry” business, is bogged down with problems.”

In the last few years, Intel has struggled to turn a profit, yet its position in the chipmaking industry is not getting better. The American corporation posted a massive 36% drop in revenue for the first quarter of 2023 alongside a 133% decline in earnings per share year-over-year.

Moreover, revenue expectations by the company for Q2 fell below the market watchers’ projections despite cost-cutting initiatives that have seen top officials including Gelsinger accept pay cuts.

Nvidia Cashes in on the AI Boom – Intel Slacks

Intel’s troubles over the last decade can to a large extent, be explained. However, experts are struggling to grasp why the chipmaker is wobbling amid the emergence of disruptive artificial intelligence with AI spending exploding.

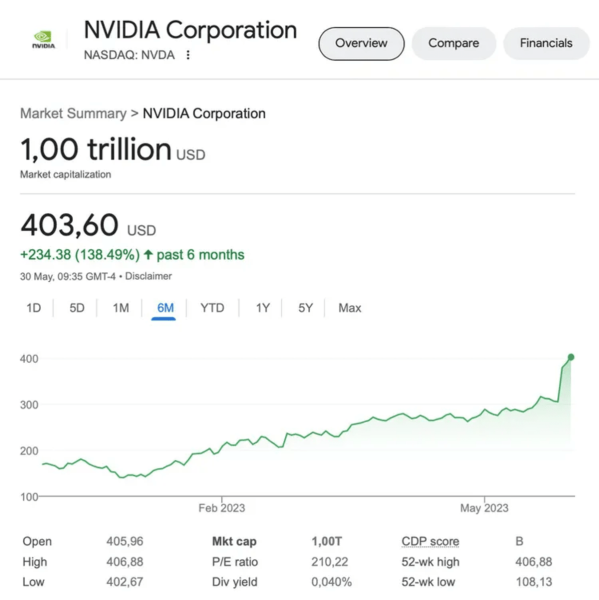

Rival chip manufacturers like Nvidia have been cashing in on the trending AI technologies, with the company’s market capitalization briefly rising to 1 trillion dollars on Tuesday, The Verge Reported.

Nvidia’s transition as the preeminentAI hardware provider has seen the company clinch numerous partnership deals.

AI solutions dominated recent events – Google I/O and Microsoft, showcasing their importance for the future of technology. Nvidia, as a leading provider of chips for AI applications, has positioned itself to benefit from the growing demand for AI capabilities.

Nvidia reported a staggering $2 billion in profit in the last quarter, showing its resilience in the chip market.

The company had previously enjoyed a surge in demand for its GPUs from PC gamers and crypto miners, but those segments cooled down in 2022.

Despite the strides made by its rivals, TSMC, Nvidia, and Samsung, Gelsinger believes Intel still has a chance at the top of the chipmaking industry, as long as it grows “a lot faster than” the competition in the market.

“Is TSMC going to keep growing between now and the end of the decade?” Gelsinger said. “Yes. Will Samsung grow? Yes. Will Intel grow? I hope a lot faster than either of those two.”

At this point, Intel is simply dreaming big. However, time will tell if Gelsinger can turn around the company, now that he is eying to be the second biggest chip manufacturer in the world, behind Taiwan’s TSMC—a company four times bigger than Intel’s market value.

“If you don’t have a little bit of boldness, you shouldn’t be in the semi-industry,” Gelsinger said.

Recommended Articles:

- 16 Best AI Writer Tools for 2023

- Alibaba Rolls Outs Its ChatGPT-Like Service as US-China AI War Heats Up

- LinkedIn Increasing Its Dominance Over the Recruiting App Market With 88% Increase in Confirmed Hires

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops