The persistent downtrend in the ad market exhibited no signs of easing at the turn of 2023 mainly held back by significant ad budget cuts in 2022. Five months later, ad spending is still down, although April recorded the smallest decline since September 2022.

According to an earlier report by Forbes, these market doldrums impacted ad-tech stocks, including Big Tech companies like Meta and Alphabet.

The advertising industry faced a massive downturn as ad spend budgets were cut drastically year-over-year.

This single factor outweighed any advantages that advertising companies had, such as having huge audiences of over 2 billion, using AI to enhance their R&D, or focusing on the fast-growing segment of CTV ads.

As a result, advertising stocks plummeted by 50% to 80% across the board, the Forbes report explained.

The Ad Spend Winter

The ad market is still shrinking year-over-year, with March being the ninth consecutive month of lower spending, according to Tinuiti’s study on “In-Depth Insights into the Advertising Landscape” for Q1 2023.

Magna, a marketing research and consulting firm, lowered its 2023 US ad spending growth forecast from 3.7% to 3.4% but anticipates a recovery in the latter half of the year fueled by video streaming with ads.

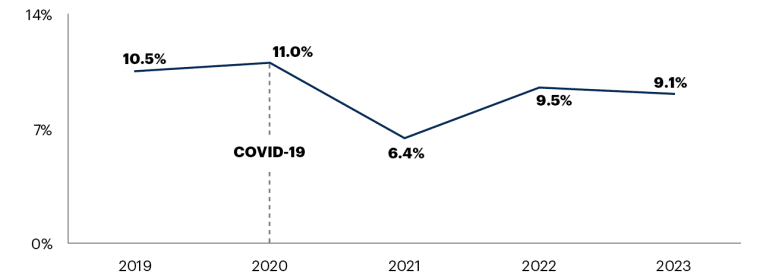

In the heat of the pandemic, companies bumped up their ad spend budgets with more and more shoppers turning to the internet for goods and services amid the lockdowns. However, as the pandemic eased, ad spend growth reversed.

Social media companies like Meta and Twitter saw their ad revenues tumble in large margins. Advertisers started rolling back the big ad spend budget allocations in addition to trimming marketing teams.

Consistent interest rate hikes in the US meant that companies were pushed between a rock and a hard place, with many choosing to contain their wallets.

Ad Spend Recovery Imminent?

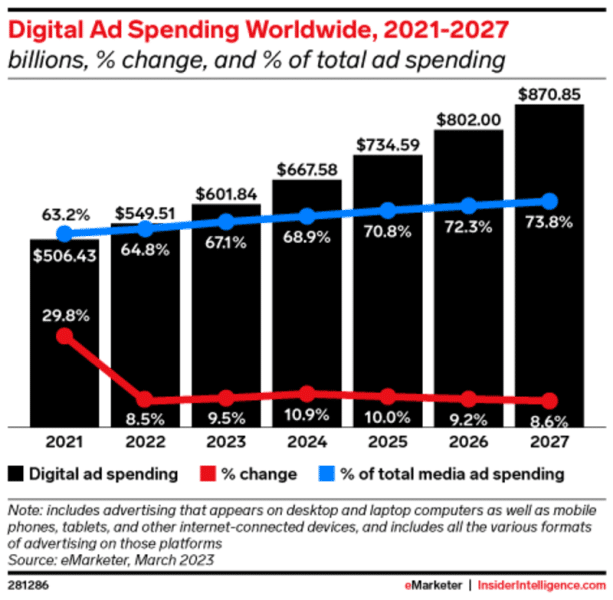

While the ad market has suffered a spectacular decline since 2022, the outlook is not entirely grim with worldwide media ad spending projected to grow by 5.8% in 2023 based on a report by Insider Intelligence.

“Digital ad spending will grow 9.5% this year, an increase over 2022 but still the second-slowest rate of expansion since our worldwide tracking began more than a decade ago,” Insider Intelligence said in the report.

This bullish projection, nevertheless, does not discredit the 10-month downtrend in ad spend. Organizations in the ad market are reacting differently to the fading growth, with some introducing a raft of changes to cope with the small budgets.

A recent study by Gartner revealed that 71% of content marketing officers admit to having insufficient budgets to execute their strategies. About 410 CMOs and marketing leaders were interviewed in this report.

“Suppressed budgets, increasing costs, and lower productivity are squeezing CMOs’ spending power,” Ewan McIntyre, the Chief of Research and VP Analyst in the Gartner Marketing practice said. “As volatility becomes the new normal, many CMOs are pricing disruption into their 2023 plans.”

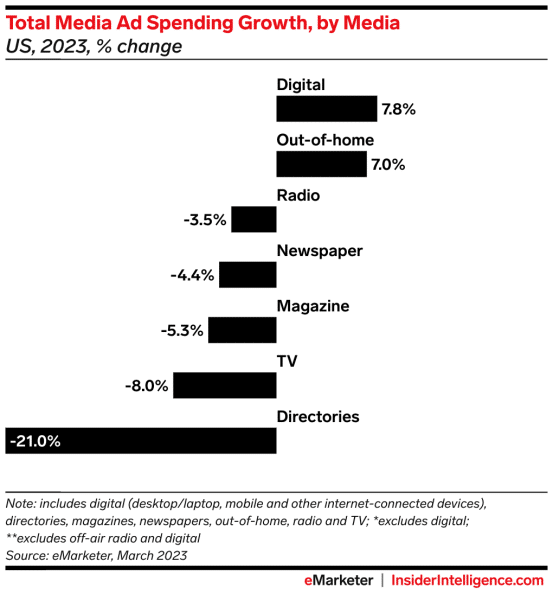

The TV industry is facing a rapid decline in both advertising and viewership, Insider Intelligence added in their report. US TV advertising will drop by 8.1% in 2023 alone. This is a continuation of a long-term trend that worsened during the pandemic.

Although traditional TV advertising is not expected to turn around in 2023, advertisers are noticing a shift to retail media. The retail media has grown exponentially in recent years with a 6.7% expected growth rate through 2027 and could be worth $27.03 billion, as per The Business Research Company.

“Product innovation has emerged as a key trend gaining popularity in the retail media network market. Major companies operating in the retail mediate network market are focused on developing new and innovative solutions to sustain their market position,” The Business Research Company report states.

The advertising industry must go back to the drawing board to revamp revenues possibly with new innovative solutions. With the emergence of generative artificial intelligence (AI), the ad market landscape is expected to change drastically toward the end of 2023, which may shape the industry for years to come.

The industry, according to Tinuiti, is already grappling with “the loss of deterministic user-level data.” Ad companies have started to embrace new solutions such as “the Android Privacy Sandbox and Total Cookie Protection,” which try to strike a balance between consumer privacy and targeted advertising.

Related Articles:

- Best Email Marketing Agencies : Top 8 for 2022

- Hundreds of AI Execs and Researchers Say That Their Own Tech Incurs “Risk of Extinction”

- Viral Mobile Web Browser Web Roulette Is Built Around Gen Z’s Tiny Attention Spans

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops