Fidelity has marked down Twitter valuation for the third time to just around $15 billion which means that the social media company’s valuation now is down by around 66% since October when Elon Musk acquired it for $44 billion.

Incidentally, earlier this year, Musk himself lowered Twitter’s valuation to $20 billion while offering ESOPs to employees. He, however, expressed hope that eventually Twitter would be valued at $250 billion – a figure that looks increasingly out of bounds looking at the current scenario.

To be sure, last year only Musk acknowledged that he overpaid for Twitter. However, a couple of months later he invited investors to invest in the company at similar terms as he did during the acquisition.

In an interview with BBC in April – an organization that Twitter labeled “state-funded” only to change it to “publicly funded” later – Musk admitted that he bought Twitter as he thought courts would force him to do so.

Since he acquired Twitter, Musk has laid off roughly 80% of the workforce while cutting expenses elsewhere also.

He tried shifting the focus away from advertising to subscription and Twitter started offering paid subscriptions as well as started charging for APIs.

The pivot wasn’t much successful and reports say that less than 1% of Twitter users opted for paid memberships.

Musk meanwhile alluded that ad revenues look the best course for Twitter and hired NBC Universal advertising executive Linda Yaccarino to lead Twitter.

Fidelity Slashes Twitter Valuation by Two-Thirds

During the shareholder meeting earlier this month, the billionaire said, “I guess I should say ‘advertising is awesome and everyone should do it.”

He added that Tesla might also try advertising its cars – a major climb down from his earlier position.

While Twitter hasn’t disclosed its advertising revenues, Musk himself said that the company’s revenues are down by half amid an exodus of advertisers since he took over.

That said, Musk has also said that the microblogging site is nearing breakeven amid the relentless cost-cutting.

At the shareholder meeting, Musk stressed that he needed to do “some major open-heart surgery on Twitter to ensure the company’s survival” while adding the company is “stable” now.

After performing “open-heart surgery” on #Twitter, Musk says the platform is now in a “stable place”. He says he’s very excited @lindayacc is joining.

“Linda is going to do a great job running Twitter,” he said, adding he won’t need to devote the same amount of incremental time.— Christiaan Hetzner 🇺🇸🇩🇪🇺🇦 (@christiaanhtznr) May 16, 2023

Fidelity meanwhile does not seem to buy the Twitter turnaround story which is reflected in the latest valuation cut.

Would Twitter be Valued in Excess of $250 Billion Eventually?

Notably, last year Musk claimed that Tesla could become the world’s biggest company with a market cap in excess of combined market cap of Apple and Saudi Aramco – the world’s top two companies by the metric.

Some of the Tesla bulls indeed see the stock rising that far and last month Cathie Wood of ARK Invest – who’s among the most vocal Tesla bulls – raised Tesla’s base case target price to $2,000 which would imply a market cap of around $5 trillion.

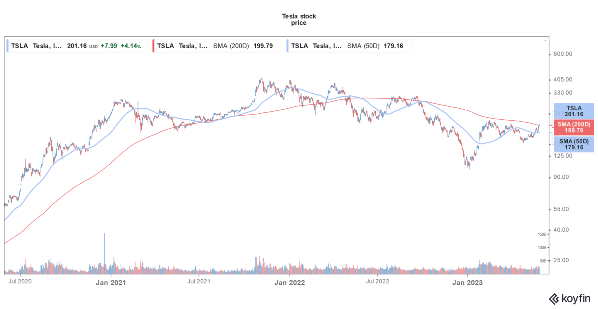

Wood bought more Tesla shares this year – a decision that paid off well looking at the 86% rally in the stock this year.

To be fair to Musk, under his watch, Tesla’s market cap surpassed $1 trillion in 2021 – a milestone no other automaker has even come remotely closer to.

Would Twitter’s valuation also one day surpass $250 billion as Musk seems to believe? We’ll have to wait and see.

For now, though the platform looks like a bigger mess than it did before Musk acquired the company – the most recent example being the Twitter Spaces technical glitches during Florida Gov. Ron DeSantis’s 2024 presidential launch.

Related stock news and analysis

- Best Twitter Crypto – Cryptocurrency Trending on Twitter

- Jack Dorsey Turns Musk Critic, Says He is Not the Right ‘Steward’ for Twitter

- HP CEO Says AI Would Help Create New PCs: Would It Help Beat the Slowdown?

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops