Wharton Professor and renowned economist Jeremy Siegel has backed AI and said the sector does not look in a bubble yet even as some fellow economists have warned of an impending bubble.

Siegel said that he has got several questions on whether the current AI boom is similar to the tech boom of the 1990s which eventually went bust.

According to Siegel, it’s not a bubble yet” and added that the AI stock driven market rally has helped drive the S&P 500 higher despite the banking crisis.

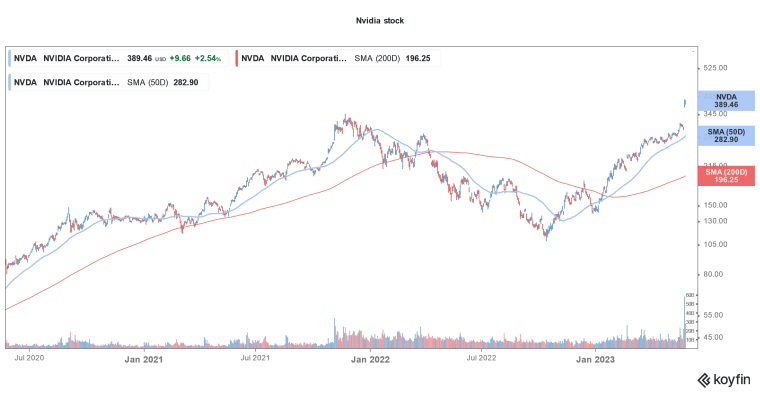

He added that while “Nasdaq was oversold in 2022 and it did bounce back but I think AI has pushed those big cap tech stocks even higher.”

Notably, the tech-heavy Nasdaq Composite lost a third of its value last year but has gained over 25% in 2023. The rally – largely led by AI-related stocks – has added over $4 trillion to the market cap of Nasdaq constituents.

Siegel emphasized, “As we all know that the top eight or nine companies have accounted for all the gains of the S&P 500. This year, the other 490 have been flat or down.”

Nvidia incidentally is the best-performing S&P 500 stock with 167% gains. Its market cap is now a tad short of $1 trillion after the splendid post earnings rally last week.

Rally in AI Stocks Has Helped Lift US Stocks

Nvidia reported revenues of $7.19 billion in the quarter that ended in April – a YoY rise of 19% – and ahead of the $6.52 billion that analysts were expecting.

It forecast revenues of $11 billion for the fiscal second quarter of 2024 which is way above the $7.15 billion that analysts were expecting.

In his prepared remarks, Nvidia CEO Jensen Huang said, “A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process.”

We’re on the brink of an AI bubble.

BUT we’re not there yet.

ARK, Bitcoin and FAANG stocks inflated by +250-1400%.

Still room for growth in AI.

And guess what? These companies actually have earnings. pic.twitter.com/6PjTnBkWXA

— Genevieve Roch-Decter, CFA (@GRDecter) May 25, 2023

Commenting on the rally in Nvidia and AI stocks last week, Siegel said, “First, there was excitement about AI and Nvidia ratified that excitement with blowout earnings. That’s a double push.”

Wharton Professor Says AI is Not in Bubble Zone Yet

Meanwhile, Siegel’s views are in contrast to some of the other observers. For instance, David Kostin, the chief US equity strategist at Goldman Sachs advised caution pointing to the “euphoria.”

Michael Hartnett, chief investment strategist at Bank of America Global Research also echoed similar views and has termed the AI-driven rally as a “baby bubble.”

Even Berkshire Hathaway vice chairman Charlie Munger said earlier this month that he is “skeptical of some of the hype in AI.”

Munger on ChatGPT/AI

“well I think AI is very important, but there’s also a lot of crazy hype. It’s not gonna cure cancer. There is a lot of nonsense in it”

— Jerry Capital (@JerryCap) February 15, 2023

Some others see AI as a long-term opportunity and Jason Ware, chief investment officer at Albion Financial Group believes that the sector offers an opportunity to make money in the long term.

Analysts see a long-term opportunity in Artificial Intelligence

“I mean, there’s some large cap, high quality, good companies today that are going to be made better tomorrow because of innovations in AI,” said Ware.

He added, “not every company in AI is going to be a winner, but there are quality companies you can own within the space.”

All said, while the market opinion is still mixed on AI most agree that that it has the potential to disrupt the industry.

For instance, Goldman Sachs’ senior strategist Ben Snider predicted that AI could increase productivity by 1.5% annually which can increase S&P 500 profits by 30% or higher over the next 10 years.

He added that while tech companies look like the “immediate winners” “the real question for investors is who are going to be winners down the road.”

Related stock news and analysis

- Best AI Crypto Tokens & Projects to Invest in 2023

- Singapore’s Temasek Cuts Staff Compensation after FTX Fiasco

- JPMorgan Reportedly Looking at ChatGPT-like AI Service for Investment Advice

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops