As Lido (LDO) price analysis reveals a make-or-break retest of the MA200 in a lifeline to technical structure, has the Lido V2 hype passed? And how will it impact Lido price prediction.

As a major player in the Decentralized Finance (DeFi) world, the liquid staking protocol Lido has not just made a mark but is etching its dominance with an iron fist.

Lido Dispute with SushiSwap Escalates

Lido (LDO) Price Analysis

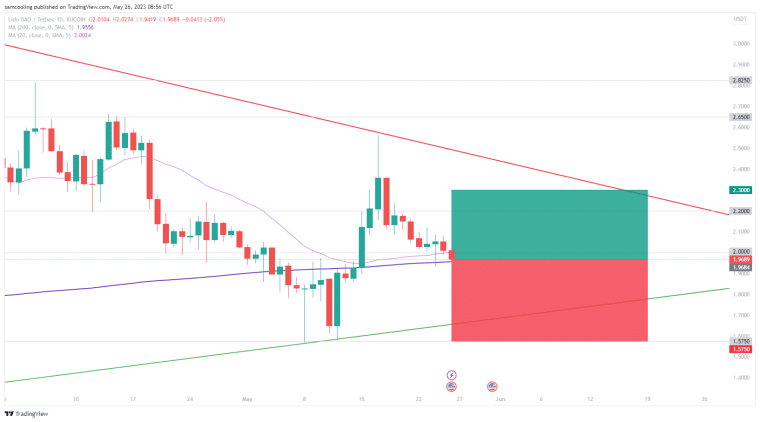

After a thunderous pump in mid-May saw price surge +61% following the highly anticipated launch of Lido V2, LDO has been stuck in a tough 9 days of retracement as bulls reel from top line resistance.

Now trading at a critical $1.96 (a 24 hour change of -2.42%) – Lido bulls are fighting to hold ground and consolidate above a vital lifeline from moving average support.

Indeed, the -23.5% retracement move now faces a sink-or-swim moment, as markets wait to see if a consolidation zone can form here.

Moving averages have emerged as the foundation of LDO price action over the past month, as the descending MA20 converged with the ascending MA200 on May 14.

A gently cascading -52% bleed-out dominated LDO price action from the end of February to the onset of May.

On May 4, as Ethereum pumped, LDO sank critically below the MA200 which formed over a week of capstone local resistance only ended by the timely launch of the V2 staking platform.

Now in a re-test of the MA200, failure to consolidate above $2.00 could spell disaster for Lido’s recovery.

The recent rejection from topside resistance on May 17 has given some silver-lining, notably the RSI oscillator has cooled off dramatically from an overheated 63.

Now sat with bullish divergence at 45 (a clear oversold signal), a return to upside momentum could be on the cards.

However, the MACD highlights the vital ongoing retest of the MA200, with an on the fence reading at 0.0012 showcasing the make-or-break moment in technical structure.

Lido (LDO) Price Prediction

With Lido’s technical structure in such a decisive position, markets are on edge for the impact of US PCE data (released at 8:30AM ET today) for directive momentum.

Bullish project sentiment, with DeFi dominance surging could see Lido bounce hard back up to topside resistance from this level.

However, challenging technical structure could see the value of Lido plummet, especially if persistent core inflation comes in higher than anticipated.

With this in mind, the Lido price prediction has a topside target at $2.30 (a possible +16.85% move).

However, looking to downside risk LDO has the propensity to cascade back down to a lowly $1.575 (a potential drop of -20%).

This leaves the Lido price prediction with a risk: reward structure of 0.84 – as risk overwhelms reward.

Stay tuned with Business2Community to discover the latest crypto market price predictions.

RELATED:

AiDoge (AI) - Meme Generation Platform

- Create & Share AI-Generated Memes

- Newest Meme Coin in the AI Crypto Sector

- Listed on MEXC, Uniswap

- Token-Based Credit System

- Stake $AI Tokens to Earn Daily Rewards